Frontier Airlines 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

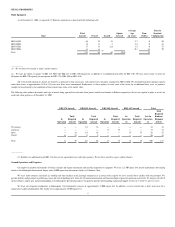

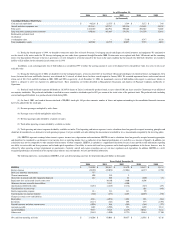

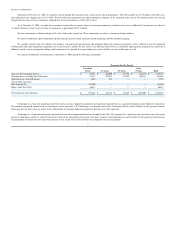

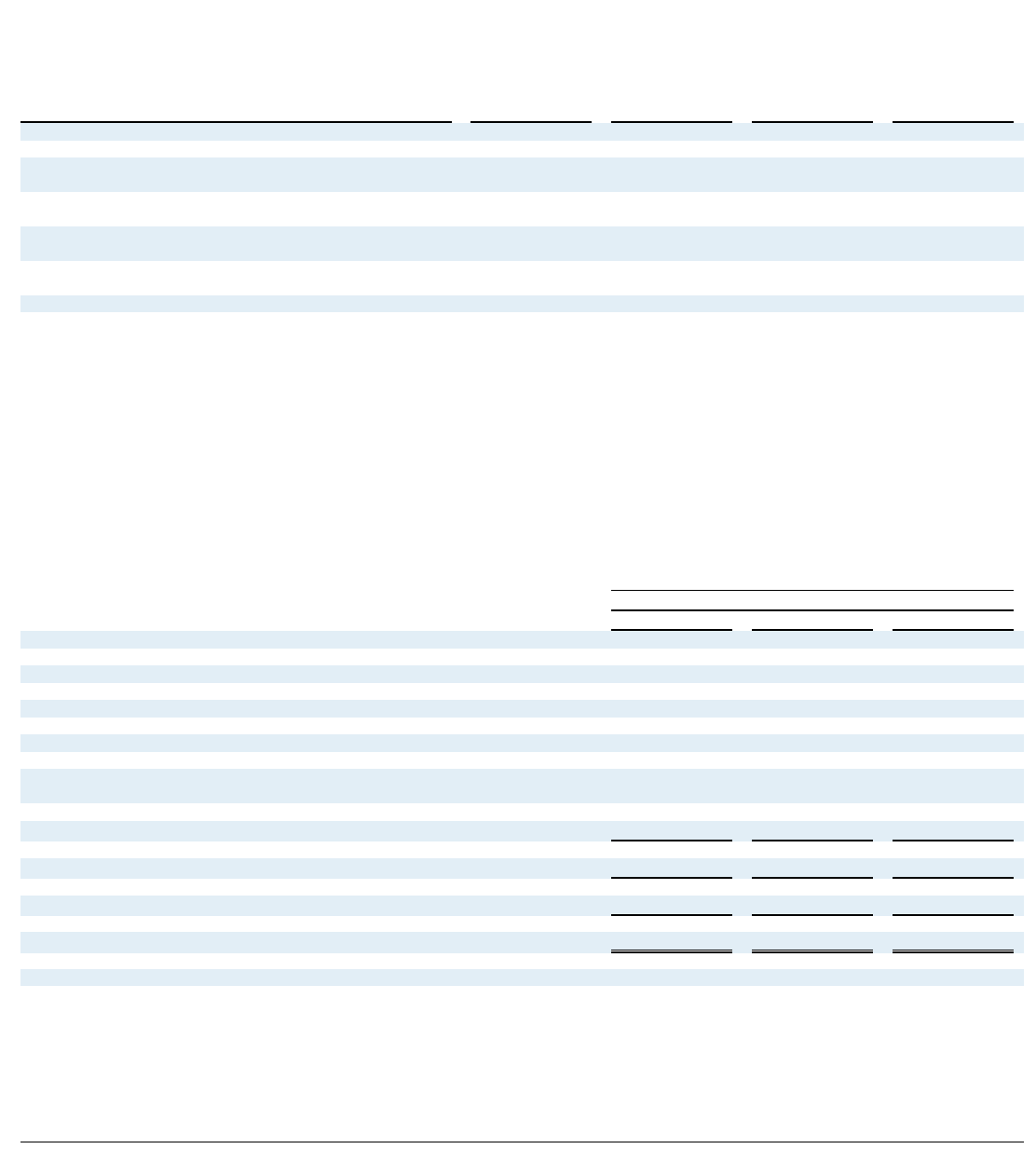

Deferred Warrant Charge

Pursuant to our code

-

share agreement with Delta, we have issued Delta the following warrants:

