Frontier Airlines 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

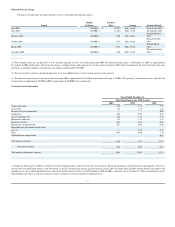

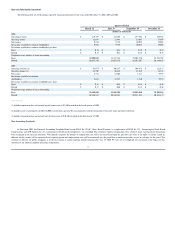

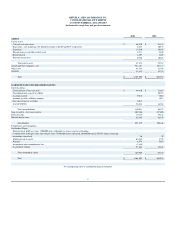

Quarterly Information (unaudited)

The following table sets forth summary quarterly financial information for the years ended December 31, 2002, 2003 and 2004.

___________

(1) Includes impairment loss and accrued aircraft return costs of $3,800 recorded in the fourth quarter of 2002.

(2) Includes in the second quarter of 2003, $6,000 received from America West in connection with the termination of our code

-

share agreement with them.

(3) Includes impairment loss and accrued aircraft return costs of $10,160 recorded in the third quarter of 2003.

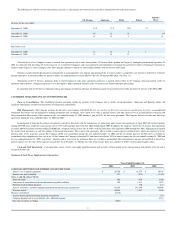

New Accounting Standards

In December 2004, the Financial Accounting Standards Board issued SFAS No. 123(R), Share

-

Based Payment, as a replacement of SFAS No. 123, Accounting for Stock

-

Based

Compensation, and APB Opinion No. 25, Accounting for Stock Issued to Employees, was rescinded. This statement requires compensation costs related to share

-

based payment transactions

to be recognized in the financial statements. With limited exceptions, the amount of compensation cost will be measured based upon the grant date fair value of the equity or liability issued. In

addition, liability awards will be remeasured each reporting period and compensation costs will be recognized over the period that an employee provides service in exchange for the award. This

statement is effective for public companies as of the first interim or annual reporting period beginning after June 15, 2005. We have not yet completed our assessment of the impact of this

statement on our financial condition and results of operations.

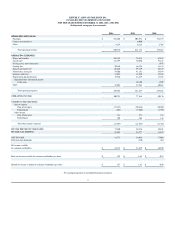

Quarters Ended

March 31

June 30

September 30

December 31

(dollars in thousands)

2004

Operating revenues

$

119,197

$

124,692

$

137,882

$

158,965

Operating income

22,653

21,988

23,065

33,047

Net income

9,936

9,789

10,045

15,001

Net income available for common stockholders

9,936

9,789

10,045

15,001

Net income available for common stockholders per share:

Basic

$

0.50

$

0.44

$

0.39

$

0.59

Diluted

$

0.48

$

0.42

$

0.38

$

0.57

Weighted average number of shares outstanding:

Basic

20,000,000

22,317,363

25,508,756

25,542,702

Diluted

20,887,240

23,055,110

26,203,207

26,164,628

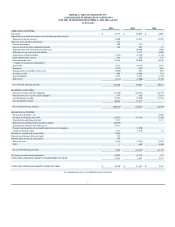

2003

Operating revenues (2)

$

93,679

$

106,147

$

108,472

$

112,817

Operating income (3)

18,707

26,245

11,545

21,321

Net income

8,741

12,602

3,111

9,595

Net income available for common

stockholders

8,651

12,523

3,110

9,595

Net income available for common stockholders per share:

Basic

$

0.43

$

0.63

$

0.15

$

0.48

Diluted

$

0.42

$

0.60

$

0.15

$

0.46

Weighted average number of shares outstanding:

Basic

20,000,000

20,000,000

20,000,000

20,000,000

Diluted

20,826,841

20,826,563

20,821,534

20,841,415

35