Honda 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

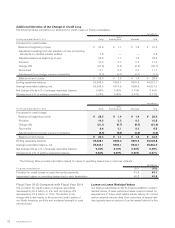

Additional Narrative of the Change in Credit Loss

The following tables summarize our allowance for credit losses on finance receivables:

Yen (billions)

For the year ended March 31, 2011 Retail

Direct

financing lease Wholesale Total

Provisions for credit losses

Balance at beginning of year ¥ 33.9 ¥ 1.7 ¥ 1.6 ¥ 37.3

Adjustment resulting from the adoption of new accounting

standards on variable interest entities 0.8 — — 0.8

Adjusted balance at beginning of year 34.8 1.7 1.6 38.2

Provision 10.3 0.7 0.3 11.3

Charge-offs (27.6) (1.5) (0.5) (29.7)

Recoveries 11.1 0.5 0.0 11.7

Adjustments from foreign currency translation (3.0) (0.0) (0.0) (3.2)

Balance at end of year ¥ 25.5 ¥ 1.4 ¥ 1.4 ¥ 28.4

Ending receivable balance ¥3,368.0 ¥362.1 ¥301.6 ¥4,031.7

Average receivable balance, net ¥3,346.5 ¥374.9 ¥309.5 ¥4,031.0

Net charge-offs as a % of average receivable balance 0.49% 0.26% 0.15% 0.45%

Allowance as a % of ending receivable balance 0.76% 0.40% 0.47% 0.71%

Yen (billions)

For the year ended March 31, 2012 Retail

Direct

financing lease Wholesale Total

Provisions for credit losses

Balance at beginning of year ¥ 25.5 ¥ 1.4 ¥ 1.4 ¥ 28.4

Provision 10.3 0.3 0.0 10.8

Charge-offs (21.1) (0.7) (0.0) (21.9)

Recoveries 6.6 0.1 0.0 6.8

Adjustments from foreign currency translation (0.9) (0.0) (0.0) (1.0)

Balance at end of year ¥ 20.4 ¥ 1.1 ¥ 1.4 ¥ 23.0

Ending receivable balance ¥3,328.1 ¥380.3 ¥301.3 ¥4,009.8

Average receivable balance, net ¥3,233.1 ¥366.1 ¥243.7 ¥3,843.0

Net charge-offs as a % of average receivable balance 0.45% 0.16% 0.03% 0.39%

Allowance as a % of ending receivable balance 0.62% 0.30% 0.46% 0.57%

The following table provides information related to losses on operating leases due to customer defaults:

Yen (billions)

Fiscal years ended March 31 2011 2012

Provision for credit losses on past due rental payments ¥1.6 ¥1.1

Impairment losses on operating leases due to early termination ¥0.8 ¥1.5

Fiscal Year 2012 Compared with Fiscal Year 2011

The provision for credit losses on finance receivables

decreased by ¥0.5 billion, or 5%, and net charge-offs

decreased by ¥2.8 billion, or 16%. The decline in net

charge-offs is due mainly to the improved credit quality of

our North American portfolio and sustained strength in used

vehicle prices.

Losses on Lease Residual Values

Our finance subsidiaries in North America establish contract

residual values of lease vehicles at lease inception based on

expectations of future used vehicle values, taking into consid-

eration external industry data. End-customers of leased vehi-

cles typically have an option to buy the leased vehicle for the

Annual Report 201242