Family Dollar 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

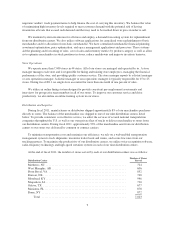

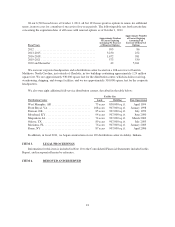

Our stores offer a variety of general merchandise. The following table summarizes the percentage of net

sales attributable to each product category over the last three fiscal years.

Product Category 2011 2010 2009

Consumables .................................................... 66.5% 65.1% 64.4%

Home Products ................................................... 12.7% 13.2% 13.4%

Apparel and Accessories ........................................... 10.0% 10.7% 11.2%

Seasonal and Electronics ........................................... 10.8% 11.0% 11.0%

The following table describes our product categories in more detail.

Consumables .............. Household chemicals

Paper products

Food

Health and beauty aids

Hardware and automotive supplies

Pet food and supplies

Home Products ............ Domestics, including blankets, sheets and towels

Housewares

Giftware

Home décor

Apparel and Accessories .... Men’s clothing

Women’s clothing

Boys’ and girls’ clothing

Infants’ clothing

Shoes

Fashion accessories

Seasonal and Electronics .... Toys

Stationery and school supplies

Seasonal goods

Personal electronics, including pre-paid cellular phones and services

Reflecting trends in customer demand over the past three fiscal years, we have expanded our assortment of

consumable merchandise in our stores. During fiscal 2011, we expanded the number of basic SKUs in our stores,

primarily in food and health and beauty aids, by 20-25%. During fiscal 2011, nationally advertised brand name

merchandise accounted for approximately 53% of sales. Merchandise sold under our private brands program,

across all merchandise categories, accounted for approximately 25% of sales. Merchandise sold under other

brands and labels, or which was unlabeled, accounted for the balance of sales. During fiscal 2011, closeout

merchandise accounted for approximately 1% of sales.

We purchase merchandise from a wide variety of suppliers and generally have not experienced difficulty in

obtaining adequate quantities of merchandise. In fiscal 2011, no single supplier accounted for more than 8% of

the merchandise we sold.

In fiscal 2011, approximately 31% of our purchased merchandise (at cost) was manufactured overseas. We

imported approximately 11% of our merchandise purchases (at cost) during fiscal 2011 and relied on domestic

suppliers for approximately 20% of our purchased merchandise (at cost). While most of our merchandise is

shipped to our distribution centers from domestic suppliers, a substantial amount of such merchandise is

manufactured outside the United States and imported by the domestic suppliers. Our vendor arrangements

provide for payment in U.S. dollars.

We maintain a substantial variety and depth of merchandise inventory in stock in our stores (and in our

distribution centers for weekly store replenishment) to attract customers and meet their shopping needs. We

8