Frontier Airlines 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

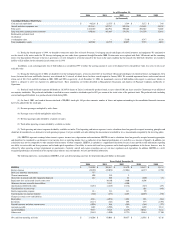

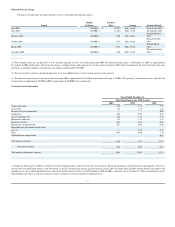

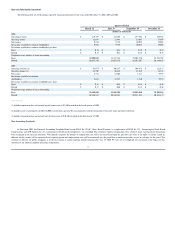

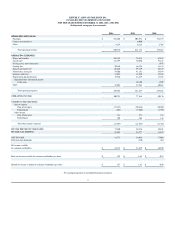

2003 Compared to 2002

Operating revenue in 2003 increased by 33.5%, or $105.7 million, to $421.1 million in 2003 compared to $315.5 million in 2002. The increase was due to the additional regional jets

added to the fixed

-

fee flying. Twenty

-

four additional Embraer regional jets were added to the fleet since December 31, 2002. Sixteen were added for Delta and eight were added for US

Airways. In February 2003, we and America West mutually agreed to terminate our code

-

share agreement and we concurrently allocated the aircraft previously designated for America West to

Delta. The transition of these aircraft was completed during the second quarter of 2003. We recorded a breakage fee of $6.0 million from America West as a result of this transaction. Pro

-

rate

operating revenue decreased $11.1 million due to the elimination of the pro

-

rate turboprop operations for US Airways in September 2002.

Total operating expenses increased by 24.7%, or $68.0 million, to $343.3 million for 2003 compared to $275.3 million during 2002 due to the increase in flight operations and the

impairment loss and accrued aircraft return costs of $10.2 million in 2003 compared to $3.8 million in 2002. Total operating and interest expenses increased by $78.0 million, or 27.2%. The unit

cost on total operating and interest expenses decreased 13.7% to 10.5

¢

for 2003 compared to 12.2

¢

for 2002 due primarily to the increase in capacity (as measured by ASMs) associated with

the additional Embraer regional jets. Factors relating to the change in operating expenses are discussed below.

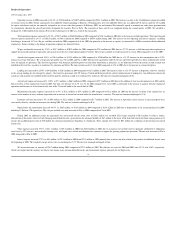

Wages and benefits increased by 45.5%, or $23.9 million, to $76.4 million for 2003 compared to $52.5 million for 2002 due to a 31.6% increase in full time equivalent employees to

support the increased regional jet operations and an increase in the costs of providing employee benefit plans. Wages and benefits cost per available seat mile remained unchanged at 2.2

¢

for

2003 compared to 2002 primarily due to the increase in capacity associated with the additional Embraer regional jets.

Aircraft fuel expense increased 32.4%, or $18.6 million, to $76.0 million for 2003 compared to $57.4 million for 2002 due to a 44.7% increase in fuel consumption, offset by a decline in

fuel pricing. The average price per gallon was 83

¢

in 2003 and 91

¢

in 2002. The fixed

-

fee agreement with US Airways provides for a direct reimbursement of fuel costs for Embraer regional jet

operations. The fixed

-

fee agreements with American and Delta protect us from future fluctuations in fuel prices, as any difference between the actual cost and assumed cost included in the fixed

fees is paid to or reimbursed by American and Delta. The unit cost has decreased by 10.2% to 2.2

¢

in 2003 compared to 2.4

¢

in 2002 due to the decrease in the average fuel price.

There were no passenger fees and commissions (which were paid only for the pro

-

rate turboprop flying for US Airways) paid during 2003 because of the elimination of the turboprop

operations in September 2002.

Landing fees increased by 45.1%, or $5.0 million, to $16.1 million in 2003 compared to $11.1 million in 2002. The increase is due to the increase in flying and an increase in the average

landing fee rate charged by airports. The unit cost remained unchanged at 0.5

¢.

Our fixed

-

fee agreements with US Airways and Delta provide for a direct reimbursement of landing fees. Any

difference between the actual cost and assumed cost included in the fixed

-

fees paid by American is paid to or reimbursed by American.

Aircraft and engine rent increased by 5.6%, or $3.2 million, to $59.3 million in 2003 compared to $56.2 million in 2002 due to the addition of three leased Embraer regional jets in

October and November 2002, and four leased Embraer regional jets in October and November 2003. The increase was partially offset with the decrease in rent on the Saab turboprops that

were eliminated from service in September 2002. Unit cost decreased by 28.5% to 1.7

¢

for 2003 compared to 2.4

¢

for 2002 due to the increase in capacity from the Embraer regional jet

operations and because we lease financed only four of the 24 additional aircraft added in 2003.