___________

(1) These amounts reflect the surrender of 45% of the warrants originally issued by us to Delta in December 2004. The deferred warrant charge as of December 31, 2004 was approximately

$3.8 million. In 2005 and thereafter, deferred warrant charges, excluding charges with respect to the warrants issued in December 2004, will be amortized over the term of the Delta code

-

share

agreement, as amended, resulting in an annual non

-

cash charge of approximately $334,000.

(2) The exercise price is subject to downward adjustment, if we issue additional shares of our common stock in certain instances.

(3) The deferred warrant charge for warrants issued in December 2004 is approximately $3.6 million. Amortization will begin as the ERJ

-

170 regional jets are placed into service and will result

in amortization of approximately $97,000 in 2005 and approximately $380,000 each year thereafter.

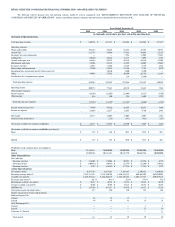

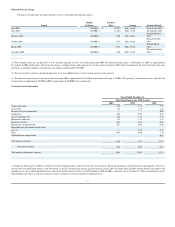

Certain Statistical Information

(1) During the fourth quarter of 2001, we decided to exit the turboprop business, return our entire fleet of leased Saab 340 aircraft and dispose of related inventory and equipment. New leases

(between the lessor and Shuttle America) were obtained for 21 aircraft, of which leases for three aircraft expired in January 2004. We remain liable if Shuttle America defaults with respect to the

remaining leases. We recorded impairment losses and accrued aircraft return cost of $3.8 and $10.2 million in 2002 and 2003, respectively. As of December 31, 2004, we maintained a reserve

of $6.0 million with respect to such losses which we believe is adequate to cover our exposure for additional losses.

Issued

Number

of Shares

Exercise

Price

Vesting

Exercise Period

June 2002

825,000(1

)

$

12.50(2

)

Fully Vested

Through June 2012

June 2004

825,000(1

)

12.35(2

)

Fully Vested

Through May 2014

February 2003

396,000(1

)

13.00

Fully Vested

Through February

2013

October 2003

165,000(1

)

12.35

Fully Vested

Through October

2013

March 2004

264,000(1

)

12.35

Fully Vested

Through March

2014

December 2004

960,000(3

)

11.60

Fully Vested

Through December

2014

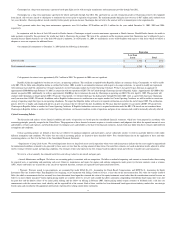

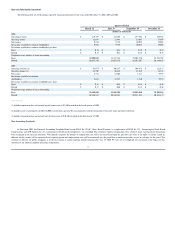

Years Ended December 31,

Operating Expenses per ASM in cents

2004

2003

2002

Wages and benefits

2.29

2.21

2.24

Aircraft fuel

2.55

2.19

2.44

Passenger fees and commissions

—

—

0.08

Landing fees

0.46

0.47

0.47

Aircraft and engine rent

1.50

1.71

2.39

Maintenance and repair

1.23

1.22

1.47

Insurance and taxes

0.27

0.34

0.66

Depreciation and amortization

0.77

0.68

0.50

Impairment loss and accrued aircraft return

costs (1)

—

0.29

0.16

Other

0.87

0.80

1.30

Stabilization Act compensation

0.01

Total operating expenses

9.94

9.91

11.72

Plus interest expense

0.64

0.64

0.51

Total operating and interest expenses

10.58

10.55

12.23

28