Family Dollar 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion summarizes the significant factors affecting our consolidated results of operations

and financial condition for fiscal 2011, fiscal 2010, and fiscal 2009, and our expectations for fiscal 2012. You

should read this discussion in conjunction with our Consolidated Financial Statements and the Notes to

Consolidated Financial Statements, which are included in this Report. Our discussion contains forward-looking

statements which are based upon our current expectations and which involve risks and uncertainties. Actual

results and the timing of events could differ materially from those anticipated in these forward-looking

statements as a result of a number of factors, including those set forth in the “Cautionary Statement Regarding

Forward-Looking Statements” in the General Information section of this Report and the “Risk Factors” listed in

Part I—Item 1A of this Report.

Our fiscal year generally ends on the Saturday closest to August 31 of each year, which generally results in

an extra week every six years. Fiscal 2011, fiscal 2010 and fiscal 2009 were 52-week years.

Executive Overview

We operate a chain of more than 7,000 general merchandise retail discount stores in 44 states, providing

primarily low- and middle-income consumers with a selection of competitively priced merchandise in convenient

neighborhood stores. Our merchandise assortment includes Consumables, Home Products, Apparel and

Accessories, and Seasonal and Electronics. We sell merchandise at prices that generally range from less than $1

to $10.

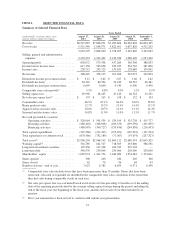

During fiscal 2011 as compared with fiscal 2010, our net sales increased 8.7% to $8.5 billion, our net

income increased 8.5% to $388.4 million, and our diluted net income per common share increased 19.1% to

$3.12. Comparable store sales (stores open more than 13 months) for fiscal 2011 increased 5.5% compared with

fiscal 2010. Our strong performance during fiscal 2011 was due primarily to our strong sales performance and an

improvement in selling, general and administrative (“SG&A”) expenses, as a percentage of net sales.

Several years ago, we slowed new store growth to focus on improving returns in existing stores and the

chain overall. We completed an end-to-end re-engineering of our merchandising and supply chain processes,

enhanced the performance of our store teams, refreshed our store technology platform, and created a store layout

for new stores that is more convenient and easier to shop. As a result of these investments, we have upgraded our

operational capabilities, increased profitability, gained productivity and expanded our financial returns. More

importantly, these investments have provided us with a strong foundation to accelerate revenue growth.

In today’s uncertain economic environment, value and convenience continues to resonate with consumers.

Our strategy of providing customers with value and convenience continues to attract not only our core

low-income customers but also middle-income families with greater frequency. To continue to capitalize on this

opportunity, we have launched several initiatives to enhance the customer’s shopping experience and improve

their perception of our value and convenience proposition.

During fiscal 2011, we continued to focus on achieving our four corporate goals: build customer loyalty and

experience; develop diverse, high performing teams; deliver profitable sales growth; and drive continuous

improvement. These goals are designed to drive both short-term and longer-term financial results. The following

are some highlights from these efforts.

• We accelerated our new store growth and increased our store openings by 50% from fiscal 2010 to 300

stores.

• We renovated 972 stores under our comprehensive store renovation program. This program is intended

to increase our competitiveness and sales productivity by transforming the customer’s shopping

experience in a Family Dollar store. As a part of this program, we: expanded key consumable

24