Family Dollar 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

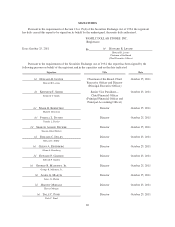

*10.23 Relocation Policy applicable to executive officers of the Company (filed as Exhibit 10.27 to the

Company’s Form 10-K for the fiscal year ended August 27, 2005)

*10.24 Amended and Restated Family Dollar Compensation Deferral Plan (filed as Exhibit 10.3 to the

Company’s Form 10-Q for the quarter ended March 1, 2008)

*10.25 Family Dollar Stores Inc., 2006 Incentive Plan Directors’ Share Awards Guidelines (filed as

Exhibit 10.1 to the Company’s Report on Form 8-K filed with the SEC on August 21, 2006)

*10.26 Family Dollar Stores Inc., 2006 Incentive Plan 2006 Non-Qualified Stock Option Grant Program

(filed as Exhibit 10.3 to the Company’s Report on Form 8-K filed with the SEC on January 25,

2006)

*10.27 Family Dollar Stores, Inc., 2006 Incentive Plan Guidelines for Long Term Incentive Performance

Share Rights Awards (filed as Exhibit 10.1 to the Company’s Report on Form 8-K filed with the

SEC on October 16, 2009)

*10.28 Form of Performance Share Rights Award Certificate Awards (filed as Exhibit 10.2 to the

Company’s Report on Form 8-K filed with the SEC on September 29, 2005)

*10.29 Stipulation and Agreement of Compromise, Settlement and Release (filed as Exhibit 10.1 to the

Company’s Report on Form 8-K filed with the SEC on June 26, 2007)

*10.30 Agreement dated September 28, 2011 between Family Dollar Stores, Inc. and Trian Fund

Management, L.P., Trian Management GP, LLC, certain funds managed by Trian Management L.P.

and Nelson Peltz, Peter W. May and Edward P. Garden (filed as Exhibit 10.1 to the Company’s

Current Report on Form 8-K filed on September 29, 2011)

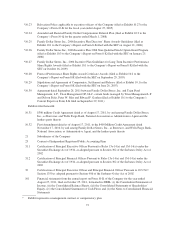

Exhibits filed herewith:

10.31 $300 million Credit Agreement dated as of August 17, 2011, by and among Family Dollar Stores,

Inc., as Borrower, and Wells Fargo Bank, National Association as Administrative Agent and the

lenders party thereto

10.32 First Amendment dated as of August 17, 2011, to the $400 Million Credit Agreement dated

November 17, 2010, by and among Family Dollar Stores, Inc., as Borrower, and Wells Fargo Bank,

National Association, as Administrative Agent, and the lenders party thereto

21 Subsidiaries of the Company

23 Consent of Independent Registered Public Accounting Firm

31.1 Certification of Principal Executive Officer Pursuant to Rules 13a-14(a) and 15d-14(a) under the

Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of

2002

31.2 Certification of Principal Financial Officer Pursuant to Rules 13a-14(a) and 15d-14(a) under the

Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of

2002

32 Certification of Principal Executive Officer and Principal Financial Officer Pursuant to 18 U.S.C.

Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

101 Financial statements from the annual report on Form 10-K of the Company for the year ended

August 27, 2011, filed on October 25, 2011, formatted in XBRL: (i) the Consolidated Statements of

Income, (ii) the Consolidated Balance Sheets, (iii) the Consolidated Statements of Shareholders’

Equity, (iv) the Consolidated Statements of Cash Flows and (iv) the Notes to Consolidated Financial

Statements

* Exhibit represents a management contract or compensatory plan

72