Family Dollar 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

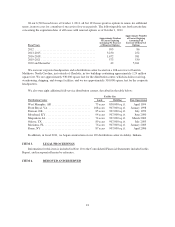

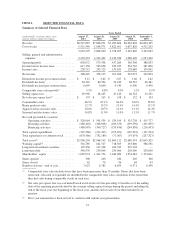

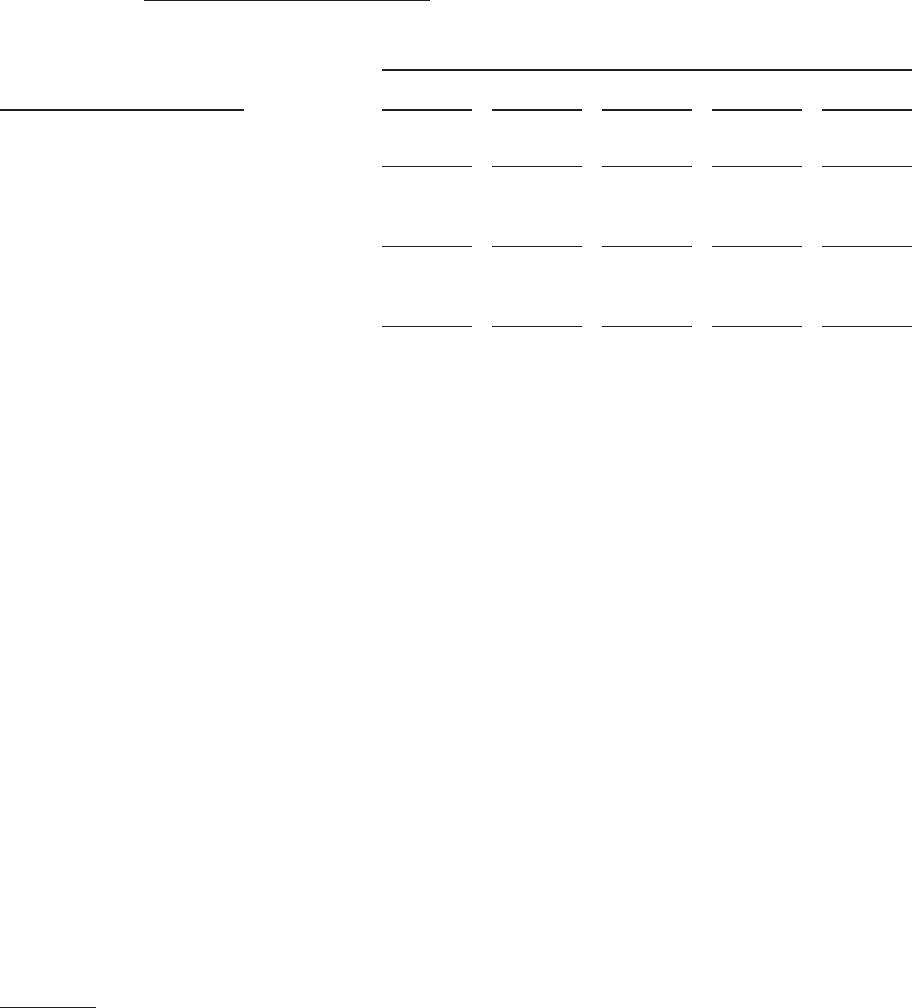

ITEM 6. SELECTED FINANCIAL DATA

Summary of Selected Financial Data

Years Ended

(in thousands, except per share, store,

and net sales per square foot data)

August 27,

2011

August 28,

2010

August 29,

2009

August 30,

2008

September 1,

2007

Net sales ............................ $8,547,835 $7,866,971 $7,400,606 $6,983,628 $6,834,305

Cost of sales ......................... 5,515,540 5,058,971 4,822,401 4,637,826 4,512,242

3,032,295 2,808,000 2,578,205 2,345,802 2,322,063

Selling, general and administrative

expenses .......................... 2,394,223 2,232,402 2,120,936 1,980,496 1,933,430

Operating profit ....................... 638,072 575,598 457,269 365,306 388,633

Income before income taxes ............. 617,158 563,858 450,925 361,762 381,896

Income taxes ......................... 228,713 205,723 159,659 128,689 139,042

Net income .......................... 388,445 358,135 291,266 233,073 242,854

Diluted net income per common share ..... $ 3.12 $ 2.62 $ 2.07 $ 1.66 $ 1.62

Dividends declared .................... 84,342 80,394 74,013 68,537 66,361

Dividends declared per common share ..... 0.695 0.600 0.530 0.490 0.450

Comparable store sales growth(1) ......... 5.5% 4.8% 4.0% 1.2% 0.9%

Selling square feet ..................... 49,996 48,225 47,120 46,324 45,251

Net sales per square foot(2) .............. $ 174 $ 165 $ 158 $ 152 $ 154

Consumables sales ..................... 66.5% 65.1% 64.4% 61.0% 58.8%

Home products sales ................... 12.7% 13.2% 13.4% 14.4% 15.1%

Apparel and accessories sales ............ 10.0% 10.7% 11.2% 13.1% 14.4%

Seasonal and electronics sales ............ 10.8% 11.0% 11.0% 11.5% 11.7%

Net cash provided by (used in):

Operating activities ................ $ 528,064 $ 591,539 $ 529,199 $ 515,738 $ 415,777

Investing activities ................ (280,418) (306,948) (109,355) (199,556) (191,835)

Financing activities ................ (488,995) (340,727) (139,456) (244,856) (216,493)

Total capital expenditures ............... (345,268) (212,435) (155,401) (167,932) (131,594)

Total repurchases of common stock ....... (670,466) (332,189) (71,067) (97,674) (257,523)

Total assets(3) ......................... $2,996,205 $2,968,145 $2,864,112 $2,689,354 $2,645,425

Working capital(3) ..................... 516,789 641,527 718,509 453,806 586,531

Long-term investment securities .......... 107,458 147,108 163,545 222,104 —

Long-term debt ....................... 548,570 250,000 250,000 250,000 250,000

Shareholders’ equity ................... 1,087,074 1,421,554 1,440,060 1,254,083 1,174,641

Stores opened ........................ 300 200 180 205 300

Stores closed ......................... 62 70 96 64 43

Number of stores—end of year ........... 7,023 6,785 6,655 6,571 6,430

(1) Comparable store sales include stores that have been open more than 13 months. Stores that have been

renovated, relocated or expanded are included in the comparable store sales calculation to the extent that

they had sales during comparable weeks in each year.

(2) Net sales per square foot was calculated based on total sales for the preceding 12 months as of the ending

date of the reporting period divided by the average selling square footage during the period, including the

end of the fiscal year, the beginning of the fiscal year, and the end of each of our three interim fiscal

quarters.

(3) Prior year amounts have been revised to conform with current year presentation.

23