Frontier Airlines 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

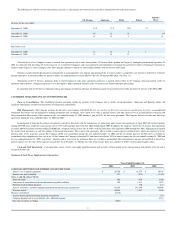

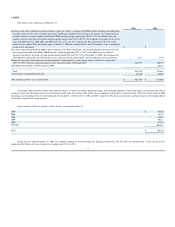

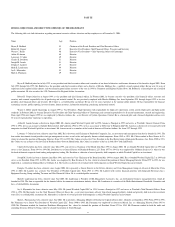

10. RELATED PARTY TRANSACTIONS

Fees are paid to Wexford Capital LLC for administrative functions not performed by Republic and its subsidiaries. Fees incurred were approximately $226, $257 and $327 for the years

ended December 31, 2004, 2003 and 2002, respectively. In addition, included in accrued liabilities were $213 and $528 due to Wexford Capital LLC as of December 31, 2004 and 2003,

respectively.

During 1999, Chautauqua entered into an agreement with Solitair Corporation ("Solitair"), an affiliate of WexAir LLC, to purchase or lease Embraer regional jets from Solitair. Through

December 31, 2002, Chautauqua had purchased fifteen aircraft and leased thirty

-

eight aircraft from third parties, who acquired the aircraft from Solitair. The cost per aircraft was equal to the

purchase price paid by Solitair, including all direct and indirect costs and expenses ($191 for the year ended December 31, 2002) relating thereto, plus up to $440 per aircraft in 2002.

Chautauqua issued a subordinated promissory note payable to Solitair in the amount of $440 for each of the eight aircraft purchased during 2002. The subordinated promissory notes payable to

Solitair were repaid in 2003 (total of $3,520). No lease payments were paid to Solitair for the years ended December 31, 2004, 2003, or 2002.

In August 2002, Solitair assigned to Chautauqua 20 options for aircraft to be purchased from Embraer. Chautauqua issued a subordinated promissory note payable to Solitair for the

options. The note was repaid in January 2003.

On April 16, 2004, Chautauqua sold the demand note receivable from Shuttle America to Imprimis Investors LLC, one of the members of our majority stockholder, for the net book

value of $2,400.

On April 16, 2004, the Company made a payment of $2,800 on the subordinated note payable to our majority stockholder. The payment consisted of $1,400 for principal and $1,400

for accrued interest. In May 2004, the maturity date of the subordinated note payable to affiliate was extended to June 13, 2004. On June 2, 2004, the Company fully repaid the principal

balance of $19,100 of the subordinated note payable to our majority stockholder and accrued interest of $80.

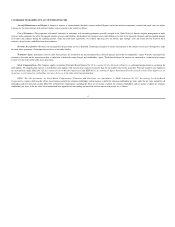

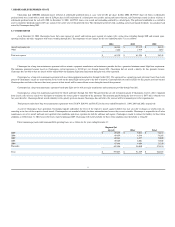

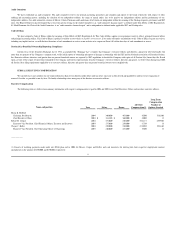

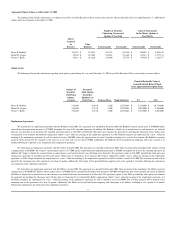

11. CAPITAL STOCK, STOCK OPTIONS AND WARRANTS

Common Stock

On May 15, 1998, WexAir LLC acquired 100 shares of Republic's common stock for cash of $8,133. These proceeds and the proceeds from the subordinated promissory note (see

Note 6) were used by Republic to acquire the common stock of Chautauqua.

In June 2004, the Company completed its initial public stock offering. The Company issued 5,000,000 shares of common stock at $13 per share. The net proceeds provided by this

offering were $58,172, before the repayment of debt.

In February 2005, the Company completed its follow

-

on public stock offering. The Company issued 6,900,000 shares of common stock at $12.50 per share. The net proceeds

provided by this follow

-

on offering were approximately $80,800.

At December 31, 2004, approximately 5,615,000 shares of the Company

’

s 75,000,000 authorized shares were reserved for issuances under the 2002 Equity Incentive Plan and

warrants.

52