Frontier Airlines 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

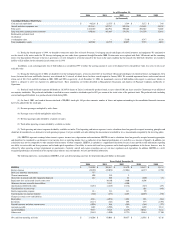

(1) During the fourth quarter of 1999, we decided to return our entire fleet of leased Jetstream 31 turboprop aircraft and dispose of related inventory and equipment. We continued to

use the aircraft to fly routes under the US Airways turboprop pro

-

rate code

-

share agreement through December 2000. Certain routes were replaced with Saab 340 aircraft and the remaining

routes were discontinued. Pursuant to the lease agreements, we were obligated to return the aircraft to the lessor in the same condition that the aircraft were delivered; therefore, we recorded a

liability of $2.6 million for the estimated aircraft return costs in 1999.

In addition, a non

-

cash impairment loss of $4.0 million was recorded in 1999 to reduce the carrying amount of assets to be disposed of to estimated fair value, less costs to sell, or net

realizable value.

(2) During the fourth quarter of 2001, we decided to exit the turboprop business, return our entire fleet of leased Saab 340 aircraft and dispose of related inventory and equipment. New

leases (between the lessor and Shuttle America) were obtained for 21 aircraft, of which leases for three aircraft expired in January 2004. We recorded impairment losses and accrued aircraft

return cost of $8.1, $3.8 and $10.2 million in 2001, 2002 and 2003, respectively. As of December 31, 2004, we maintained a reserve of $6.0 million with respect to such losses which we

believe is adequate to cover our exposure for additional losses. These calculations are further described in Management's Discussion and Analysis of Financial Condition and Results of

Operations.

(3) Preferred stock dividends represent dividends on 16.295828 shares of Series A redeemable preferred stock at a par value of $.01 per share issued by Chautauqua to an affiliate of

our majority stockholder. The preferred stockholder is entitled to receive cumulative dividends equal to 10% per annum of the stated value of the preferred stock. The preferred stock, including

accrued and unpaid dividends, was purchased and retired during 2003.

(4) On June 4, 2002, our board of directors declared a 200,000:1 stock split. All per share amounts, number of shares and options outstanding in the consolidated financial statements

have been adjusted for the stock split.

(5) Revenue passengers multiplied by miles flown.

(6) Passenger seats available multiplied by miles flown.

(7) Revenue passenger miles divided by available seat miles.

(8) Total airline operating revenues divided by available seat miles.

(9) Total operating and interest expenses divided by available seat miles. Total operating and interest expenses is not a calculation based on generally accepted accounting principles and

should not be considered as an alternative to total operating expenses. Cost per available seat mile utilizing this measurement is included as it is a measurement recognized by the investing public.

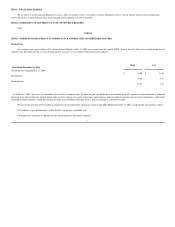

(10) EBITDA represents earnings before interest expense, income taxes, depreciation and amortization. EBITDA is not a calculation based on generally accepted accounting principles

and should not be considered as an alternative to net income (loss) or operating income (loss) as indicators of our financial performance or to cash flow as a measure of liquidity. In addition, our

calculations may not be comparable to other similarly titled measures of other companies. EBITDA is included as a supplemental disclosure because it may provide useful information regarding

our ability to service debt and lease payments and to fund capital expenditures. Our ability to service debt and lease payments and to fund capital expenditures in the future, however, may be

affected by other operating or legal requirements or uncertainties. Currently, aircraft and engine ownership costs are our most significant cash expenditure. In addition, EBITDA is a well

recognized performance measurement in the regional airline industry and, consequently, we have provided this information.

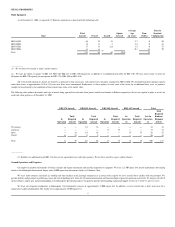

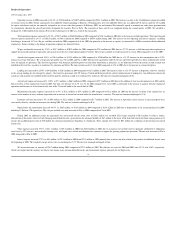

The following represents a reconciliation of EBITDA to net cash from operating activities for the periods indicated (dollars in thousands):

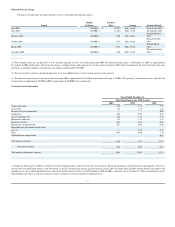

As of December 31,

2004

2003

2002

2001

2000

(in thousands)

Consolidated Balance Sheet Data:

Cash and cash equivalents

$

46,220

$

21,535

$

3,399

$

3,272

$

389

Aircraft and other equipment, net

983,181

547,717

298,536

133,810

25,529

Total assets

1,168,108

661,921

390,201

204,802

72,601

Long

-

term debt, including current maturities

850,186

482,667

278,581

131,350

32,885

Redeemable preferred stock

of subsidiary

at redemption value

—

—

5,160

4,747

4,329

Total stockholders' equity

169,969

65,755

30,075

9,792

4,053

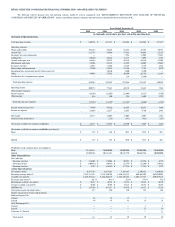

Years Ended December 31,

2004

2003

2002

2001

2000

EBITDA

$

135,509

$

101,817

$

52,470

$

24,837

$

13,124

Interest expense

(28,109

)

(22,052

)

(12,044

)

(6,227

)

(3,550

)

Debt issue and other amortization

757

Warrant amortization

800

359

9

(Gain) loss on aircraft and other equipment disposals

261

865

67

(460

)

(31

)

Impairment loss and accrued aircraft return costs

10,160

3,800

8,100

Allowance for note receivable from affiliate

2,113

4,900

Amortization of deferred credits

(1,285

)

(1,249

)

(1,132

)

(889

)

(278

)

Unrealized loss on fuel swaps

202

(841

)

Stock compensation expense

214

214

213

90

Current income tax expense (benefit)

(520

)

(237

)

4,485

(6,659

)

(776

)

Changes in certain assets and liabilities:

Receivables

4,212

(4,952

)

1,654

896

(884

)

Inventories

(3,115

)

(367

)

698

579

(1,597

)

Prepaid expenses and other current assets

(1,036

)

868

(985

)

(368

)

(373

)

Accounts payable

1,402

(1,903

)

933

1,490

2,512

Accrued liabilities

9,535

9,325

(1,479

)

10,826

7,164

Other assets

(2,419

)

(1,900

)

(2,732

)

(9,461

)

(7,760

)

Net cash from operating activities

$

116,206

$

93,061

$

50,857

$

22,956

$

6,710