Frontier Airlines 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

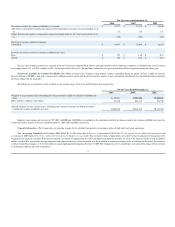

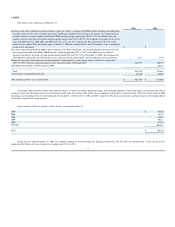

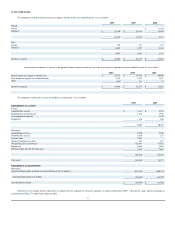

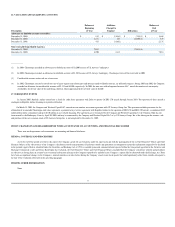

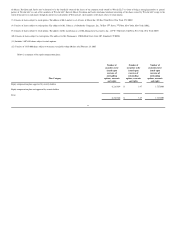

16. VALUATION AND QUALIFYING ACCOUNTS

___________

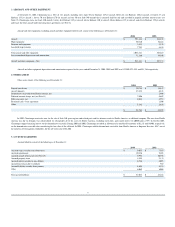

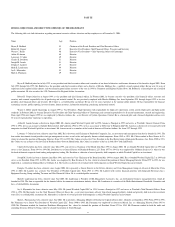

17. SUBSEQUENT EVENTS

In January 2005, Republic Airline entered into a fixed

-

fee code

-

share agreement with Delta to operate 16 ERJ

-

170 aircraft through January 2019. The operation of these aircraft is

contingent on Republic Airline obtaining its required certification.

On March 15, 2005, the Company and Wexford Capital LLC, entered into an omnibus investment agreement with US Airways Group, Inc. The agreement includes provisions for the

affirmation of an amended Chautauqua code

-

share agreement, a potential new jet service agreement with Republic Airline for the operation of ERJ

-

170 and ERJ

-

190 aircraft, a conditional $125

million dollar equity commitment and up to $110 million in asset related financing. The agreement can be terminated by the Company and Wexford Capital LLC if the Omnibus Order has not

been entered by the Bankruptcy Court by April 20, 2005, and may be terminated by the Company and Wexford Capital LLC or by US Airways Group, Inc. if the closing on the issuance, sale

and purchase of the new common stock of US Airways Group, Inc. is not completed by December 31, 2005.

ITEM 9. CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

There were no disagreements with accountants on accounting and financial disclosure.

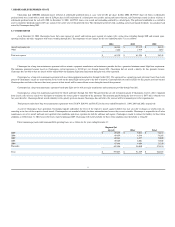

ITEM 9A. CONTROLS AND PROCEDURES

As of the end of the period covered by this report, the Company carried out an evaluation, under the supervision and with the participation of the its Chief Executive Officer and Chief

Financial Officer, of the effectiveness of the Company

’

s disclosure controls and procedures. Disclosure controls and procedures are designed to ensure that information required to be disclosed

in the periodic reports filed or submitted under the Securities and Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and

Exchange Commission

’

s rules and forms. Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company

’

s disclosure controls and procedures

are effective in alerting them on a timely basis to material information relating to the Company required to be included in the Company

’

s reports filed or submitted under the Exchange Act. There

have been no significant changes in the Company

’

s internal controls or in other factors during the Company

’

s most recent fiscal quarter that could significantly affect these controls subsequent to

the date of the evaluation referenced in the preceding paragraph.

ITEM 9B. OTHER INFORMATION

None

Description

Balance at

Beginning

of Year

Additions

Charged to

Expense

Deductions

Balance at

End

of Year

Allowance for doubtful accounts receivables:

December 31, 2004

$

819

$

3,385(1

)

$

(335)(3

)

$

3,869

December 31, 2003

2,231

637

(2,049)(2

)

819

December 31, 2002

415

1,816(2

)

2,231

Note receivable from Shuttle America:

December 31, 2004

7,013

(7,013)(4

)

December 31, 2003

4,900

2,113

7,013

(1)

In 2004, Chautauqua recorded an allowance for doubtful accounts of $3,200 because of US Airways

’

bankruptcy.

(2)

In 2002, Chautauqua recorded an allowance for doubtful accounts of $1,504 because of US Airways' bankruptcy. Chautauqua wrote off the receivable in 2003.

(3)

Uncollectible accounts written off net of recoveries.

(4)

In 2002, Chautauqua received a note for the sale of spare engines and related parts and advances made to Shuttle America, an affiliated company. During 2003 and 2002, the Company

recorded an allowance for uncollectible accounts of $2,113 and $4,900, respectively. In 2004, the note was sold to Imprimis Investors LLC, one of the members of our majority

stockholder, for the fair value of the underlying collateral, which approximated the net book value of $2,400.

56