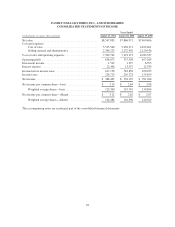

Family Dollar 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During fiscal 2011, we borrowed $46.0 million under the credit facilities at a weighted-average interest rate

of 1.3%. As of August 27, 2011, and August 28, 2010, we had no outstanding borrowings under the credit

facilities. The credit facilities contain certain restrictive financial covenants, which include a consolidated debt to

consolidated total capitalization ratio, a fixed charge coverage ratio, and a priority debt to consolidated net worth

ratio. As of August 27, 2011, we were in compliance with all such covenants.

Long-Term Debt

On January 28, 2011, we issued $300 million of 5.00% unsecured senior notes due February 1, 2021 (the

“2021 Notes”), through a public offering. Our proceeds were approximately $298.5 million, net of an issuance

discount of $1.5 million. In addition, we incurred issuance costs of approximately $3.3 million. Both the discount

and issuance costs are being amortized to interest expense over the term of the 2021 Notes. Interest on the 2021

Notes is payable semi-annually in arrears on the 1st day of February and August of each year, commencing on

August 1, 2011. The 2021 Notes rank pari passu in right of payment with our other unsecured senior

indebtedness and will be senior in right of payment to any subordinated indebtedness. We may redeem the 2021

Notes in whole at any time or in part from time to time, at our option, subject to a make-whole premium. In

addition, upon the occurrence of certain change of control triggering events, we may be required to repurchase

the 2021 Notes, at a price equal to 101% of their principal amount, plus accrued and unpaid interest to the date of

repurchase. The proceeds of the issuance were used to fund our share repurchase program and for general

corporate purposes.

On September 27, 2005, we obtained $250 million through a private placement of unsecured senior notes

due September 27, 2015 (the “2015 Notes”), to a group of institutional accredited investors. The 2015 Notes

were issued in two tranches at par and rank pari passu in right of payment with our other unsecured senior

indebtedness. The first tranche has an aggregate principal amount of $169 million, is payable in a single

installment on September 27, 2015, and bears interest at a rate of 5.41% per annum from the date of issuance.

The second tranche has an aggregate principal amount of $81 million, matures on September 27, 2015, with

amortization commencing on September 27, 2011, and bears interest at a rate of 5.24% per annum from the date

of issuance. The second tranche has a required principal payment of $16.2 million on September 27, 2011, and

on each September 27 thereafter to and including September 27, 2015. Interest on the 2015 Notes is payable

semi-annually in arrears on the 27th day of March and September of each year. The 2015 Notes contain certain

restrictive financial covenants, which include a consolidated debt to consolidated total capitalization ratio, a fixed

charge coverage ratio, and a priority debt to consolidated net worth ratio. As of August 27, 2011, we were in

compliance with all such covenants.

On November 17, 2010, we amended the 2015 Notes to remove the subsidiary co-borrower and all

subsidiary guarantors.

Other Considerations

Our merchandise inventories at the end of fiscal 2011 were 12.3% higher than at the end of fiscal

2010. Inventory per store at the end of fiscal 2011 was approximately 9% higher than inventory per store at the

end of fiscal 2010. The increases were due primarily to the expansion of our assortment of consumable

merchandise.

Capital expenditures for fiscal 2011 were $345.3 million, compared with $212.4 million in fiscal 2010, and

$155.4 million in fiscal 2009. The increase in capital expenditures during fiscal 2011, as compared to fiscal 2010,

was due primarily to the investments we made to drive revenue growth, including our comprehensive store

renovation program, other improvements and upgrades to existing stores, purchases of new and existing stores,

and supply chain projects (including the start of construction of the 10th distribution center). In fiscal 2011, we

purchased 44 stores, including existing stores from our landlords and the construction of new stores, compared to

20 existing stores purchased from our landlords in fiscal 2010. During fiscal 2011, we opened 300 new stores,

29