Frontier Airlines 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Aircraft Maintenance and Repair

is charged to expense as incurred under the direct expense method. Engines and certain airframe component overhaul and repair costs are subject

to power

-

by

-

the

-

hour contracts with external vendors and are accrued as the aircraft are flown.

Use of Estimates—

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts

of revenues and expenses during the reporting periods. Under the code

-

share agreements, we estimate operating costs for certain

“

pass through

”

costs and record revenue based on these

estimates. Actual results could differ from those estimates.

Revenue Recognition—

Revenues are recognized in the period the service is provided. Chautauqua recognizes revenues and expenses at the contract rate for pass

-

through costs under

the code

-

share agreements. Chautauqua does not have an air traffic liability.

Warrants—

Equity instruments issued to code

-

share partners are recorded on the measurement date as deferred charges and credits to stockholders

’

equity. Warrants surrendered are

recorded at fair value on the measurement date as reductions to deferred warrant charges and stockholders

’

equity. The deferred charges for warrants are amortized as a reduction of passenger

revenue over the terms of the code

-

share agreements.

Stock Compensation—

The Company applies Accounting Principles Board Opinion No. 25,

Accounting for Stock Issued to Employees,

and related interpretations in accounting for

stock options. No compensation expense is recorded for stock options with exercise prices equal to or greater than the fair market value on the grant date. Warrants issued to non

-

employees

are accounted for under SFAS No. 123,

Accounting for Stock

-

Based Compensation

and EITF 96

-18, Accounting for Equity Instruments That Are Issued to Other Than Employees for

Acquiring, or in Conjunction with Selling, Goods or Services,

at fair value on the measurement date.

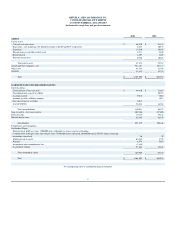

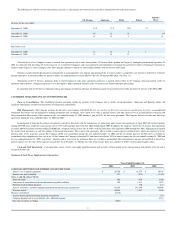

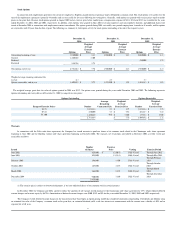

SFAS No. 148, Accounting for Stock

-

Based Compensation—Transition and Disclosure—an Amendment of FASB Statement No. 123, Accounting for Stock

-

Based

Compensation

, requires disclosing the effects on net income available for common stockholders and net income available for common stockholders per share under the fair value method for all

outstanding and unvested stock awards. SFAS No. 148 disclosure requirements, including the effect on net income available for common stockholders and net income available for common

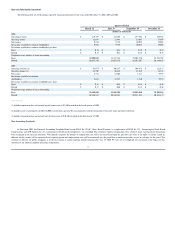

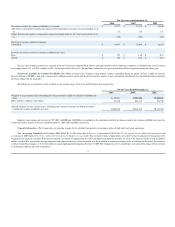

stockholders per share, if the fair value based method had been applied to all outstanding and unvested stock awards in each period, are as follows:

45