Frontier Airlines 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(6) Messrs. Davidson and Jacobs may be deemed to be the beneficial owner of the shares of our common stock owned by WexAir LLC by virtue of being a managing member or general

partner of WexAir LLC or each of the members of WexAir LLC. Each of Messrs. Davidson and Jacobs disclaims beneficial ownership of the shares owned by WexAir LLC except to the

extent of his interest in such shares through his interest in each member of WexAir LLC. Also includes 4,163 shares subject to stock options.

(7) Consists of shares subject to stock options. The address of Mr. Lambert is c/o Alvarez & Marsal Inc, 101 East 52nd Street, New York, NY 10022.

(8) Consists of shares subject to stock options. The address for Mr. Cohen is: c/o Pembroke Companies, Inc., 70 East 55

th

Street, 7

th Floor, New York, New York 10022.

(9) Consists of shares subject to stock options. The address for Mr. Landesman is: c/o ML Management Associates, Inc., 125 W. 55th Street, 8th Floor, New York, New York 10019.

(10) Consists of shares subject to stock options. The address for Mr. Plaumann is: 350 Bedford Street, Suite 307, Stamford, CT 06901.

(11) Includes 1,407,630 shares subject to stock options.

(12) Consists of 3,435,000 shares subject to warrants exercisable within 60 days after February 28, 2005.

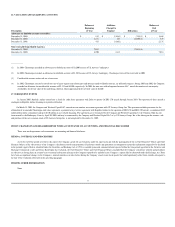

Below is a summary of the equity compensation plans:

Plan Category

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

Equity compensation plans approved by security holders

6,216,864

$

3.47

1,727,600

Equity compensation plans not approved by security holders

Total

6,216,864

$

3.47

1,727,600

65