Family Dollar 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.All shares are purchased pursuant to share repurchase authorizations approved by the Board of Directors. On

November 18, 2009, the Board of Directors authorized the Company to purchase up to $400 million of the

Company’s outstanding common stock from time to time as market conditions warrant. On September 29, 2010,

the Company announced that the Board of Directors authorized the Company to purchase up to $750 million of

the Company’s outstanding common stock (the “2010 authorization”). The remaining amount under the previous

authorization was cancelled. As of August 27, 2011, the Company had $87.3 million remaining under the 2010

authorization.

On September 26, 2011, the Company announced that the Board of Directors authorized the Company to

purchase up to an additional $250 million of the Company’s outstanding common stock. As such, after the

announcement, the Company has $337.3 million remaining under current authorizations.

There is no expiration date related to the above referenced authorizations. Shares purchased under the share

repurchase authorizations are generally held in treasury or are cancelled and returned to the status of authorized

but unissued shares.

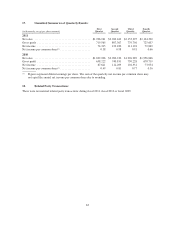

13. Stockholders’ Rights Plan

On March 2, 2011, the Company adopted a stockholders’ rights plan whereby the Board of Directors of the

Company authorized and declared a dividend distribution of one right for each outstanding share of common

stock of the Company to stockholders of record at the close of business on March 2, 2011. Each right entitles the

registered holder to purchase from the Company a unit consisting of one one-thousandth of a share of Series A

Junior Participating Preferred Stock, par value $1.00 per share, at a price of $250.00 per unit, subject to

adjustment. The rights are not presently exercisable and remain attached to the shares of common stock until the

occurrence of certain triggering events. Subject to certain exceptions, the rights will separate from the shares of

common stock and a distribution date will be deemed to occur on the earlier of (i) the 10th business day after a

person or group becomes a beneficial owner of at least 10% of the Company’s outstanding common stock or

(ii) the 10th business day after the date that a tender or exchange offer is launched that would, if completed, result

in a person or group becoming a beneficial owner of at least 10% of the Company’s outstanding common stock.

Upon such an event, each holder of a right, other than the person or group becoming a beneficial owner of at least

10% of the Company’s outstanding common stock, will thereafter have the right to receive, upon exercise,

common stock (or, in certain circumstances, cash, property or other securities of the Company) having a value

equal to two times the exercise price of the right. The Company may redeem the rights in whole at a price of

$0.001 per right. The rights will expire on March 2, 2012, unless exercised, redeemed or exchanged prior to that

time. The Board may terminate the rights plan before the expiration date or extend the expiration date. The rights

have no voting or dividend privileges, and, unless and until they become exercisable, have no dilutive effect on

the earnings of the Company.

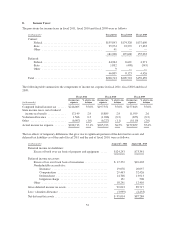

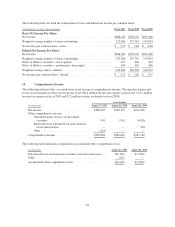

14. Earnings per Share:

Basic net income per common share is computed by dividing net income by the weighted average number of

shares outstanding during each period. Diluted net income per common share gives effect to all securities

representing potential common shares that were dilutive and outstanding during the period. Certain stock options

and performance share rights were excluded from the calculation of diluted net income per common share

because their effects were antidilutive (0.3 million, 0.6 million and 1.7 million shares for fiscal 2011, fiscal 2010

and fiscal 2009, respectively). In the calculation of diluted net income per common share, the denominator

includes the number of additional common shares that would have been outstanding if the Company’s

outstanding dilutive stock options and performance share rights had been exercised, as determined pursuant to

the treasury stock method.

60