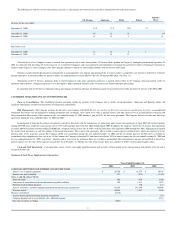

Frontier Airlines 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

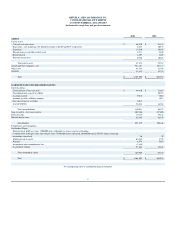

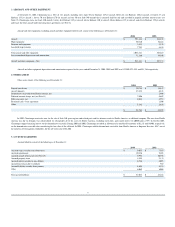

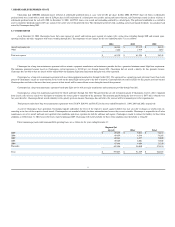

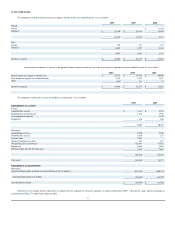

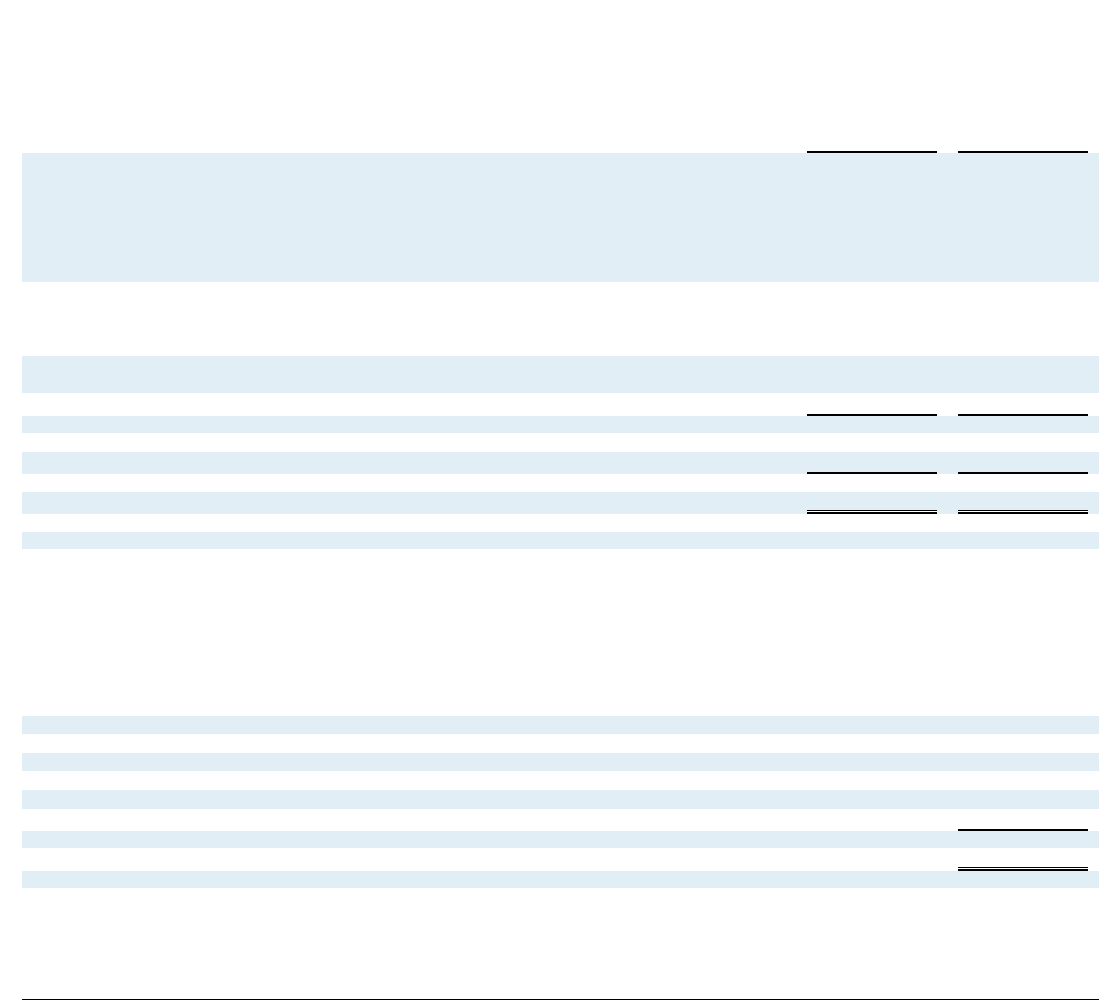

6. DEBT

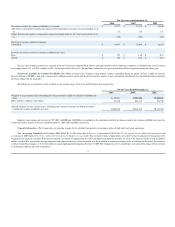

Debt consists of the following as of December 31:

