Frontier Airlines 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

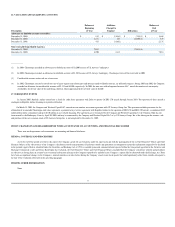

Adjustments Upon Changes in Capitalization.

Upon any increase, reduction, or change or exchange of the common stock for a different number or kind of shares or other securities,

cash or property by reason of a reclassification, recapitalization, merger, consolidation, reorganization, stock dividend, stock split or reverse stock split, combination or exchange of shares, or

any other corporate action that affects our capitalization, an equitable substitution or adjustment may be made in the aggregate number and/or kind of shares reserved for issuance (or reference

purposes) under the 2002 Equity Incentive Plan, the aggregate number and/or kind of shares for which prospective awards to non

-

employee directors are made, the kind, number and/or

exercise price of shares or other property subject to outstanding options granted under the 2002 Equity Incentive Plan, and the kind, number and/or purchase price of shares or other property

subject to outstanding awards of restricted stock, restricted stock units, stock appreciation rights, dividend equivalents and other equity

-

based awards granted under the 2002 Equity Incentive

Plan, as may be determined by the compensation committee, in its sole discretion. The compensation committee may provide, in its sole discretion, for the cancellation of any outstanding awards

in exchange for payment in cash or other property of the fair market value of the shares of our common stock covered by such awards (whether or not otherwise vested or exercisable), reduced,

in the case of options, by the exercise price thereof, or for no consideration in the case of awards which are not otherwise then vested or exercisable.

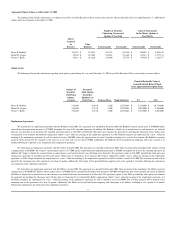

Nonassignability

. Except to the extent otherwise provided in an award agreement or approved by the compensation committee, no award granted under the 2002 Equity Incentive Plan

will be assignable or transferable other than by will or by the laws of descent and distribution and all awards will be exercisable during the life of a recipient only by the recipient (or in the event of

incapacity, his or her guardian or legal representative).

Amendment and Termination.

The 2002 Equity Incentive Plan may be amended or terminated at any time by our board of directors, subject, however, to stockholder approval in the

case of certain material amendments if required by applicable law, such as an increase in the number of shares available under the 2002 Equity Incentive Plan or a change in the class of

individuals eligible to participate in the 2002 Equity Incentive Plan.

U.S. Federal Income Tax Consequences.

The following is a brief description of the material U.S. federal income tax consequences generally arising with respect to awards granted

under the 2002 Equity Incentive Plan.

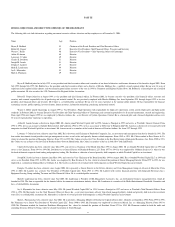

In general, the grant of an option will have no income tax consequences to the recipient or to us. Upon the exercise of an option, other than an ISO, the recipient generally will recognize

ordinary income equal to the excess of the fair market value of the shares of common stock subject to the option on the date of exercise over the exercise price for such shares (i.e., the option

spread), and we generally will be entitled to a corresponding tax deduction in the same amount. Upon the sale of the shares of our common stock acquired pursuant to the exercise of an option,

the recipient will recognize capital gain or loss equal to the difference between the selling price and the sum of the exercise price plus the amount of ordinary income recognized on the exercise.

A recipient generally will not recognize ordinary income upon the exercise of an ISO (although, on exercise, the option spread is an item of tax preference income potentially subject to

the alternative minimum tax) and we will not receive any deduction. If the stock acquired upon exercise of an ISO is sold or otherwise disposed of within two years from the grant date or within

one year from the exercise date, then gain realized on the sale generally is treated as ordinary income to the extent of the ordinary income that would have been realized upon exercise if the

option had not been an ISO, and we generally will be entitled to a corresponding deduction in the same amount. Any remaining gain is treated as capital gain.

If the shares acquired upon the exercise of an ISO are held for at least two years from the grant date and one year from the exercise date and the recipient is employed by us at all times

beginning on the grant date and ending on the date three months prior to the exercise date, then all gain or loss realized upon the sale will be capital gain or loss and we will not receive any

deduction.

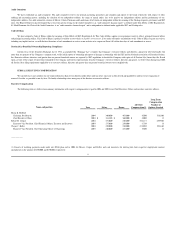

In general, an individual who receives an award of restricted stock will recognize ordinary income at the time such award vests in an amount equal to the difference between the value of

the vested shares and the purchase price for such shares, if any, and we generally will be entitled to a deduction in an amount equal to the ordinary income recognized by the recipient at such

time.

The recipient of an award of restricted stock units generally will recognize ordinary income upon the issuance of the shares of common stock underlying such restricted stock units in an

amount equal to the difference between the value of such shares and the purchase price for such units and/or shares, if any, and we generally will be entitled to a deduction in an amount equal to

the ordinary income recognized by the recipient at such time.

With respect to other equity

-

based awards, upon the payment of cash or the issuance of shares or other property that is either not restricted as to transferability or not subject to a

substantial risk of forfeiture, the participant will generally recognize ordinary income equal to the cash or the fair market value of shares or other property delivered, less any amount paid by the

participant for such award. Generally, we will be entitled to a deduction in an amount equal to the ordinary income recognized by the participant.

61