Frontier Airlines 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

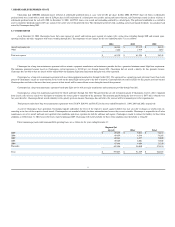

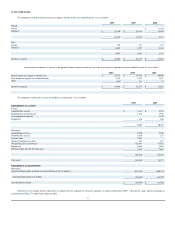

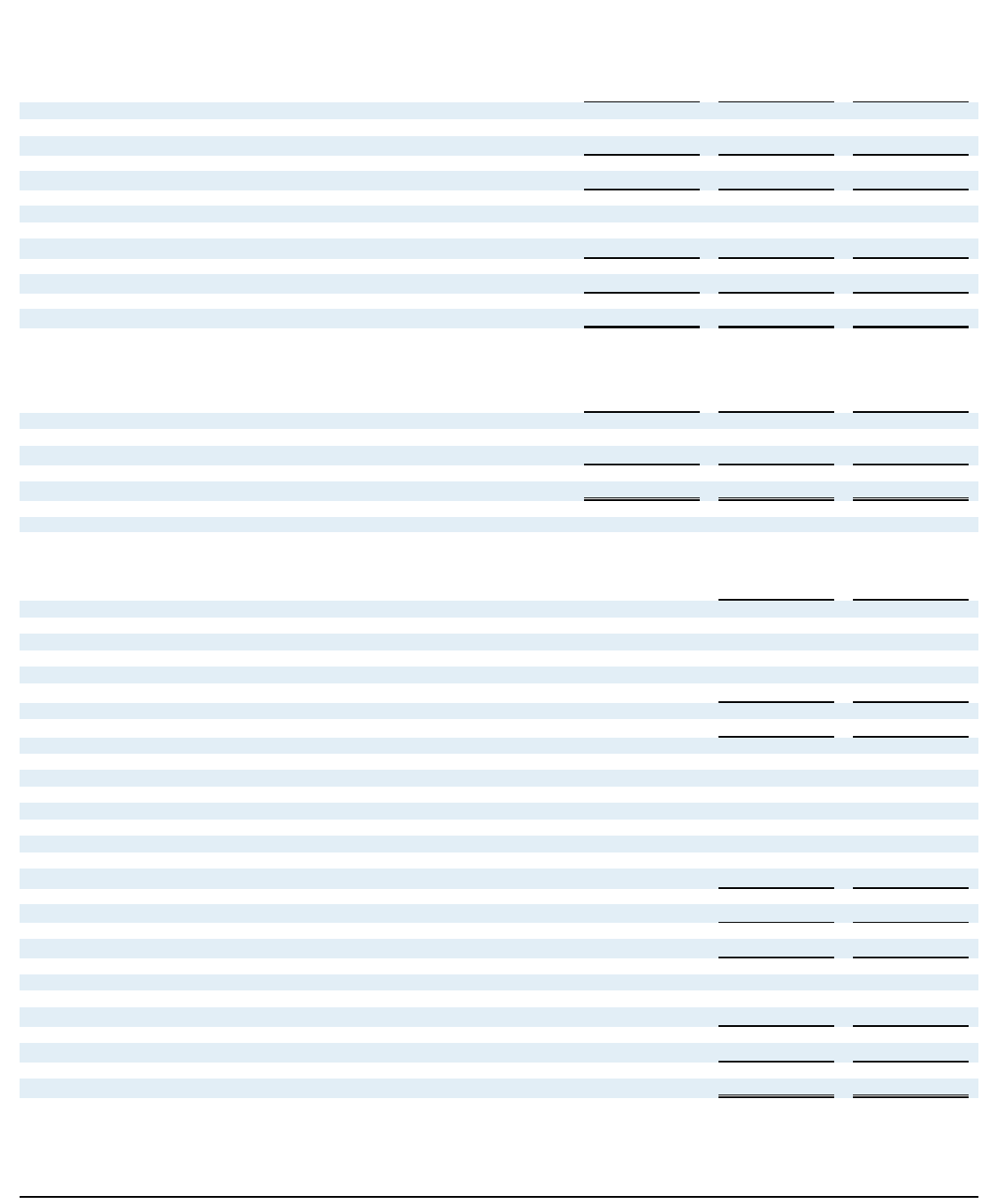

12. INCOME TAXES

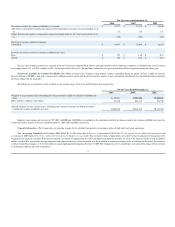

The components of the provision for income tax expense (benefit) for the years ended December 31 are as follows:

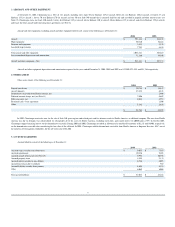

A reconciliation of income tax expense at the applicable federal statutory income tax rate to the tax provision as reported for the years ended December 31 are as follows:

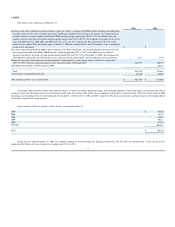

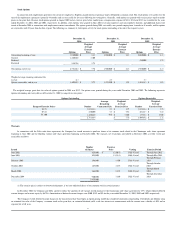

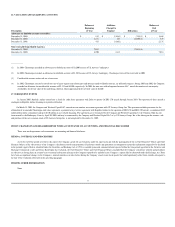

The components of deferred tax assets and liabilities as of December 31 are as follows:

Deferred tax assets include benefits expected to be realized from the utilization of alternative minimum tax credit carryforwards of $457, which do not expire, and net operating loss

carryforwards of $362,272, which begin expiring in 2022.

2004

2003

2002

Federal:

Current

$

(4,633

)

Deferred

$

22,130

$

18,813

13,830

22,130

18,813

9,197

State:

Current

520

237

148

Deferred

6,039

3,227

2,310

6,559

3,464

2,458

Income tax expense

$

28,689

$

22,277

$

11,655

2004

2003

2002

Federal income tax expense at statutory rate

$

25,711

$

19,714

$

10,030

State income tax expense, net of federal benefit

3,145

2,252

1,598

Other

(167

)

311

27

Income tax expense

$

28,689

$

22,277

$

11,655

2004

2003

DEFERRED TAX ASSETS

Current:

Nondeductible accruals

$

5,111

$

5,198

Nondeductible accrued interest

1,351

3,895

Asset impairment expenses

1,150

Prepaid rent

524

390

6,986

10,633

Noncurrent:

Nondeductible reserves

2,920

2,920

Nondeductible accruals

1,868

153

Treasury locks

2,793

Alternative minimum tax credit

457

457

Net operating loss carryforward

126,795

47,672

Prepaid rent

6,284

4,680

Deferred credits and sale leaseback gain

7,831

7,662

148,948

63,544

Total assets

155,934

74,177

DEFERRED TAX LIABILITIES

Noncurrent:

Accelerated depreciation and fixed asset basis differences for tax purposes

(212,533

)

(106,139

)

Total noncurrent deferred tax liability

(63,585

)

(42,595

)

Total deferred tax liability

$

(56,599

)

$

(31,962

)

54