Frontier Airlines 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

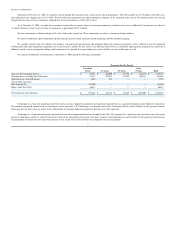

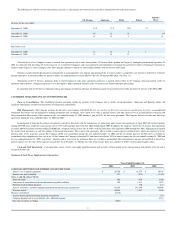

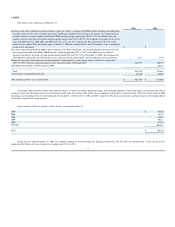

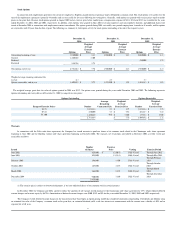

The following sets forth the revenue and accounts receivable (as a percentage of revenue and net receivables) information for the code

-

share partners:

Substantially all of the Company's revenue is derived from agreements with its code

-

share partners. US Airways filed a petition for Chapter 11 bankruptcy protection on September 12,

2004. In connection with this filing, US Airways has not yet assumed the Company's code

-

share agreement and could choose to terminate the agreement. United is attempting to reorganize its

business under Chapter 11 of the bankruptcy code. The Company continues to operate its normal flight schedules with US Airways and United.

Delta has recently reported operating losses primarily due to an uncompetitive cost structure and announced that if it fails to achieve a competitive cost structure it will need to restructure

through bankruptcy. In December 2004, we agreed to reduce our compensation level on the ERJ

-

145 fleet by 3% through May 2016. (See Note 11.)

Termination of the US Airways, American, Delta or United regional jet code

-

share agreements could have a material adverse effect on the Company's financial position, results of

operations and cash flows. Contingency plans have been developed to address potential outcomes of the US Airways and United bankruptcy proceedings.

In connection with the US Airways bankruptcy filing, the Company recorded an allowance for doubtful accounts for pre

-

petition receivables due from US Airways of $3,200 in 2004.

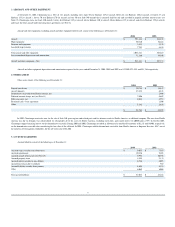

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Consolidation—

The consolidated financial statements include the accounts of the Company and its wholly

-

owned subsidiaries, Chautauqua and Republic Airline. All

significant intercompany accounts and transactions are eliminated in consolidation.

Risk Management—

The Company accounts for derivatives in accordance with SFAS No. 133,

Accounting for Derivative Instruments and Hedging Activities,

as amended and

interpreted

.

Fuel swaps were not designated as hedging instruments and, accordingly, were carried at fair value in prepaid expenses and other current assets or accrued liabilities with gains and

losses recorded in other income. Other income for the year ended December 31, 2002 includes a gain of $228, for fuel swap agreements. The Company did not enter into any fuel swap

agreements during the years ended December 31, 2004 and 2003.

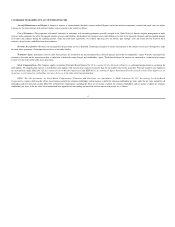

In anticipation of financing the purchase of regional jet aircraft on firm order with the manufacturer, we entered into eight treasury lock agreements in April 2004 with notional amounts

totaling $253,500 and a weighted average interest rate of 4.23% with expiration dates from July 2004 through March 2005. In addition, the Company entered into six treasury lock agreements

in August 2004 with notional amounts totaling $120,000 and a weighted average interest rate of 4.80% with expiration dates from September 2004 through June 2005. Management designated

the treasury lock agreements as cash flow hedges of forecasted transactions. The treasury lock agreements will be settled at each respective settlement date, which are expected to be the

purchase dates of the respective aircraft. The Compnay settled seven agreements during the year ended December 31, 2004 and the net amount paid was $2,969 and was recorded in

accumulated other comprehensive loss, net of tax. Of this amount, the Company reclassified $21 and expect to reclassify $198 to interest expense for the year ended December 31, 2004 and

the year ending December 31, 2005, respectively. Amounts paid or received on the settlement dates are recorded to accumulated other comprehensive income and amortized or accreted to

interest expense over the terms of the respective aircraft debt. As of December 31, 2004 the fair value of the treasury locks was a liability of $4,012 based on quoted market values.

Cash and Cash Equivalents—

Cash equivalents consist of short

-

term, highly liquid investments with maturities of three months or less when purchased. Substantially all of our cash is

on hand with one bank.

