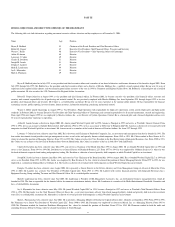

Frontier Airlines 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

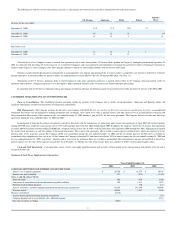

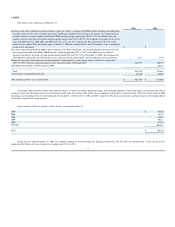

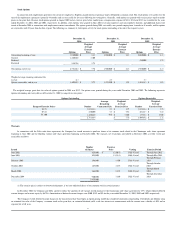

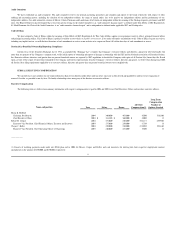

Stock Options

In connection with employment agreements for certain key employees, Republic granted options to purchase shares of Republic's common stock. The stock options vest ratably over the

term of the employment agreements (generally 48 months) and are exercisable for five years following the vesting dates. Generally, stock options are granted with exercise prices equal to market

prices on the grant date. Because stock options granted in August 2001 had an exercise price below market price, compensation expense of $214, $214 and $213 was recorded for the years

ended December 31, 2004, 2003 and 2002, respectively. In addition, stock options were granted in May 2004 to certain employees and non

-

employee directors, and additional shares were

issued in December 2004 in connections with employment contract amendments. The options granted during 2004 vest ratably over periods ranging from 8 months to 48 months, and the options

are exercisable until 10 years from the date of grant. The following is a summary of stock option activity for stock options outstanding at the end of the respective years:

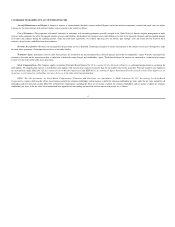

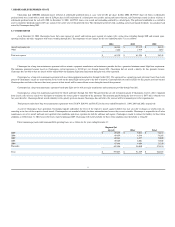

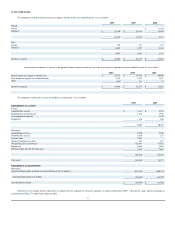

The weighted average grant date fair value of options granted in 2004 was $3.32. No options were granted during the years ended December 2003 and 2002. The following represents

options outstanding and exercisable as of December 31, 2004 by range of exercise prices:

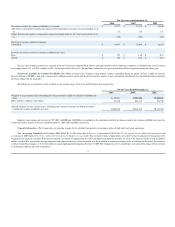

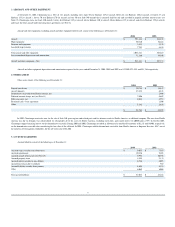

Warrants

In connection with the Delta code

-

share agreement, the Company has issued warrants to purchase shares of its common stock related to the Chautauqua code

-

share agreement

beginning in June 2002 and the Republic Airline code

-

share agreement beginning in December 2004. The warrants, net of amounts surrendered in December 2004, are fully vested and

exercisable as follows:

(1) The exercise price is subject to downward adjustment, if we issue additional shares of our common stock in certain instances.

In December 2004, the Company and Delta agreed to reduce the amounts of all warrants issued pursuant to the Chautauqua code

-

share agreement by 45%, which reduced deferred

warrant charges and warrant equity by $6,756. Amortization of deferred warrant charges were $800, $359 and $9 for the years ended December 31, 2004, 2003 and 2002, respectively.

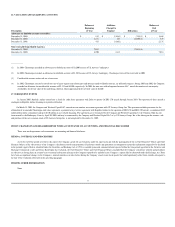

The Company records deferred warrant charges on the measurement date based upon an option pricing model that considered continuous compounding of dividends and dilution using

an estimated fair value of the Company

’

s common stock on the grant date, an estimated dividend yield, a risk

-

free interest rate commensurate with the warrant term, volatility of 40% and an

expected life of 10 years.

December 31,

2004

December 31,

2003

December 31,

2002

Options

Weighted

Average

Exercise

Price

Options

Weighted

Average

Exercise

Price

Options

Weighted

Average

Exercise

Price

Outstanding, beginning of year

1,920,000

$

2.11

1,920,000

$

2.13

2,040,000

$

2.11

Granted

1,420,620

13.00

Forfeited

120,000

1.75

Exercised

558,756

1.75

Outstanding, end of year

2,781,864

$

7.76

1,920,000

$

2.13

1,920,000

$

2.13

Weighted average remaining contractual life

in years

6.3

2.7

3.7

Options exercisable, end of year

1,409,892

$

2.72

1,872,500

$

1.99

1,594,583

$

1.91

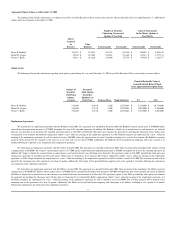

Options Outstanding

Options Exercisab

le

Range of Exercise Prices

Number

Average

Remaining

Contractual Life

Weighted

-

Average

Exercise Price

Number

Weighted

-

Average

Exercise Price

$1.75

1,241,244

2.3

$

1.75

1,241,244

$

1.75

$7.83

120,000

3.7

$

7.83

101,417

$

7.83

$13.00

1,420,620

10.0

$

13.00

67,231

$

13.00

2,781,864

$

7.76

1,409,892

$

2.72

Issued

Number

of Shares

Exercise

Price

Vesting

Exercise Period

June 2002

825,000

$

12.50 (1

)

Fully Vested

Through June 2012

June 2004

825,000

12.35 (1

)

Fully Vested

Through May 2014

February 2003

396,000

13.00

Fully Vested

Through February

2013

October 2003

165,000

12.35

Fully Vested

Through October

2013

March 2004

264,000

12.35

Fully Vested

Through March

2014

December 2004

960,000

11.60

Fully Vested

Through December

2014

3,435,000

53