Frontier Airlines 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

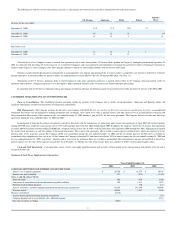

Purchase Commitments

Subsequent to December 31, 2004, we acquired 4 aircraft through debt financing from a bank and the aircraft manufacturer. Total debt incurred was $73.4 million, with fifteen year

terms and interest rates ranging from 6.13% to 6.76%. We have substantial commitments for capital expenditures, primarily for the acquisition of new aircraft. We intend to finance these aircraft

through long

-

term loans or lease arrangements, although there can be no assurance we will be able to do so.

As of December 31, 2004, our code

-

share agreements required that we acquire (subject to financing commitments) and place into service an additional 28 regional jets over the next

18 months. Embraer's current list price of these 28 regional jets is approximately $752.2 million.

We have commitments to obtain financing for 24 of the 28 firm order regional jets. These commitments are subject to customary closing conditions.

We expect to fund future capital commitments through internally generated funds, third

-

party aircraft financings, and debt and other financings.

We currently anticipate that our available cash resources, cash generated from operations and anticipated third

-

party financing arrangements, will be sufficient to meet our anticipated

working capital and capital expenditure requirements for at least the next 12 months. We may need to raise additional funds, however, to fund more rapid expansion, principally the acquisition of

additional aircraft, or meet unanticipated working capital requirements. It is possible that future funding may not be available to us on favorable terms, or at all.

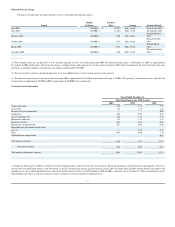

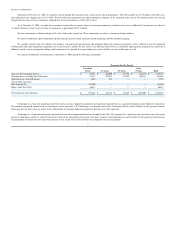

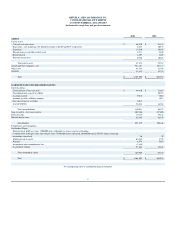

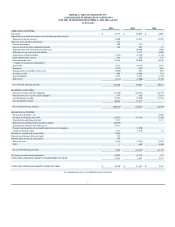

Our contractual obligations and commitments at December 31, 2004, include the following (in thousands):

Chautauqua has a long

-

term maintenance agreement with an avionics equipment manufacturer and maintenance provider that has a guaranteed minimum annual flight hour requirement.

The minimum guaranteed amount based on Chautauqua's current operations is $3.9 million per year through January 2012. Chautauqua did not record a liability for this guarantee because

Chautauqua does not believe that any aircraft will be utilized below the minimum flight hour requirement during the term of the agreement.

Chautauqua has a long

-

term maintenance agreement with an aviation equipment manufacturer through October 2013. The agreement has a penalty payment provision if more than twenty

percent of Chautauqua's aircraft are removed from service based on the annual flight activity prior to the date of removal. Chautauqua did not record a liability for this penalty provision because

Chautauqua does not believe that more than twenty percent of their aircraft will be removed from service during the term of the agreement.

Payments Due By Period

Less than

1 year

1

-

3 years

4

-

5 years

Over

5 years

Total

Long

-

term debt (including interest)

$

88,698

$

265,606

$

175,764

$

682,189

$

1,212,257

Operating leases, excluding Saab 340 aircraft

74,672

222,031

142,892

404,812

844,407

Operating leases, Saab 340 aircraft

2,405

518

—

—

2,923

Aircraft under firm orders:

Debt

-

financed (28)

752,200

—

—

—

752,200

Engines under firm orders

10,671

—

—

—

10,671

Total contractual cash obligations

$

928,646

$

488,155

$

318,656

$

1,087,001

$

2,822,458

33