Frontier Airlines 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

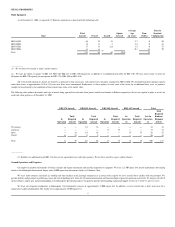

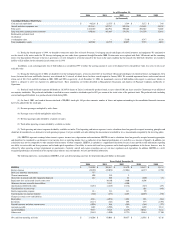

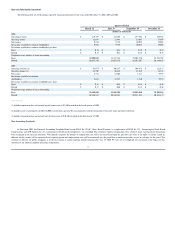

Revenue

Under our fixed

-

fee arrangements with American, Delta, US Airways and United for regional jets, we receive a fixed

-

fee, as well as reimbursement of specified costs with additional

possible incentives from our partners for superior performance. Under our pro

-

rate revenue sharing agreement with US Airways for turboprop aircraft, we received a negotiated portion of ticket

revenue. As of December 31, 2002, 2003 and 2004 approximately 96.5%, 100.0% and 100%, respectively, of our passenger revenue was earned under our fixed

-

fee arrangements. Because

all of our passenger revenue is now derived from these fixed

-

fee arrangements, the number of aircraft we operate, as opposed to the number of passengers that we carry, will have the largest

impact on our revenues.

Operating Expenses

A brief description of the items included in our operating expenses line items follows.

Wages and Benefits

This expense includes not only wages and salaries, but also expenses associated with various employee benefit plans, employee incentives and payroll taxes. These expenses will fluctuate

based primarily on our level of operations and changes in wage rates for contract and non

-

contract employees.

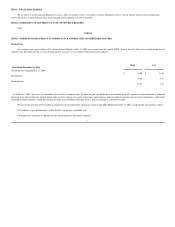

Aircraft Fuel

Fuel expense includes the cost of aircraft fuel, including fuel taxes and into

-

plane fees. Under the fixed

-

fee agreements with American and Delta, the fixed

-

fee includes an assumed fuel

price per gallon. Any difference between the actual cost and assumed cost included in the fixed fees is paid to or reimbursed by American and Delta. Under the fixed

-

fee agreement with US

Airways we are reimbursed and under the fixed

-

fee agreements with United, we will be reimbursed the actual cost of fuel.

Passenger Fees and Commissions

This expense includes the costs of travel agent commissions, computer reservation system fees and certain fees paid to US Airways for aircraft ground and passenger handling and use of

the US Airways aircraft facilities and services with respect to turboprop pro

-

rate revenue sharing flights performed on behalf of US Airways. These expenses are not borne by us under any of

the fixed

-

fee agreements.

Landing Fees

This expense consists of fees charged by airports for each aircraft landing. Under our fixed

-

fee agreement with American, the fixed fee includes an assumed rate per aircraft landing. Any

difference between the actual cost and assumed cost included in the fixed fees is paid to or reimbursed by American. Under the fixed

-

fee agreements with US Airways, Delta and United, we are

reimbursed for the actual cost of landing fees.

Aircraft and Engine Rent

This expense consists of the costs of leasing aircraft and spare engines. The leased aircraft and spare engines are operated under long

-

term operating leases with third parties. The lease

payments associated with future aircraft deliveries are subject to market conditions for interest rates and contractual price increases for the aircraft. Aircraft rent is reduced by the amortization of

integration funding credits received from the aircraft manufacturer for parts and training. The credits are amortized on a straight

-

line basis over the term of the respective lease of the aircraft.

Under our fixed

-

fee agreements with US Airways, American, Delta and United, we are reimbursed for our actual costs or at agreed upon rates that, in certain instances, are subject to a cap.

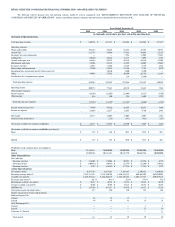

Maintenance and Repair

Maintenance and repair expenses include all parts, materials, tooling and spares required to maintain our aircraft. We have entered into long

-

term maintenance "power

-

by

-

the

-

hour"

service contracts with third

-

party maintenance providers under which we are charged fixed rates for each flight hour accumulated by our engines and some of the major airframe components.

The effect of such contracts is to reduce the volatility of aircraft maintenance expense over the term of the contract.

Insurance and Taxes

This expense includes the costs of passenger liability insurance, aircraft hull insurance and all other insurance policies, other than employee welfare insurance. Additionally, this expense

includes personal and real property taxes, including aircraft property taxes. Under our current fixed

-

fee agreements, we are reimbursed for the actual costs of passenger liability insurance, war

risk insurance, aircraft hull insurance and property taxes, subject to certain restrictions. Under our United fixed

-

fee agreements, we are reimbursed for the actual costs of such items other than

aircraft hull insurance, which will be reimbursed at agreed upon rates.

Depreciation and Amortization

This expense includes the depreciation of all fixed assets, including aircraft that we own. Additionally, goodwill, which was incurred in connection with Republic Airways' acquisition of

Chautauqua in 1998, was amortized over a 20

-

year period. Beginning January 1, 2002, we no longer amortize this goodwill, which aggregated $807,000 annually, but are required to evaluate it

on an annual basis to determine whether there is an impairment of the goodwill. If we determine the goodwill is impaired, we are required to write

-

off the amount of goodwill that is impaired. As

of December 31, 2004, goodwill was $13,335,000.

Other

This expense includes the costs of crew training, crew travel, airport, passenger and ground handling related expenses, all other lease expense, professional fees and all other

administrative, facilities and operational overhead expenses not included in other line items above.

Income Tax

Income tax expense is computed by applying estimated effective income tax rates to income before income taxes. Income tax expense varies from the statutory federal income tax rate

due primarily to state taxes and non

-

deductible meals and entertainment expense.

27