Family Dollar 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

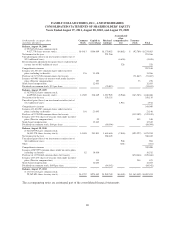

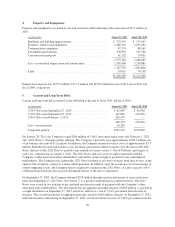

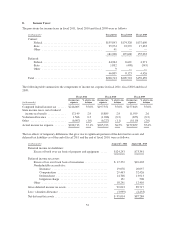

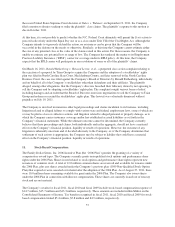

4. Property and Equipment:

Property and equipment is recorded at cost and consisted of the following at the end of fiscal 2011 and fiscal

2010:

(in thousands) August 27, 2011 August 28, 2010

Buildings and building improvements ......................... $ 572,039 $ 537,647

Furniture, fixtures and equipment ............................ 1,460,116 1,291,282

Transportation equipment .................................. 87,274 80,161

Leasehold improvements ................................... 398,803 357,768

Construction in progress ................................... 61,152 19,831

2,579,384 2,286,689

Less: accumulated depreciation and amortization ................ 1,391,806 1,250,881

1,187,578 1,035,808

Land ................................................... 93,011 76,158

$1,280,589 $1,111,966

Depreciation expense was $179.5 million, $171.2 million and $159.8 million for fiscal 2011, fiscal 2010 and

fiscal 2009, respectively.

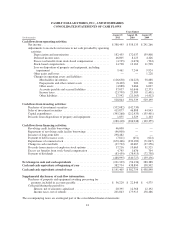

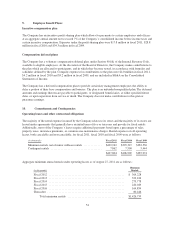

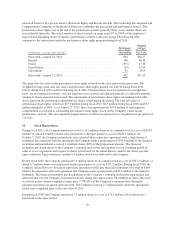

5. Current and Long-Term Debt:

Current and long-term debt consisted of the following at the end of fiscal 2011 and fiscal 2010:

(in thousands) August 27, 2011 August 28, 2010

5.24% Notes due September 27, 2015 ......................... $ 81,000 $ 81,000

5.41% Notes due September 27, 2015 ......................... 169,000 169,000

5.00% Notes due February 1, 2021 ........................... 298,570 —

548,570 250,000

Less: current portion ...................................... 16,200 —

Long-term portion ........................................ $532,370 $250,000

On January 28, 2011, the Company issued $300 million of 5.00% unsecured senior notes due February 1, 2021

(the “2021 Notes”), through a public offering. The Company’s proceeds were approximately $298.5 million, net

of an issuance discount of $1.5 million. In addition, the Company incurred issuance costs of approximately $3.3

million. Both the discount and issuance costs are being amortized to interest expense over the term of the 2021

Notes. Interest on the 2021 Notes is payable semi-annually in arrears on the 1st day of February and August of

each year, commencing on August 1, 2011. The 2021 Notes rank pari passu in right of payment with the

Company’s other unsecured senior indebtedness and will be senior in right of payment to any subordinated

indebtedness. The Company may redeem the 2021 Notes in whole at any time or in part from time to time, at the

option of the Company, subject to a make-whole premium. In addition, upon the occurrence of certain change of

control triggering events, the Company may be required to repurchase the 2021 Notes, at a price equal to 101%

of their principal amount, plus accrued and unpaid interest to the date of repurchase.

On September 27, 2005, the Company obtained $250 million through a private placement of unsecured senior

notes due September 27, 2015 (the “2015 Notes”), to a group of institutional accredited investors. The 2015

Notes were issued in two tranches at par and rank pari passu in right of payment with the Company’s other

unsecured senior indebtedness. The first tranche has an aggregate principal amount of $169 million, is payable in

a single installment on September 27, 2015, and bears interest at a rate of 5.41% per annum from the date of

issuance. The second tranche has an aggregate principal amount of $81 million, matures on September 27, 2015,

with amortization commencing on September 27, 2011, and bears interest at a rate of 5.24% per annum from the

50