Frontier Airlines 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

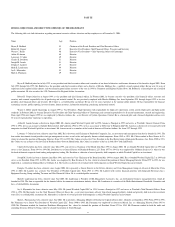

ITEM 13. CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

Arrangements with Solitair Corp.

In July 1999, Chautauqua entered into an agreement with Solitair Corp., a wholly

-

owned subsidiary of Solitair Kapital AB. Solitair Kapital AB is controlled by Solitair Intressenter AB, a

wholly

-

owned subsidiary of Wexford Solitair Corp. Wexford Solitair Corp. is an affiliate of WexAir LLC, our majority stockholder. Pursuant to the agreement, Chautauqua agreed to purchase

Embraer regional jets from Solitair which had contracts to purchase such jets from Embraer. Solitair was required to sell the firm aircraft to Chautauqua. Through December 31, 2002, the cost to

us per aircraft was equal to the purchase price paid by Solitair, including Solitair's expenses related to the purchase of the aircraft, plus up to $500,000. This amount was later decreased to

$440,000 per aircraft. As of December 31, 2002, Chautauqua issued notes to Solitair totaling approximately $3,500,000 relating to these expenses. These notes were repaid in April 2003 with

accrued interest.

Subsequently, Solitair agreed to assign its option to purchase 20 aircraft from Embraer to us, and we issued a subordinated promissory note payable to Solitair in principal amount plus

accrued interest equal to approximately $782,000, which amount was repaid in full in January 2003. We now have an agreement with Embraer to purchase aircraft directly from Embraer. We

have no current arrangement, or plan to enter into any arrangement, with Solitair.

Transactions with Wexford Capital LLC

In May 1998, WexAir LLC, a limited liability company formed by several investment funds managed by Wexford Capital LLC, purchased all of our outstanding capital stock, for an

aggregate purchase price of $8,133,000, and loaned us $12,000,000. We used these proceeds to purchase Chautauqua for a purchase price of $20,133,000 (including expenses). The note for

the Chautauqua purchase price, which currently bears interest at the annual rate of 7.5% compounded semi

-

annually, currently matures on June 13, 2004. In April 2004, we made a payment of

$2,800,000, which payment consisted of $1,400,000 for principal and $1,400,000 for accrued interest. We used a portion of the proceeds from our initial public offering to repay the loan from

WexAir LLC.

In July 1999, Imprimis Investors LLC ("Imprimis"), one of the members of our majority stockholder, loaned Chautauqua $1,000,000 for working capital purposes. In April 2000,

Imprimis loaned Chautauqua an additional $1,500,000 for working capital purposes. These loans were evidenced by a note that bore interest at a rate of 7.5% per annum and were due on

demand. In May 2000, Chautauqua issued to Imprimis 10.295828 shares of Chautauqua's Series A preferred stock in payment of principal and accrued interest on the note, which totaled

$2,573,950. In May 2000, Chautauqua sold to Imprimis an additional six shares of Chautauqua's Series A preferred stock for an aggregate purchase price of $1,500,000. Chautauqua used the

proceeds from the sale of the preferred stock for working capital. The preferred stock was redeemed in full on September 30, 2003.

In April 2004, Chautauqua sold a demand note receivable from an affiliated company to Imprimis for approximately $2,400,000 which was equal to the net carrying value of such note.

Employees of Wexford Capital provide certain administrative functions to us, including legal services and assistance with financing transactions. We paid Wexford Capital $327,000,

$257,000 and $226,000 for these services for the years ended December 31, 2002, 2003 and 2004.

During the fourth quarter of 2001, we decided to exit the turboprop business, return our entire fleet of Saab 340 aircraft and dispose of related inventory and equipment. New leases

(between the lessor and Shuttle America) were obtained for 21 aircraft, of which leases for three aircraft expired in January 2004. We remain liable if Shuttle America defaults with respect to the

remaining leases. We recorded impairment losses and accrued aircraft return cost of $8.1, $3.8 and $10.2 million in 2001, 2002 and 2003, respectively. As of December 31, 2004, we

maintained a reserve of $6.0 million with respect to such losses which we believe is adequate to cover our exposure for additional losses.

Wexford Capital has advised us that it and the investment funds it manages will not enter into any transaction with us unless the transaction is approved by the disinterested members of

our board of directors.

Our by

-

laws provide that any interested party transaction involving Wexford Capital, any of its affiliates and us, shall be approved by a majority of our directors not otherwise affiliated

with Wexford Capital or any of its affiliates.

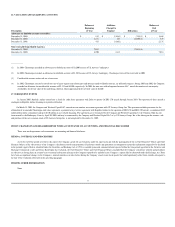

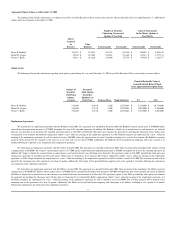

ITEM 14. PRINCIPAL

ACCOUNTING FEES AND SERVICES

The Company incurred professional fees from Deloitte & Touche LLP, its principal auditor, for the following professional services:

Audit Fees.

Fees in the amount of $722,751 were billed or expected to be billed in 2004, and fees in the amount of $325,695 were billed or expected to be billed in 2003. For 2004,

$231,021 related to the audit of the Company

’

s annual financial statements and the review of the interim financial statements included in the Company

’

s quarterly reports. For 2003, $175,695

related to audit of the Company

’

s annual financial statements. The remainder amounts of $491,730 and $150,000, respectively, related to the Company

’

s registration statement filed with the

Securities Exchange Commission.

Audit

-

Related Fees.

Fees in the amount of $24,700 were paid in 2004 related to the audit of the Company

’

s employee benefit plan and for financial accounting and reporting

consultations and Sarbanes Oxley Act, Section 404 advisory services. In 2003, $11,500 of fees were paid related to the Company

’

s employee benefit plans.

Tax Fees

. Fees in the amount of $86,685 and $58,200 were incurred for services provided in 2004 and 2003, respectively, related to services rendered for tax compliance, tax advice

and tax planning.

All Other Fees

. The Company did not incur such fees in 2004 or 2003.

The Company

’

s Audit Committee has determined that the non

-

audit services provided by the Company

’

s auditors in connection with the year ended December 31, 2004 were

compatible with the auditor

’

s independence.

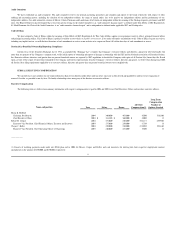

Pre

-

Approval Policies

The Audit Committee is required to approve in advance any audit or non

-

audit services performed by the Company

’

s independent public accountants that do not meet the pre

-

approval

standards established by the audit committee. The pre

-

approval policies and procedures established by the Audit Committee require that the Audit Committee meet with the independent auditor

and financial management to review planning, the scope of the proposed services, the procedures to be utilized, and the proposed fees. During 2004, 100% of the tax fees were pre

-

approved by

the Audit Committee.

66