Family Dollar 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

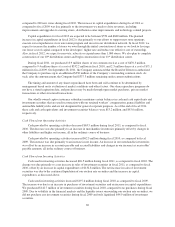

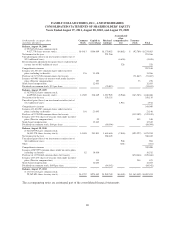

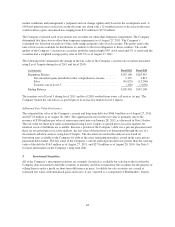

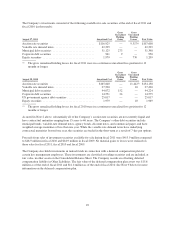

FAMILY DOLLAR STORES, INC., AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Years Ended August 27, 2011, August 28, 2010, and August 29, 2009

(in thousands, except per share

and share amounts)

Common

Stock

Capital in

excess of par

Retained

earnings

Accumulated

other

comprehensive

loss

Treasury

stock Total

Balance, August 30, 2008

(139,704,542 shares common stock;

4,427,779 shares treasury stock) .................. $14,413 $166,669 $1,170,652 $(4,862) $ (92,789) $1,254,083

Net income for the year ............................. 291,266 291,266

Unrealized gains (losses) on investment securities (net of

$2.5 million of taxes) ............................ (4,626) (4,626)

Reclassification adjustment for (gains) losses realized in net

income (net of $0.3 million of taxes) ................ 528 528

Comprehensive income ............................. 287,168

Issuance of 1,353,413 common shares under incentive

plans, including tax benefits ....................... 136 31,450 31,586

Purchase of 2,271,528 common shares for treasury ....... (71,067) (71,067)

Issuance of 9,405 shares of treasury stock under incentive

plans (Director compensation) ..................... 197 73 270

Stock-based compensation .......................... 12,033 12,033

Dividends on common stock, $.53 per share ............ (74,013) (74,013)

Balance, August 29, 2009

(138,795,832 shares common stock;

6,689,902 shares treasury stock) .................. 14,549 210,349 1,387,905 (8,960) (163,783) 1,440,060

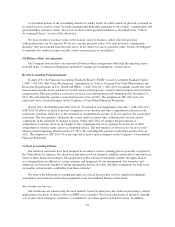

Net income for the year ............................. 358,135 358,135

Unrealized gains (losses) on investment securities (net of

$1.2 million of taxes) ............................ 1,914 1,914

Comprehensive income ............................. 360,049

Issuance of 1,010,503 common shares under incentive

plans, including tax benefits ....................... 101 21,045 21,146

Purchase of 9,370,908 common shares for treasury ....... (332,189) (332,189)

Issuance of 17,532 shares of treasury stock under incentive

plans (Director compensation) ..................... 95 445 540

Stock-based compensation .......................... 12,342 12,342

Dividends on common stock, $.60 per share ............ (80,394) (80,394)

Balance, August 28, 2010

(130,452,959 shares common stock;

16,043,278 shares treasury stock) ................. 14,650 243,831 1,665,646 (7,046) (495,527) 1,421,554

Net income for the year ............................. 388,445 388,445

Unrealized gains (losses) on investment securities (net of

$0.6 million of taxes) ............................ 904 904

Other ........................................... (261) (261)

Comprehensive income ............................. 389,088

Issuance of 819,995 common shares under incentive plans,

including tax benefits ............................ 82 16,430 16,512

Purchase of 13,934,868 common shares for treasury ...... (670,466) (670,466)

Issuance of 15,255 shares of treasury stock under incentive

plans (Director compensation) ..................... 131 544 675

Stock-based compensation .......................... 14,053 14,053

Dividends on common stock, $.695 per share ........... (84,342) (84,342)

Balance, August 27, 2011

(117,353,341 shares common stock;

29,962,891 shares treasury stock) ................. $14,732 $274,445 $1,969,749 $(6,403) $(1,165,449) $1,087,074

The accompanying notes are an integral part of the consolidated financial statements.

40