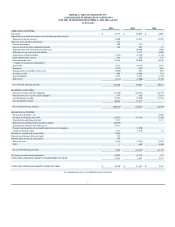

Chautauqua's debt agreements with the Bank contain restrictive covenants that require, among other things, that Chautauqua maintain a certain fixed charge coverage ratio and a debt to

earnings leverage ratio. Chautauqua received a waiver from the lender under the revolving credit facility for non

-

compliance with the debt to earnings leverage ratio for the fourth quarter of 2004.

Chautauqua has outstanding letters of credit totaling $4,782 and $2,438 as of December 31, 2004 and 2003, respectively. The American code

-

share agreement requires a debt sinking fund for

Chautauqua's required semi

-

annual payments.

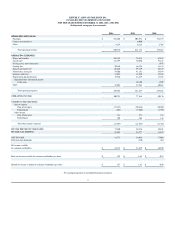

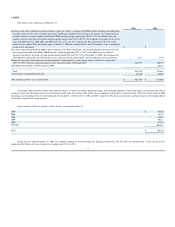

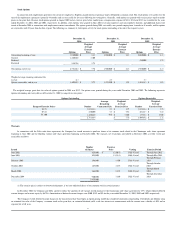

Future maturities of debt are payable as follows for the years ending December 31:

During the year ended December 31, 2004, the Company acquired 24 aircraft through debt financing totaling $318,456. The debt was obtained from a bank and the aircraft

manufacturer for fifteen year terms at interest rates ranging from 4.31% to 6.85%.

2004

2003

Revolving credit facility with Bank of America Business Capital (the "Bank"), maximum of $25,000 available (including outstanding letters

of credit), subject to 70% of the net book value of spare rotable parts and 40% of the net book value of spare non

-

rotable parts and

inventory. Interest is payable monthly at the Bank's LIBOR rate plus spreads ranging from 2.0% to 2.75% or the Bank's base rate

(which is generally equivalent to the prime rate) plus spreads ranging from 0.25% to 0.75%. The weighted average interest rates for the

years ended December 31, 2004, 2003 and 2002 were 4.2%, 4.5%, and 5.1%, respectively. Fees are payable at 0.375% on the

unused revolver amount. The credit facility expires on March 31, 2006 and is collateralized by all of Chautauqua's assets, excluding the

owned aircraft and engines.

$

$

Term loans with the Bank due March 2006 or upon termination of the Bank credit facility, with monthly principal payments of $54, and

interest payable monthly at the Bank's LIBOR rate plus spreads ranging from 2.0% to 2.75% or the Bank's base rate (which is

generally equivalent to the prime rate) plus spreads ranging from 0.25% to 0.75% (5.3% at December 31, 2004). The term loans are

collateralized by substantially all of Chautauqua's assets, except for aircraft collateralized by various banks and aircraft manufacturer.

3,212

1,336

Promissory notes with various banks and aircraft manufacturer, collateralized by aircraft, bearing interest at fixed rates ranging from

4.01% to 6.85% with semi

-

annual principal and interest payments of $44,349 through 2019.

846,974

460,939

Subordinated note payable to affiliate (repaid in 2004).

20,392

Total

850,186

482,667

Current portion (including Bank term loan)

46,420

45,059

Debt and notes payable

—

Less current portion

$

803,766

$

437,608

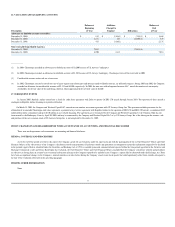

2005

$

46,420

2006

45,575

2007

48,075

2008

50,221

2009

52,641

Thereafter

607,254

Total

$

850,186

48