Family Dollar 2011 Annual Report Download - page 60

Download and view the complete annual report

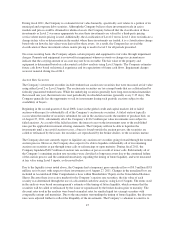

Please find page 60 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Presently, there are a total of 39 named plaintiffs and intervenors in the Grace and Ward cases, and 65 named

plaintiffs and/or opt-ins in the remaining cases, for which the N.C. Federal Court has not decided the class

certification issue.

The Company has been sued in six additional class action lawsuits alleging that Store Managers should be

non-exempt employees under various state laws. The plaintiffs in these cases seek recovery of overtime pay,

liquidated damages, and attorneys’ fees and court costs. Twila Walters et. al. v. Family Dollar Stores of Missouri,

Inc., alleging violations of the Missouri Minimum Wage Law, was originally filed on January 26, 2010, and is

pending in the Circuit Court of Jackson County, Missouri (the “Circuit Court”). On May 10, 2011, the Circuit

Court certified the class under the Missouri Minimum Wage Law and common law. On May 20, 2011, the

Company petitioned the Appellate Court for an interlocutory appeal of the Circuit Court’s decision certifying the

class. The Appellate Court denied that petition on June 10, 2011. The Company filed a writ of prohibition with

the Missouri Supreme Court on July 1, 2011. On October 4, 2011, the Missouri Supreme Court denied the

Company’s writ of prohibition and vacated the stay of the litigation. Hegab v. Family Dollar Stores, Inc., was

filed in the United States District Court for the District of New Jersey on March 3, 2011. Plaintiff seeks recovery

for himself and allegedly similarly situated Store Managers under New Jersey law. The Company has sought a

stay of the Hegab proceedings, which was denied. The parties are now engaged in class discovery in this matter.

Barker v. Family Dollar, Inc., alleging violations of the Kentucky Wages and Hours Law, was filed in Circuit

Court in Jefferson County, Kentucky on February 17, 2010, and removed to the United States District Court for

the Western District of Kentucky. On March 11, 2011, the district court denied the Company’s partial motion to

dismiss the overtime claim under Kentucky law and requested more discovery on that claim. The parties will be

conducting pre-certification discovery through December 2011. Youngblood, et al. v. Family Dollar Stores, Inc.,

Family Dollar, Inc., Family Dollar Stores of New York, Inc. et al., was filed in the United States District Court

for the Southern District of New York on April 2, 2009. Rancharan v. Family Dollar Stores, Inc., was filed in the

Supreme Court of the State of New York, Queens County on March 4, 2009, was removed to the United States

District Court for the Eastern District of New York on May 6, 2009, and was subsequently transferred to the

Southern District of New York and has been consolidated with Youngblood. On October 4, 2011, the New York

District Court certified the class in the Rancharan and Youngblood cases under Rule 23. Cook, et al. v. Family

Dollar Stores of Connecticut, Inc., was filed in the Superior Court State of Connecticut on October 5, 2011,

seeking unpaid overtime for a class of current and former Connecticut Store Managers for alleged violations of

the Connecticut Minimum Wage Act.

In general, the Company continues to believe that its Store Managers are “exempt” employees under the FLSA and

have been and are being properly compensated under both federal and state laws. The Company further believes

that these actions are not appropriate for collective or class action treatment. The Company intends to vigorously

defend the claims in these actions. While the N.C. Federal Court has previously found that the Grace and Ward

actions are not appropriate for collective action treatment, at this time it is not possible to predict whether one or

more of the remaining cases may be permitted to proceed collectively on a nationwide or other basis. No assurances

can be given that the Company will be successful in the defense of these actions, on the merits or otherwise. The

Company cannot reasonably estimate the possible loss or range of loss that may result from these actions.

If at some point in the future the Company determines that a reclassification of some or all of its Store Managers

as non-exempt employees under the FLSA is required, such action could have a material effect on the

Company’s financial position, liquidity or results of operation. At this time, the Company cannot quantify the

impact of such a determination.

On October 14, 2008, a complaint was filed in the U.S. District Court in Birmingham, Alabama, captioned Scott,

et al. v. Family Dollar Stores, Inc., alleging discriminatory pay practices with respect to the Company’s female

Store Managers. This case was pled as a putative class action or collective action under applicable statutes on

behalf of all Family Dollar female Store Managers. The plaintiffs seek recovery of compensatory and punitive

money damages, recovery of attorneys’ fees and equitable relief. The case has been transferred to the N.C.

Federal Court. Presently, there are 48 named plaintiffs in the Scott case, with no additional opt-ins. In response to

56