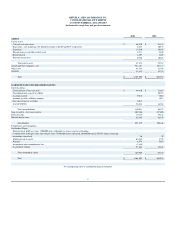

Statement of Cash Flows Supplementary Information

US Airways

American

Delta

United

America

West

Revenue for the years ended:

December 31, 2004

41

%

17

%

35

%

7

%

December 31, 2003

40

23

29

8

%

December 31, 2002

53

31

1

15

Receivables as of:

December 31, 2004

31

37

6

1

December 31, 2003

35

21

15

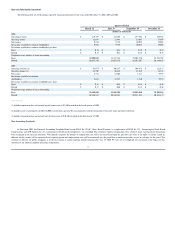

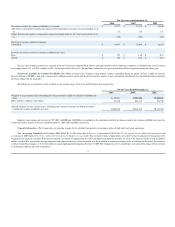

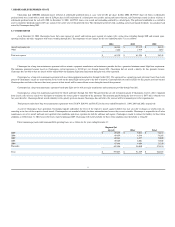

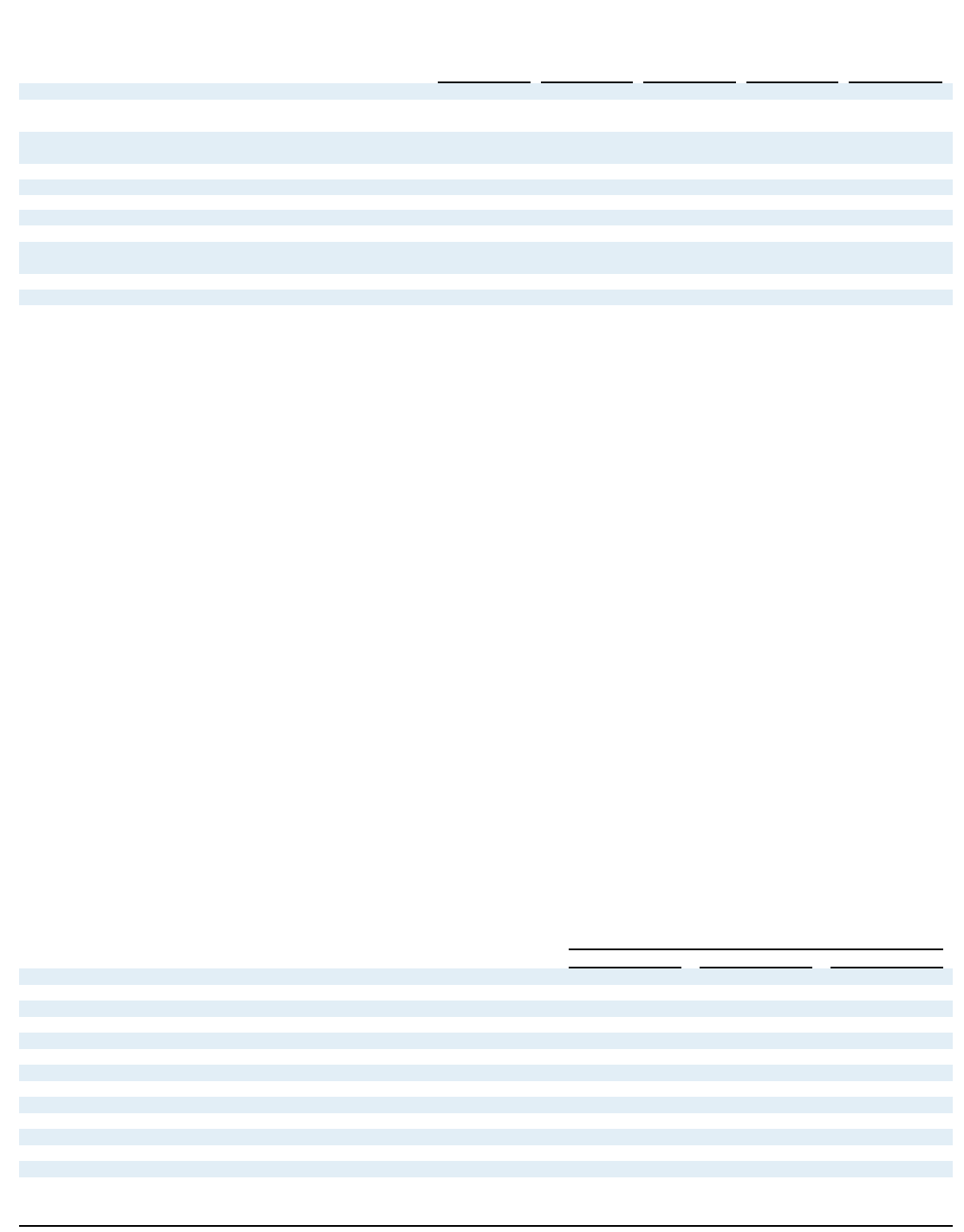

Years Ended December 31,

2004

2003

2002

CASH PAID (REFUNDED) FOR INTEREST AND INCOME TAXES:

Interest

—

net of amount capitalized

$

26,705

$

18,379

$

10,438

Income taxes paid (refunded)

373

(575

)

(3,435

)

NON-

CASH TRANSACTIONS:

Deferred credits

662

650

1,200

Conversion of accrued interest to subordinated note payable to affiliate

107

1,512

1,997

Preferred stock dividends declared

170

413

Aircraft, inventories, and other equipment purchased through financing arrangements

318,456

241,690

156,080

Warrants issued

10,263

1,587

3,480

Warrants surrendered

(6,756

)

Aircraft options purchased through financing arrangements

768

Company financed sale of assets held for sale

—

affiliated company

8,583

Fair value of interest rate hedge

(4,012

)

43