Frontier Airlines 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

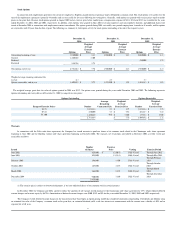

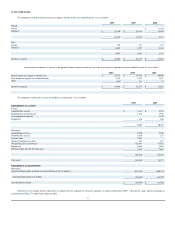

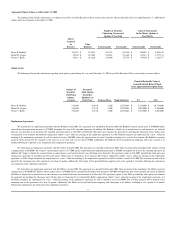

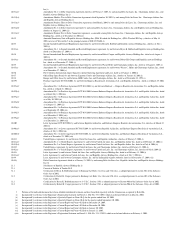

Aggregated Option Values as of December 31, 2004

The following table provides information as to options exercised by our Chief Executive Officer and our other executive officers during the fiscal year ended December 31, 2004 and the

number and value of options at December 31, 2004.

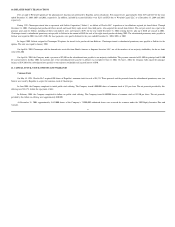

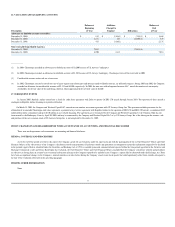

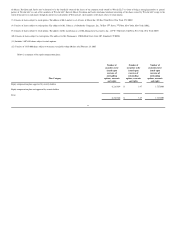

Option Grants

The following table provides information regarding stock options granted during the year ended December 31, 2004 to our Chief Executive Officer and our other executive officers.

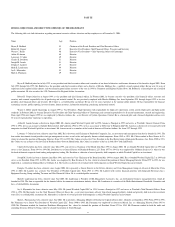

Employment Agreements

We entered into an employment agreement with Mr. Bedford in July 2003. The agreement was amended in December 2004. Mr. Bedford's current annual salary is $340,000 and his

annual deferred compensation payment is $170,000, throughout the term of the amended agreement. In addition, Mr. Bedford is eligible for an annual bonus in such amount as our board of

directors may determine in its discretion. The amended agreement expires in June 2007, provided that either party may terminate the agreement by providing the other party notice 30 days prior

to termination. If we terminate Mr. Bedford's employment without "cause" within the meaning of the employment agreement, or if Mr. Bedford terminates his employment for "cause," within the

meaning of the employment agreement, he will be entitled to receive $680,000, unless the agreement has less than 24 months remaining in its term. In that situation, Mr. Bedford's severance

payment will be prorated for the remainder of the term, but in no event will it be less than $170,000. Additionally, Mr. Bedford will be precluded from competing with us for a period of 12

months following the expiration or any termination of his employment agreement.

We entered into an employment agreement with Mr. Cooper in August 2003. The agreement was amended in December 2004. Upon execution of the amendment, Mr. Cooper received

a signing bonus of $350,000. Mr. Cooper's current annual salary is $175,000 and his annual deferred compensation payment is $70,000, throughout the term of the amended agreement. In

addition, Mr. Cooper is eligible for an annual bonus in such amount as our board of directors may determine in its discretion. The agreement expires in July 2007, provided that either party may

terminate the agreement by providing the other party notice 30 days prior to termination. If we terminate Mr. Cooper's employment without "cause" within the meaning of the employment

agreement, or if Mr. Cooper terminates his employment for "cause," within the meaning of the employment agreement, he will be entitled to receive $175,000. The severance payment will be

prorated if the remaining term of the agreement is less than 12 months. Additionally, Mr. Cooper will be precluded from competing with us for a period of 12 months following the expiration or

any termination of his employment agreement.

We entered into an employment agreement with Mr. Heller in August 2003. The agreement was amended in December 2004. Upon execution of the amendment, Mr. Heller received a

signing bonus of $170,000. Mr. Heller's current annual salary is $170,000 and his annual deferred compensation payment is $68,000, throughout the term of the amended agreement. In addition,

Mr. Heller is eligible for an annual bonus in such amount as our board of directors may determine in its discretion. The agreement expires in July 2007, provided that either party may terminate

the agreement by providing the other party notice 30 days prior to termination. If we terminate Mr. Heller's employment without "cause" within the meaning of the employment agreement, or if

Mr. Heller terminates his employment for "cause," within the meaning of the employment agreement, he will be entitled to receive $170,000. The severance payment will be prorated if the

remaining term of the agreement is less than 12 months. Additionally, Mr. Heller will be precluded from competing with Chautauqua or its affiliates, including us, for a period of 12 months

following the expiration or any termination of his employment agreement.

Number of Securities

Underlying Unexercised

Options at Year End

Value of Unexercised

In

-

the

-

Money Options at

Year End ($)

Shares

Acquired

on

Exercise

Value

Realized

Unexercisable

Exercisable

Unexercisable

Exercisable

Bryan K. Bedford

341,475

$

875,852

483,338

893,288

$

130,501

$

9,899,594

Robert H. Cooper

85,369

$

218,965

238,965

231,626

$

64,521

$

2,477,138

Wayne C. Heller

81,912

$

183,220

184,890

127,358

$

49,920

$

1,362,877

Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for Option Term

Number of

Securities

Underlying

Options

Granted

Percent of

Total Options

Granted to

Employees in

Fiscal Year

Exercise Price

Expiration Date

5%

10%

Bryan K. Bedford

518,100

38.6

%

$

13.00

12/27/2014

$

4,236,000

$

10,734,000

Robert H. Cooper

255,960

19.1

%

$

13.00

12/27/2014

$

2,093,000

$

5,303,000

Wayne C. Heller

194,160

14.5

%

$

13.00

12/27/2014

$

1,587,000

$

4,023,000

59