Frontier Airlines 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 3. LEGAL PROCEEDINGS

We are subject to certain legal and administrative actions, which we consider routine to our business activities. Management believes that the ultimate outcome of any pending legal

matters will not have a material adverse effect on our financial position, liquidity or results of operations.

ITEM 4. SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

PART

II

ITEM 5. MARKET FOR REGISTRANT’S COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Market Price

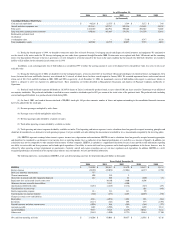

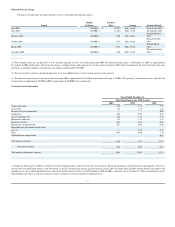

Our common stock began trading on The Nasdaq National Market on May 27, 2004 and is traded under the symbol "RJET." Prior to that date, there was no public market for our

common stock. The following table sets forth the high and low sales prices of our common stock for the periods indicated.

As of March 7, 2005, there were 49 stockholders of record of our common stock. We have not paid cash dividends on our common stock. The payment of future dividends is within the

discretion of our board of directors and will depend upon our future earnings, our capital requirements, bank financing, financial condition and other relevant factors. Chautauqua

’

s credit facility

with Bank of America Business Capital does not limit its ability to pay dividends to Republic Airways unless Chautauqua is in default thereunder.

We received net proceeds of $58.2 million in connection with our initial public offering that closed in June 2004. Through December 31, 2004, we had used the net proceeds as follows:

$19.2 million to repay all indebtedness to WexAir LLC, our majority stockholder; and

$39.0 million for acquisition of additional aircraft, related spare parts and support equipment.

Year Ended December 31, 2004

High

Low

Second Quarter (beginning May 27, 2004)

$

15.00

$

11.58

Third Quarter

14.08

8.37

Fourth Quarter

13.54

8.15

22