Frontier Airlines 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

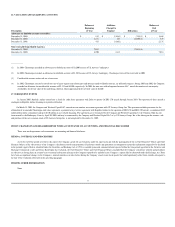

Stock Options

To date, there are outstanding options to purchase 2,781,864 shares of our common stock. These options were granted by our board of directors to our key employees and were not

granted pursuant to any established stock option plan. These options do not qualify as incentive stock options (within the meaning of Section 422 of the Internal Revenue Code of 1986, as

amended), which we refer to as ISOs. The exercise prices of these options range from $1.75 to $13.00 per share. The options vest on several different schedules.

The 2002 Equity Incentive Plan

The following is a description of the material terms of our 2002 Equity Incentive Plan. You should, however, refer to the exhibits to this Annual Report on Form 10

-

K for a complete

copy of the 2002 Equity Incentive Plan.

Type of Awards

. The 2002 Equity Incentive Plan provides for grants of options to purchase shares of our common stock, including options intended to qualify as ISOs, and options

which do not qualify as ISOs, which we refer to as NQSOs, restricted shares of our common stock, restricted stock units, the value of which is tied to shares of our common stock and other

equity

-

based awards related to our common stock, including unrestricted shares of our common stock, stock appreciation rights and dividend equivalents. In addition, non

-

employee directors

shall receive automatic grants of NQSOs.

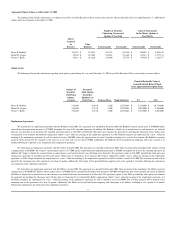

Available Shares.

A maximum of 2,180,000 shares of our common stock has been reserved for issuance, or reference purposes, under the 2002 Equity Incentive Plan, subject to

adjustment upon certain changes in capitalization (as described below). New awards may be granted under the 2002 Equity Incentive Plan with respect to shares of our common stock covered

by any award that terminates or expires by its terms (by cancellation or otherwise) or with respect to shares of our common stock that are withheld or surrendered to satisfy a recipient's income

tax or other withholding obligations or tendered to pay the purchase price of any award.

E

ligibility

. Awards under the 2002 Equity Incentive Plan may be granted to any of our (or any of our subsidiaries' or affiliates') directors, officers or other employees, including any

prospective employee, and to any of our (or any of our subsidiaries' or affiliates') advisors or consultants selected by the compensation committee of our board of directors.

Administration

. The 2002 Equity Incentive Plan will be administered by the compensation committee of our board of directors or the board of directors. However, our board of

directors may, in its sole discretion, delegate to one or more of our executive officers the authority to grant options to employees who are not officers or directors on terms specified by our board

of directors. The compensation committee will have full discretion and authority to make awards under the 2002 Equity Incentive Plan, to apply and interpret the provisions of the 2002 Equity

Incentive Plan and to take such other actions as may be necessary or desirable in order to carry out the provisions of the 2002 Equity Incentive Plan. The determinations of the compensation

committee on all matters relating to the 2002 Equity Incentive Plan and the options, restricted stock, restricted stock units and other equity

-

based awards granted thereunder will be final, binding

and conclusive.

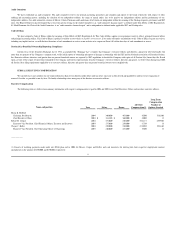

Stock Options

. The compensation committee may grant ISOs and NQSOs in such amounts and subject to such terms and conditions as it may determine. The exercise price of an

option granted under the 2002 Equity Incentive Plan will not be less than the fair market value of our common stock on the date of grant. Unless sooner terminated or exercised, options will

generally expire ten years from the date of grant. Payment for shares acquired upon the exercise of an option may be made in cash and/or such other form of payment as may be permitted by the

compensation committee from time to time, which may include previously

-

owned shares of our common stock or payment pursuant to a broker's cashless exercise procedure. Except as

otherwise permitted by the compensation committee, no option may be exercised more than 30 days after termination of the optionee's employment or other service or, if the optionee's service is

terminated by reason of disability or death, one year after such termination. If, however, an optionee's employment is terminated for "cause" (as defined in the 2002 Equity Incentive Plan),

options held by such optionee will immediately terminate.

Restricted Stock and Restricted Stock Units.

The compensation committee may grant restricted shares of our common stock in amounts, and subject to terms and conditions (such as

time vesting and/or performance

-

based vesting criteria) as it may determine. Generally, prior to vesting, the recipient will have the rights of a stockholder with respect to the restricted stock,

subject to any restrictions and conditions as the compensation committee may include in the award agreement. The 2002 Equity Incentive Plan permits us (or one of our subsidiaries or affiliates)

to make loans to recipients of restricted stock. Among other things, these loans will bear interest at a fair interest rate as determined by the compensation committee and, unless otherwise

determined by the compensation committee, shall be secured by shares of our common stock having an aggregate fair market value at least equal to the principal amount of the loan. The

compensation committee may grant restricted stock units, the value of which is tied to shares of our common stock, in amounts, and subject to terms and conditions, as the compensation

committee may determine.

Other Equity

-

Based Awards.

The compensation committee may grant other types of equity

-

based awards related to our common stock under the 2002 Equity Incentive Plan, including

the grant of unrestricted shares of our common stock, stock appreciation rights, and dividend equivalents, in amounts and subject to terms and conditions as the compensation committee may

determine. These awards may involve the transfer of actual shares of common stock or the payment in cash or otherwise of amounts based on the value of shares of our common stock.

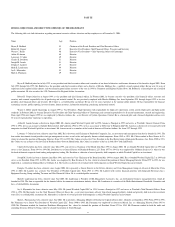

Non

-

Employee Director Stock Options.

Each non

-

employee director was automatically granted options to purchase 10,000 shares of common stock on the day prior to the

commencement of the initial public offering of our common stock with an exercise price of $13.00, our initial public offering price. Each director who first becomes a non

-

employee director after

the initial public offering of our common stock will automatically be granted options to purchase 10,000 shares of our common stock under our 2002 Equity Incentive Plan on the first trading day

following his or her commencement of service as a non

-

employee director. In addition, each non

-

employee director will generally be granted an option to purchase 2,500 shares of common

stock on the date of each annual meeting of stockholders at which he or she is reelected as a non

-

employee director. A non

-

employee director is any member of our board of directors who is

not employed by or a consultant to us of any of our subsidiaries and includes any director who serves as one of our officers but is not paid by us for this service. The exercise price per share

covered by an option granted shall be equal to the fair market value of the common stock on the date of grant. Subject to remaining in continuous service with the Company through each

applicable vesting date, a director's initial option grant will become exercisable as follows: with respect to

124

of the shares covered thereby on the first day of each month for the first 12 months

commencing after the date of the grant, and with respect to

148

of the shares covered thereby on the first day of each successive month for the next 24 months. Each annual option grant shall,

subject to the director remaining in continuous service with the Company through each applicable vesting date, become vested with respect to

112

of the shares covered thereby on the first day of

each month for the first 12 months commencing after the date of the grant. Upon the cessation of a non

-

employee director's service, such individual will generally have 180 days to exercise all

options that are exercisable on the termination date. If a director's service terminates by reason of his or her death or disability, his or her beneficiary will generally have 12 months to exercise any

portion of a director option that is exercisable on the date of death. Except as otherwise provided herein, if not previously exercised, each option granted shall expire on the tenth anniversary of

the date of grant. Upon a change in control as defined in the 2002 Equity Incentive Plan, vesting of the options held by a non

-

employee director will accelerate and become fully vested.

60