Family Dollar 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

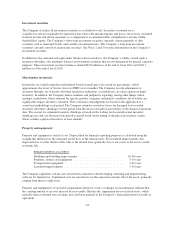

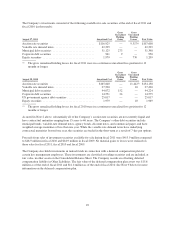

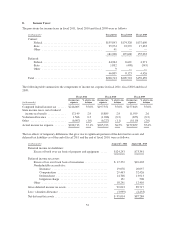

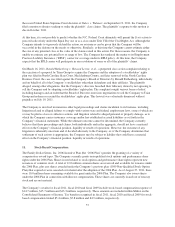

The Company’s investments consisted of the following available-for-sale securities at the end of fiscal 2011 and

fiscal 2010 (in thousands):

August 27, 2011 Amortized Cost

Gross

Unrealized

Holding

Gains

Gross

Unrealized

Holding

Losses Fair Value

Auction rate securities ............................... $116,925 — 9,317(1) $107,608

Variable rate demand notes ............................ 42,299 — — 42,299

Municipal debt securities ............................. 51,125 273 — 51,398

Corporate debt securities ............................. 941 9 — 950

Equity securities .................................... 1,979 — 770 1,209

(1) The gross unrealized holding losses for fiscal 2011 were in a continuous unrealized loss position for 12

months or longer.

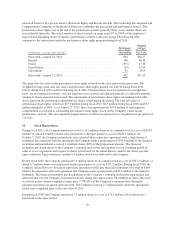

August 28, 2010 Amortized Cost

Gross

Unrealized

Holding

Gains

Gross

Unrealized

Holding

Losses Fair Value

Auction rate securities ............................... $165,600 — 11,442(1) $154,158

Variable rate demand notes ............................ 27,500 — 10 27,490

Municipal debt securities ............................. 44,072 152 — 44,224

Corporate debt securities ............................. 14,551 24 — 14,575

US government agency debt securities ................... 25,017 — — 25,017

Equity securities .................................... 1,979 — 10 1,969

(1) The gross unrealized holding losses for fiscal 2010 were in a continuous unrealized loss position for 12

months or longer.

As noted in Note 2 above, substantially all of the Company’s auction rate securities are not currently liquid and

have contractual maturities ranging from 15 years to 46 years. The Company’s other debt securities include

municipal bonds, variable-rate demand notes, agency bonds, discount notes, and commercial paper, and have

weighted average maturities of less than one year. While the variable rate demand notes have underlying

contractual maturities beyond one year, the securities are traded in the short-term as a result of 7-day put options.

Proceeds from sales of investment securities available-for-sale during fiscal 2011 were $415.9 million compared

to $46.9 million in fiscal 2010 and $44.9 million in fiscal 2009. No material gains or losses were realized on

those sales for fiscal 2011, fiscal 2010 and fiscal 2009.

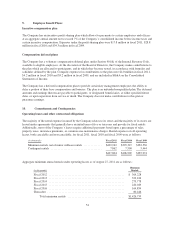

The Company also holds investments in mutual funds in connection with a deferred compensation plan for

certain key management employees. These investments are classified as trading securities and are included, at

fair value, in other assets on the Consolidated Balance Sheet. The Company records an offsetting deferred

compensation liability in Other Liabilities. The fair value of the deferred compensation plan assets was $15.6

million as of the end of fiscal 2011 and $11.4 million as of the end of fiscal 2010. See Note 9 below for more

information on the deferred compensation plan.

49