Maintenance and repair expenses increased by 21.8%, or $7.6 million, to $42.2 million in 2003 compared to $34.6 million for 2002 due to the increase in flying of the regional jets. This

increase in regional jet maintenance expense was partially offset by the decrease in expenses for the turboprop operations that ended in September 2002. The unit cost decreased by 17.0% to

1.2¢

in 2003 compared to 1.5

¢

in 2002 due to the increase in capacity from the Embraer regional jet operations and the elimination of the turboprop operations.

Insurance and taxes decreased 24.5%, or $3.8 million, to $11.7 million in 2003 compared to $15.5 million in 2002. While the average fleet value has increased due to the growth of our

regional jet fleet, insurance rates for passenger liability, war risk and hull insurance decreased during 2003 due to obtaining war risk coverage from the U.S. government in February 2003 which

was less expensive compared to commercial rates and lower passenger liability and hull rates obtained from the commercial markets in 2003 as rates have stabilized since the terrorist attacks in

September 2001. Additionally, aircraft property tax expense has decreased because we have changed Chautauqua's state of incorporation to Indiana effective February 2003, which eliminated

Indiana aircraft property tax expense for 2003. Unit cost decreased 48.5% to 0.3

¢

in 2003 compared to 0.7

¢

in 2002.

Depreciation and amortization increased 99.2%, or $11.7 million, to $23.4 million in 2003 compared to $11.8 million in 2002 due to the purchase of an additional twenty Embraer

regional jets since December 31, 2002. The cost per available seat mile increased by 36.0% to 0.7

¢

in 2003 from 0.5

¢

in 2002.

During 2003, an additional charge for impairment loss and accrued aircraft return costs of $10.2 million was recorded. This charge consists of an impairment loss of $0.8 million to reflect

a further deterioration of the market value for Saab turboprop aircraft held for sale, a provision for the estimated liability of $6.7 million to the lessor of the Saab 340 aircraft for future rent

payments on 18 aircraft (as three are due to be returned in January 2004) and an additional provision of $3.0 million for contractual maintenance obligations to a third party. These additional

amounts were recorded, because it was probable, based on the uncertainty of Shuttle America's ability to meet payment obligations, that payments to the lessor and maintenance vendor will be

required. These amounts were offset by $0.3 million for a reduction in the provision for aircraft return costs. We continue to account for this exit activity pursuant to EITF 94

-

3, Liability

Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (Including Certain Costs Incurred in a Restructuring).

Other expenses decreased 7.7%, or $2.3 million, to $28.0 million in 2003 from $30.3 million in 2002. The decrease is due to decreases in professional fees incurred for a previous IPO

attempt that were recorded in 2002 and bad debt expenses. These decreases were partially offset by increase in crew related expenses and administrative expenses. The decrease in bad debt

expense is due to recording a receivable allowance of $4.9 million in 2002 compared to $2.1 million in 2003 for a note receivable relating to the sale of the Saab inventory and equipment sold to

the new lessee of the Saab turboprop aircraft, Shuttle America, a company controlled by Wexford Capital LLC. The allowance was recorded after considering the fair value of the collateral and

Shuttle America's ability to repay the note. Increase in crew related expenses and administrative expenses are due to support of the growing regional jet operation. The unit cost decreased by

38.0% to 0.8¢

in 2003 compared to 1.3

¢

in 2002 due to the increased capacity resulting from the Embraer regional jet flying.

During 2002, the calculation for the Stabilization Act was finalized and the final payment from the federal government was reduced by $0.2 million. This figure is included in operating

expenses for 2002.

Interest expense increased by 83.1% or $10.0 million, to $22.1 million in 2003 from $12.0 million in 2002 primarily due to interest on debt related to the purchase of twenty Embraer

aircraft since December 2002. This increase was partially offset by decrease in average borrowings on the revolving credit facility and a lower weighted average interest rate of 5.1% in 2003,

versus 5.8% in 2002.

Other non

-

operating income increased 6.5% to $0.6 million in 2003 compared to $0.5 million in 2002. Non

-

operating income consists primarily of net gains on speculative fuel hedges

that we benefited from during the first quarter of 2002 and interest income. The increase in 2003 is due to having an increase in the average balance of cash generated by operations.

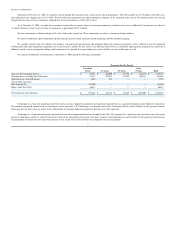

We incurred income tax expense of $22.3 million during 2003, compared to $11.7 million in 2002. The effective tax rates for 2003 and 2002 were 39.6% and 40.7%, respectively,

which were higher than the statutory rate due to state income taxes and non

-

deductible meals and entertainment expense, primarily for our flight crews.

31