Family Dollar 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

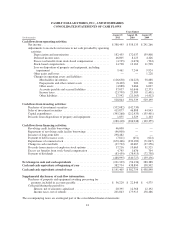

Cash Flows from Financing Activities

Cash used in financing activities increased $148.3 million during fiscal 2011, as compared to fiscal 2010.

The increase was primarily due to an increase in repurchases of common stock and changes in cash overdrafts,

partially offset by the issuance of new debt. During fiscal 2011, we purchased $670.5 million of our common

stock, as compared to $332.2 million in fiscal 2010. Cash overdrafts decreased $47.7 million in fiscal 2011, as

compared to an increase of $49.7 million in fiscal 2010. See Note 1 to the Consolidated Financial Statements

included in this report for an explanation of our cash overdrafts. Additionally, in fiscal 2011, we issued $300

million of 5.00% unsecured senior notes, creating a significant cash inflow from financing activities as compared

to fiscal 2010.

Cash used in financing activities increased $201.3 million during fiscal 2010, as compared to fiscal 2009.

The increase was due primarily to an increase in repurchases of common stock, partially offset by changes in

cash overdrafts. We paid $332.2 million for purchases of our common stock during fiscal 2010 compared to

$71.1 million in fiscal 2009. Cash overdrafts increased $49.7 million during fiscal 2010 compared with a $27.3

million decrease in fiscal 2009.

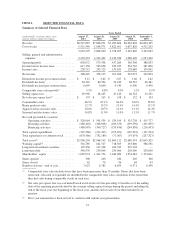

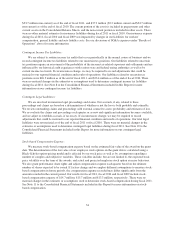

Contractual Obligations and Other Commercial Commitments

The following table shows our obligations and commitments to make future payments under contractual

obligations at the end of fiscal 2011.

Payments Due During the Period Ending

(in thousands)

Contractual Obligations Total

August

2012

August

2013

August

2014

August

2015

August

2016 Thereafter

Long-term debt .............. $ 550,000 $ 16,200 $ 16,200 $ 16,200 $ 16,200 $185,200 $300,000

Interest ..................... 188,676 27,609 26,760 25,911 25,063 15,833 67,500

Merchandise letters of credit .... 105,501 105,501 — ————

Operating leases ............. 1,426,759 364,228 323,424 273,778 220,029 164,854 80,446

Construction obligations ....... 44,568 44,568 — ————

Minimum royalties(1) .......... 9,050 2,750 2,800 2,800 700 — —

Total ...................... $2,324,554 $560,856 $369,184 $318,689 $261,992 $365,887 $447,946

(1) Minimum royalty payments related to an exclusive agreement to sell certain branded merchandise.

At the end of fiscal 2011, approximately $92.5 million of the merchandise letters of credit were included in

accounts payable and accrued liabilities on our Consolidated Balance Sheet. Most of our operating leases provide

us with an option to extend the term of the lease at designated rates. See Part I—Item 2—“Properties” in this

Report.

As of August 27, 2011, we had $26.3 million in liabilities related to our uncertain tax positions. At this time,

we cannot reasonably determine the timing of any payments related to these liabilities, except for $4.9 million,

which were classified as current liabilities and may become payable within the next 12 months. See Note 8 to the

Consolidated Financial Statements included in this Report for more information on our tax liabilities.

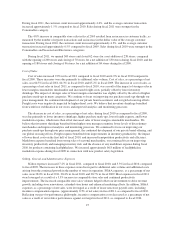

The following table shows our other commercial commitments at the end of fiscal 2011.

Other Commercial Commitments (in thousands)

Total Amounts

Committed

Standby letters of credit .......................................... $137,982

Surety bonds ................................................... 9,445

Total ..................................................... $147,427

31