Frontier Airlines 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

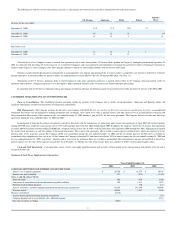

3. AIRCRAFT AND OTHER EQUIPMENT

At December 31, 2004, Chautauqua has a fleet of 112 aircraft, including sixty

-

eight 50

-

seat Embraer 145 jet aircraft, fifteen 44

-

seat Embraer 140 jet aircraft, seventeen 37

-

seat

Embraer 135 jet aircraft

’

s, eleven 70 seat Embraer 170 jet aircraft and one 30

-

seat Saab 340 aircraft that is currently held for sale and recorded in prepaid and other current assets (see

Note 15). Chautauqua owns one Saab 340 aircraft, twenty

-

five Embraer 145 jet aircraft, eleven Embraer 140 jet aircraft, fifteen Embraer 135 jet aircraft, and eleven Embraer 170 jet aircraft,

and leases the other aircraft under operating lease agreements (see Note 8).

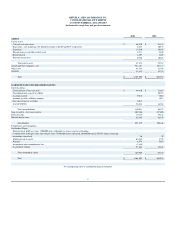

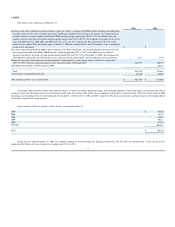

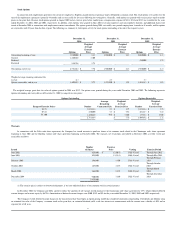

Aircraft and other equipment, excluding aircraft and other equipment held for sale, consist of the following as of December 31:

Aircraft and other equipment depreciation and amortization expense for the years ended December 31, 2004, 2003 and 2002 was $33,940, $23,439, and $11,768 respectively.

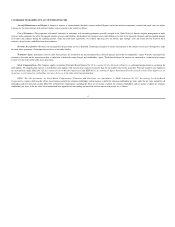

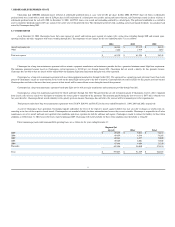

4. OTHER ASSETS

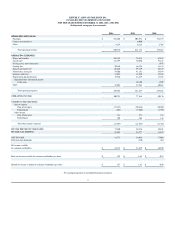

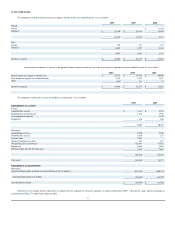

Other assets consist of the following as of December 31:

In 2002, Chautauqua received a note for the sale of Saab 340 spare engines and related parts and for advances made to Shuttle America, an affiliated company. The note from Shuttle

America was due on demand, was collateralized by substantially all of the assets of Shuttle America, excluding receivables, and earned interest of LIBOR plus 2.75%. In October 2003,

Chautauqua stopped accruing interest on the demand note receivable. During 2003 and 2002, Chautauqua recorded an allowance for uncollectible amounts of $2,113 and $4,900, respectively,

on the demand note receivable after considering the fair value of the collateral. In 2004, Chautauqua sold the demand note receivable from Shuttle America to Imprimis Investors, LLC, one of

the members of our majority stockholder, for the net book value of $2,400.

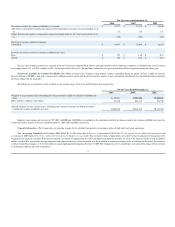

5. ACCRUED LIABILITIES

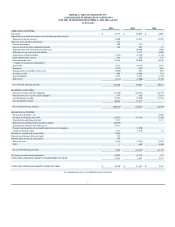

Accrued liabilities consist of the following as of December 31:

2004

2003

Aircraft

$

993,338

$

544,198

Flight equipment

50,720

36,462

Furniture and equipment

3,491

2,152

Leasehold improvements

7,792

4,855

Total aircraft and other equipment

1,055,341

587,667

Less accumulated depreciation and amortization

72,160

39,950

Aircraft and other equipment

—Net

$

983,181

$

547,717

2004

2003

Prepaid aircraft rent

$

20,744

$

18,847

Aircraft deposits

47,428

6,838

Demand note receivable from Shuttle America, net

2,408

Deferred warrant charge, net (see Note 11)

7,406

4,699

Debt issue costs, net

8,048

4,957

Restricted cash

—

lease agreement

1,500

Other

5,142

2,856

$

88,768

$

42,105

2004

2003

Accrued wages, benefits and related taxes

$

9,055

$

7,565

Accrued maintenance

10,426

5,401

Accrued aircraft return costs (see Note 15)

5,994

10,592

Accrued property taxes

1,955

2,115

Accrued interest payable to non

-

affiliates

6,726

4,091

Accrued interest payable to affiliates

963

Accrued liabilities to code

-

share partners

8,808

4,553

Other

8,069

8,008

Total accrued liabilities

$

51,033

$

43,288

47