Frontier Airlines 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

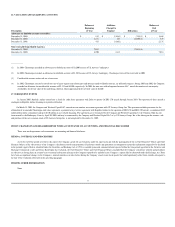

13. FAIR VALUE OF FINANCIAL INSTRUMENTS

The fair value of a financial instrument is defined as the amount at which the instrument could be exchanged in an arm's length transaction between knowledgeable, willing parties. The

following method and assumptions are used to estimate the fair value of each class of financial instruments:

Long

-

term debt—

The fair value is estimated based on discounting expected cash flows at the rates currently offered to Chautauqua for debt of the same remaining maturities. As of

December 31, 2004 and 2003, the carrying value of long

-

term debt approximates its fair value.

Subordinated notes payable to affiliates—

It is not practicable to estimate fair value of related party financial instruments because the related parties most likely have investment

strategies and expectations different from unrelated third parties.

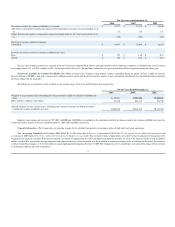

14. BENEFIT PLAN

—401(k)

Republic has a defined contribution retirement plan covering substantially all eligible employees. Republic matches up to 2.5% of eligible employees' wages. Employees are generally

vested in matching contributions after three years of service with Republic. Employees are also permitted to make pre

-

tax contributions of up to 15% and after

-

tax contributions of up to 10% of

their annual compensation. Republic's expense under this plan was $1,128, $540, and $428 for the years ended December 31, 2004, 2003 and 2002, respectively.

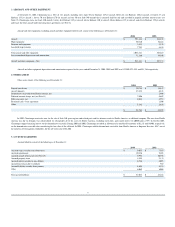

15. IMPAIRMENT LOSS AND ACCRUED AIRCRAFT RETURN COSTS

Saab 340 Turboprop Aircraft

On December 26, 2001, management made the decision to exit its Saab 340 turboprop operations which represented 4% of 2002 revenue. The exit plan included the scheduled removal

of aircraft (consisting of twenty

-

four leased and two owned aircraft) from flight service, the preparation of the aircraft for return to the lessor or for sale, and the sale of related spare engines,

parts and supplies used to maintain and operate the Saab 340 fleet.

Saab Aircraft Leasing, Inc. and affiliates (collectively referred to as "lessor") had agreed to lease twenty

-

two of the twenty

-

four leased Saab 340 aircraft when new lessees were

identified. An agreement was initially signed between the lessor and a new lessee (a company controlled by Wexford Capital LLC) for up to eighteen (16 firm and 2 option) Saab 340 aircraft at

market lease rates. During 2002, the new lessee leased the original eighteen Saab 340 aircraft and three additional Saab 340 aircraft. In 2003, Chautauqua purchased the one remaining leased

Saab 340 aircraft and terminated the lease for the aircraft. This aircraft was sold in October 2003.

During 2002, the leases between Chautauqua and the lessor were terminated when the affiliated company entered into new leases with the lessor. If the new leases are subsequently

terminated and/or the lessee does not make its lease payments, Chautauqua may be obligated for the balance due under these original leases. Chautauqua also pays the lessor a rent differential,

based on Chautauqua's original lease payments less the lease payments of the new lessee. The total future maximum liability under the guarantee for lease payments is $2,923 as of December 31,

2004 (see Note 8). As a result of changing the delivery dates of the leased aircraft, Chautauqua recorded an additional provision for lease payments of $1,200 in 2002. In 2003, Chautauqua

accrued an additional $6,690 of rent differential because the affiliated company's ability to make the lease payments is uncertain. Lease payments of $900 were accrued at December 31, 2002,

for the period from the date the aircraft was removed from service through the later of the end of the lease term or the date the aircraft was expected to be re

-

leased by the lessor.

While the aircraft were out of flight service, they were inspected and overhauled to the required return condition. Chautauqua recorded an additional provision of $1,100 in 2002 in order

to meet required return conditions.

Due to market conditions in the air transportation industry, additional impairment losses of $818 and $1,500 were recorded in 2003 and 2002, respectively, to further reduce the carrying

amounts of the assets to be disposed of. Estimated fair value for the owned aircraft are based on quotations from aircraft dealers, less selling costs. In 2002, Chautauqua sold the spare engines,

parts and supplies to an affiliated company at net book value, which approximated net realizable value based on quotations from aircraft parts manufacturers and dealers (see Note 4).

In conjunction with the lease of Saab 340 aircraft to an affiliated company, Chautauqua assigned a certain maintenance agreement to this new lessee. Should the affiliated company be

unable to make payments required by this agreement, the vendor may look to Chautauqua for payment. The term of the agreement and the maximum amount that Chautauqua may be obligated

to pay is uncertain because the lessee's use of the Saab 340 aircraft is unknown. Chautauqua's estimate for its maximum liability under this guarantee was approximately $2,600 as of December

31, 2004, of which Chautauqua has accrued $2,595 and $2,952 at December 31, 2004 and 2003, respectively. This amount is based on the current flight operations of the affiliated company.

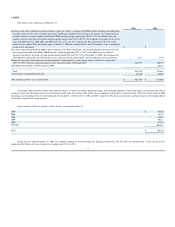

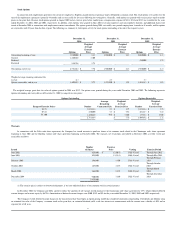

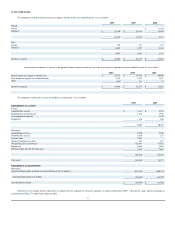

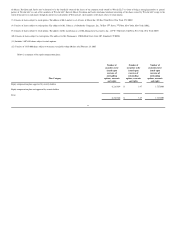

The changes in the impairment and accrued aircraft return costs are as follows for the years ended December 31, 2002, 2003 and 2004:

Description

of Charge

Reserve

at J

an.

1,

2002

2002

Provision

Charged

to

Expense

2002

Payments

Reserve at

Dec. 31,

2002

2003

Provision

(Adjustment)

Charged to

Expense

2003

Payments

Reserve

at

Dec. 31,

2003

2004

Adjustment

2004

Payments

Reserve at

Dec. 31,

2004

Aircraft return costs:

Rent differential

$

2,646

$

(581

)

$

2,065

$

6,690

$

(2,015

)

$

6,740

$

357

$

(4,174

)

$

2,923

Lease payments

1,886

$

1,200

(2,186

)

900

(900

)

Costs to return aircraft

1,500

1,100

(1,122

)

1,478

(300

)

(278

)

900

(424

)

476

Maintenance agreement

2,952

2,952

(357

)

2,595

Impairment loss

2,068

1,500

818

Total

$

8,100

$

3,800

$

(3,889

)

$

4,443

$

10,160

$

(3,193

)

$

10,592

$

$(4,598

)

$

5,994

55