Family Dollar 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

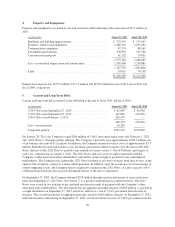

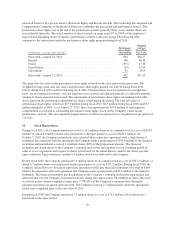

date of issuance. The second tranche has a required principal payment of $16.2 million on September 27, 2011,

and on each September 27 thereafter to and including September 27, 2015. Interest on the 2015 Notes is payable

semi-annually in arrears on the 27th day of March and September of each year. The 2015 Notes contain certain

restrictive financial covenants, which include a consolidated debt to consolidated total capitalization ratio, a fixed

charge coverage ratio, and a priority debt to consolidated net worth ratio. As of August 27, 2011, the Company

was in compliance with all such covenants.

On November 17, 2010, the Company amended the 2015 Notes to remove the subsidiary co-borrower and all

subsidiary guarantors.

Credit Facilities

On November 17, 2010, the Company entered into a new four-year unsecured revolving credit facility with a

syndicate of lenders for borrowings of up to $400 million. The credit facility matures on November 17, 2014, and

provides for two, one-year extensions that require lender consent. Any borrowings under the credit facility accrue

interest at a variable rate based on short-term market interest rates. The credit facility replaced the previous

364-day $250 million unsecured revolving credit facility.

On August 17, 2011, the Company entered into a new five-year unsecured revolving credit facility with a

syndicate of lenders for borrowings of up to $300 million. The credit facility matures on August 17, 2016, and

provides for two, one-year extensions that require lender consent. Any borrowings under the credit facility accrue

interest at a variable rate based on short-term market interest rates. The credit facility replaced the Company’s

previous five-year $200 million unsecured credit facility.

During fiscal 2011, the Company borrowed $46.0 million under the credit facilities at a weighted-average

interest rate of 1.3%. As of August 27, 2011, and August 28, 2010, the Company had no outstanding borrowings

under the credit facilities. The credit facilities contain certain restrictive financial covenants, which include a

consolidated debt to consolidated total capitalization ratio, a fixed charge coverage ratio, and a priority debt to

consolidated net worth ratio. As of August 27, 2011, the Company was in compliance with all such covenants.

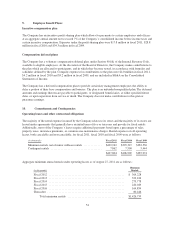

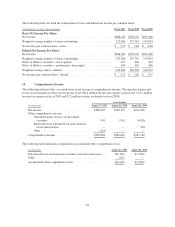

6. Accrued Liabilities:

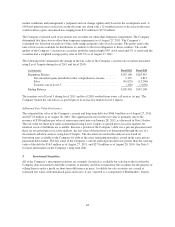

Accrued liabilities consisted of the following at the end of fiscal 2011 and fiscal 2010:

(in thousands) August 27, 2011 August 28, 2010

Compensation ........................................... $106,047 $110,932

Taxes other than income taxes ............................... 95,973 88,672

Self-insurance liabilities ................................... 56,964 64,004

Other(1) ................................................. 51,834 45,739

$310,818 $309,347

(1) Other accrued liabilities consist primarily of store utility accruals, certain store rental accruals,

litigation accruals, and accrued interest.

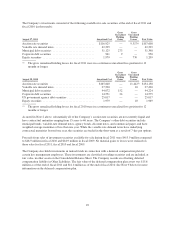

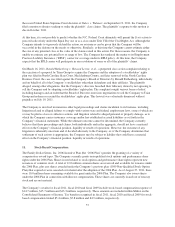

7. Other Liabilities:

Other liabilities consisted of the following at the end of fiscal 2011 and fiscal 2010:

(in thousands) August 27, 2011 August 28, 2010

Self-insurance liabilities ................................... $193,169 $185,676

Other(1) ................................................. 77,297 67,900

$270,466 $253,576

(1) Other liabilities consist primarily of deferred rent, income taxes and deferred compensation.

51