Honda 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

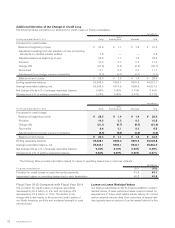

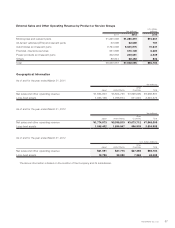

Interest Rate Swaps

Years ended March 31 2011 2012

Yen (millions) Yen (millions)

Average

receive

rate

(%)

Average

pay

rate

(%)

Expected maturity date

Fair

value

Notional

principal

currency Receive/Pay

Contract

amount Fair value

Contract

amount

Within

1 year

1-2

years

2-3

years

3-4

years

4-5

years

There-

after

JP¥ Float/Fix ¥ 420 (14) ¥ 300 —120 180 ——— (7) 1.33 3.17

US$ Float/Fix 2,357,658 (20,292) 2,465,885 301,084 651,447 953,305 472,352 87,697 —(14,818) 0.51 1.15

Fix/Float 519,895 16,611 736,422 41,095 181,638 176,709 82,190 102,738 152,052 27,384 3.52 1.81

Float/Float 12,473 16 12,329 12,329 — ———— (3) 0.74 0.77

CA$ Float/Fix 458,092 (4,218) 448,897 60,250 107,028 109,397 80,305 77,713 14,204 (3,679) 1.28 2.17

Fix/Float 179,904 5,373 123,446 49,378 74,068 ————2,929 5.46 2.82

GBP Float/Fix 32,134 (136) 31,456 15,104 16,352 ————(59) 1.35 1.22

OTHER Float/Fix 6,029 (17) 4,904 4,035 869 ————(12) 1.97 2.67

Total ¥3,566,605 (2,677) ¥3,823,639 483,275 1,031,522 1,239,591 634,847 268,148 166,256 11,735

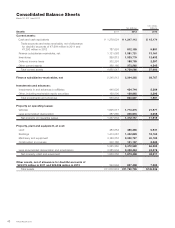

Currency & Interest Rate Swaps

Years ended March 31 2011 2012

Yen (millions) Yen (millions)

Average

receive

rate

(%)

Average

pay

rate

(%)

Expected maturity date

Fair

value

Receiving

side

currency

Paying

side

currency

Receive/

Pay

Contract

amount Fair value

Contract

amount

Within

1 year

1-2

years

2-3

years

3-4

years

4-5

years

There-

after

JP¥ US$ Fix/Float ¥ 82,078 21,523 ¥ 57,585 17,361 5,028 5,473 27,413 —2,310 10,773 1.21 1.04

Float/Float 105,671 25,179 46,563 41,858 2,844 —1,861 — — 17,045 0.49 0.77

Other Other Fix/Float 313,576 6,444 309,357 87,076 98,314 123,967 — — — (7,023) 5.03 1.95

Float/Float 47,774 (3,064) 19,033 — — 19,033 — — — 961 1.55 3.45

Float/Fix — — 17,555 —1,602 15,953 — — — 44 1.21 2.98

Total ¥549,099 50,082 ¥450,093 146,295 107,788 164,426 29,274 —2,310 21,800

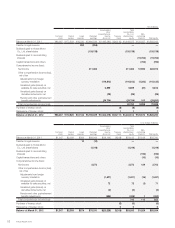

Equity Price Risk

Honda is exposed to equity price risk as a result of its

holdings of marketable equity securities. Marketable equity

securities included in Honda’s investment portfolio are held

for purposes other than trading, and are reported at fair

value, with unrealized gains or losses, net of deferred taxes,

included in accumulated other comprehensive income (loss)

in equity section of the consolidated balance sheets. At

March 31, 2011 and 2012, the estimated fair values of

marketable equity securities were ¥92.4 billion and ¥100.8

billion, respectively.

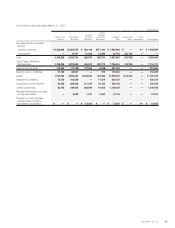

Legal Proceedings

With respect to product liability, personal injury claims or

lawsuits, we believe that any judgment that may be recovered

by any plaintiff for general and special damages and court

costs will be adequately covered by our insurance and

accrued liabilities. Punitive damages are claimed in certain of

these lawsuits. Honda is also subject to potential liability

under other various lawsuits and claims.

Honda recognizes an accrued liability for loss contingencies

when it is probable that an obligation has been incurred and

the amount of loss can be reasonably estimated. Honda

reviews these pending lawsuits and claims periodically and

adjusts the amounts recorded for these contingent liabilities, if

necessary, by considering the nature of lawsuits and claims,

the progress of the case and the opinions of legal counsel.

After consultation with legal counsel, and taking into account

all known factors pertaining to existing lawsuits and claims,

Honda believes that the ultimate outcome of such lawsuits and

pending claims should not result in liability to Honda that would

be likely to have an adverse material effect on its consolidated

financial position, results of operations or cash flows.

Honda Motor Co., Ltd. 47