Honda 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Operating and Financial Review

Net Sales and Other Operating Revenue

Honda’s consolidated net sales and other operating revenue

(hereafter, “net sales”) for the fiscal year ended March 31,

2012, decreased ¥988.7 billion, or 11.1%, to ¥7,948.0 billion

from the fiscal year ended March 31, 2011, due mainly to

decreased net sales in Automobile business by the Great East

Japan Earthquake, the floods in Thailand and negative foreign

currency translation effects, which was partially offset by

increased net sales in Motorcycle business. Honda estimates

that by applying Japanese yen exchange rates of the previous

fiscal year to the current fiscal year, net sales for the year

would have decreased by approximately ¥555.6 billion, or

6.2%, compared to the decrease as reported of ¥988.7 billion,

which includes negative foreign currency translation effects.

Operating Costs and Expenses

Operating costs and expenses decreased ¥650.3 billion, or

7.8%, to ¥7,716.7 billion from the previous fiscal year. Cost of

sales decreased ¥577.2 billion, or 8.9%, to ¥5,919.6 billion

from the previous fiscal year, due mainly to a decrease in

costs attributable to decreased unit sales in Automobile busi-

ness and positive foreign currency effects. Selling, general

and administrative expenses decreased by ¥105.3 billion, or

7.6%, to ¥1,277.2 billion from the previous fiscal year, due

mainly to a decrease in selling expenses attributable to

decreased product warranty expenses, decreased unit sales

in Automobile business, and positive foreign currency effects.

R&D expenses increased by ¥32.2 billion, or 6.6%, to ¥519.8

billion from the previous fiscal year, due mainly to improving

safety and environmental technologies and enhancing of the

attractiveness of the products.

Operating Income

Operating income decreased ¥338.4 billion, or 59.4%, to

¥231.3 billion from the previous fiscal year, due mainly to a

decrease in income attributable to decreased net sales,

increased R&D expenses and negative foreign currency

effects, which was partially offset by decreased selling,

general and administrative expenses. Excluding negative

foreign currency effects of ¥114.0 billion, Honda estimates

operating income decreased ¥224.3 billion.

With respect to the discussion above of the changes, man-

agement identified the factors and used what it believes to be

a reasonable method to analyze the respective changes in

such factors. Management analyzed changes in these factors

at the levels of the Company and its material consolidated

subsidiaries. “Foreign currency effects” consist of “translation

adjustments”, which come from the translation of the currency

of foreign subsidiaries’ financial statements into Japanese yen,

and “foreign currency adjustments”, which result from foreign-

currency-denominated sales. With respect to “foreign cur-

rency adjustments”, management analyzed foreign currency

adjustments primarily related to the following currencies: U.S.

dollar, Euro, Japanese yen and others at the level of the

Company and its material consolidated subsidiaries.

Income before Income Taxes and Equity in

Income of Affiliates

Income before income taxes and equity in income of affiliates

decreased ¥373.1 billion, or 59.2%, to ¥257.4 billion. Main

factors of this decrease except factors relating operating

income are as follows:

Unrealized gains and losses related to derivative instru-

ments had a negative impact of ¥5.9 billion. Other income

(expenses) excluding unrealized gains and losses related to

derivative instruments had a negative impact of ¥28.7 billion,

due mainly to gain on sales of investments in affiliates related

to the dissolution of the joint venture, which was included in

the previous fiscal year and a decrease in foreign currency

transaction gains.

Income Tax Expense

Income tax expense decreased ¥71.0 billion, or 34.4%, to

¥135.7 billion from the previous fiscal year. The effective tax

rate increased 19.9 percentage points to 52.7% from the pre-

vious fiscal year. The increase in the effective tax rate was due

mainly to a decrease in a portion of unrecognized tax benefits

related to transfer pricing matters of overseas transactions

between the Company and foreign affiliates, which was

included in the previous fiscal year and adjustments for the

change in income tax laws in Japan in the current fiscal year.

Equity in Income of Affiliates

Equity in income of affiliates decreased ¥39.3 billion, or

28.2%, to ¥100.4 billion, due mainly to a decrease in income

attributable to decreased net sales by the Great East Japan

Earthquake at affiliates in Asia and Japan, and decreased

Equity in income of the affiliate which was dissolved pursuant

to a joint venture agreement in the previous fiscal year.

Net Income

Net income decreased ¥341.4 billion, or 60.6%, to ¥222.0

billion from the previous fiscal year.

Net Income Attributable to Noncontrolling Interests

Net income attributable to noncontrolling interests decreased

¥18.7 billion, or 64.0%, to ¥10.5 billion from the previous

fiscal year.

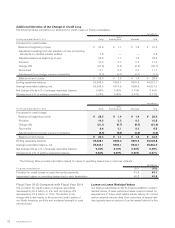

Net Sales and Other Operating Revenue

Years ended March 31

Yen (billions)

4,000

8,000

12,000

008 09 10 11 12

Honda Motor Co., Ltd. 33