Frontier Airlines 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Code

-

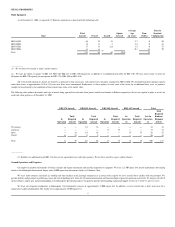

Share Agreements

On September 12, 2004, US Airways, which represented 41% of our revenue for the year ended December 31, 2004, filed a petition for Chapter 11 bankruptcy protection. Unpaid

amounts related to pre

-

petition claims were approximately $3.2 million, which are fully reserved at December 31, 2004. We have been paid for all amounts due post

-

petition in accordance with

our code

-

share agreement; however, the US Airways code

-

share agreement has not yet been assumed in the bankruptcy proceedings. United, which represented 7% of our revenue for the year

ended December 31, 2004, is attempting to reorganize its business under Chapter 11 of the bankruptcy code.

We continue to operate normal flight schedules for US Airways and United; however, contingency plans have been developed to address potential outcomes of the US Airways and

United bankruptcy proceedings.

Delta, which represented 35% of our revenue for the year ended December 31, 2004, has recently reported operating losses and has announced that if it fails to achieve a competitive

cost structure it will need to restructure through bankruptcy. In December 2004, in exchange for, among other things, Delta extending the term of its code

-

share agreement and canceling

previously issued warrants to purchase 2,025,000 shares of our common stock, we agreed to reduce our compensation level on the ERJ

-

145 fleet by 3% through May 2016.

Termination of any of our code

-

share agreements could have a material adverse effect on our financial position, results of operations and cash flows.

Fleet Transition and Growth

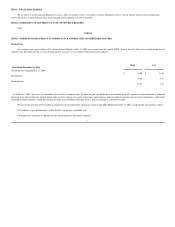

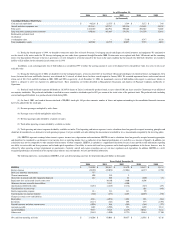

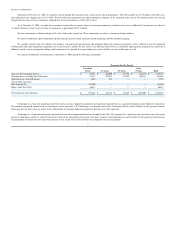

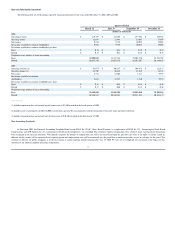

The following table sets forth the number and type of aircraft in service and operated by us at the dates indicated:

___________

(1) We use these aircraft as spares and for charters. They are not assigned to any of our code

-

share partners.

(2) Excludes two Saab 340 aircraft held for sale at December 31, 2002 and 2003 and one leased Saab 340 aircraft at December 31, 2004.

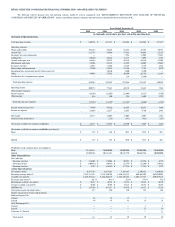

During the fourth quarter of 2001, we decided to exit the turboprop business, return our entire fleet of leased Saab 340 aircraft and dispose of related inventory and equipment. New

leases (between the lessor and Shuttle America) were obtained for 21 aircraft, of which leases for three aircraft expired in January 2004. We remain liable if Shuttle America defaults with respect

to the remaining leases. We recorded impairment losses and accrued aircraft return cost of $3.8 and $10.2 million in 2002 and 2003, respectively. As of December 31, 2004, we maintained a

reserve of $6.0 million with respect to such losses, which we believe is adequate to cover our exposure for additional losses. The impairment losses reduced the carrying value of the owned Saab

340 aircraft to be disposed of to the estimated fair value less costs to sell. The impairment losses were based on the estimated fair values obtained from aircraft dealers, less selling costs. The

accrued aircraft return costs represent Chautauqua's estimated liability for rent payments if the new leases are subsequently terminated and/or Shuttle America does not make its lease payments,

Chautauqua's obligation to pay the lessor a rent differential, based on Chautauqua's original lease payments less the lease payments of Shuttle America, estimated overhaul and return costs in

order to meet required return conditions and Chautauqua's best estimate for the liability under an assigned maintenance agreement, in which Chautauqua has guaranteed payment if Shuttle

America is unable to make the required payments. The accruals for Chautauqua's estimated liability for rent payments and the maintenance agreement were calculated to include the uncertainty as

to whether Shuttle America will be able to meet the payment obligations.

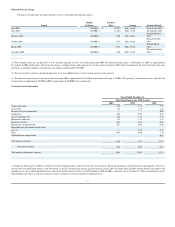

During 1999, we began operating Embraer regional jets on behalf of US Airways under a fixed

-

fee arrangement. There were 26, 34 and 35 Embraer aircraft operating on behalf of US

Airways under this agreement at December 31, 2002, 2004 and 2004, respectively. During 2000, we began operating Saab 340 turboprops and Embraer regional jets on behalf of TWA under

a fixed

-

fee arrangement; TWA was subsequently acquired by American. There were 15 Embraer regional jets operating under the agreement with American at December 31, 2002, 2003 and

2004. At December 31, 2002, 2003 and 2004, respectively, we had six, 34 and 41 aircraft in operation under the agreement with Delta. We began flying Embraer regional jets for United in

June 2004 and at December 31, 2004, we had 20 aircraft in operation under the agreement with United. During 2002, 98% of our ASMs and 96.5% of our passenger revenues were generated

under fixed

-

fee agreements. During 2003 and 2004, 100.0% of our ASMs and 100.0% of our passenger revenues were generated under fixed

-

fee agreements. The shift to fixed

-

fee flying has

reduced our exposure to fluctuations in fuel prices, fare competition

and passenger volumes. As of December 31, 2004, we operated 111 Embraer regional jets for four code

-

share partners.

December 31,

2002

2003

2004

Total

Owned

Leased

Total

Owned

Leased

Total

Owned

Leased

Regional Jets:

Embraer ERJ

-

145 LR

42

5

37

53

12

41

68

25

43

Embraer ERJ

-

140 LR

15

11

4

15

11

4

15

11

4

Embraer ERJ

-

135 LR

2

2

—

15

15

—

17

15

2(1

)

Embraer ERJ

-

170 LR

11

11

—

Saab 340 (2)

—

—

—

—

—

—

—

—

—

Total

59

18

41

83

38

45

111

62

49

26