Family Dollar 2011 Annual Report Download - page 61

Download and view the complete annual report

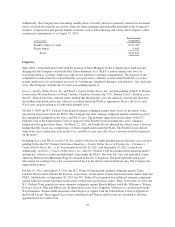

Please find page 61 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the recent United States Supreme Court decision of Dukes v. Walmart, on September 19, 2011, the Company

filed a motion to dismiss seeking to strike the plaintiffs’ class claims. The plaintiffs’ response to this motion is

due in October, 2011.

At this time, it is not possible to predict whether the N.C. Federal Court ultimately will permit the Scott action to

proceed collectively under the Equal Pay Act or as a class under Title VII of the Civil Rights Act. Although the

Company intends to vigorously defend the action, no assurances can be given that the Company will be

successful in the defense on the merits or otherwise. Similarly, at this time the Company cannot estimate either

the size of any potential class or the value of the claims raised in this action. For these reasons, the Company is

unable to estimate any potential loss or range of loss. The Company has tendered the matter to its Employment

Practices Liability Insurance (“EPLI”) carrier for coverage under its EPLI policy. At this time, the Company

expects that the EPLI carrier will participate in any resolution of some or all of the plaintiffs’ claims.

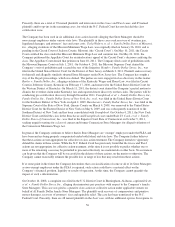

On March 16, 2011, Ronald Rothenberg v. Howard Levine, et al,. a purported class action complaint relating to

the rejection of a proposal by Trian Group to acquire the Company and the adoption of a stockholders’ rights

plan was filed in North Carolina State Court, Mecklenburg County, and later removed to the North Carolina

Business Court, the case was filed against the Company’s Board of Directors by Ronald Rothenberg, individually

and on behalf of all of the Company’s stockholders other than defendants and their affiliates. The plaintiffs

alleged, among other allegations, that the Company’s directors breached their fiduciary duties by not agreeing to

sell the Company and by adopting a stockholders’ rights plan. The complaint sought various forms of relief,

including damages and an order that the Board of Directors enter into negotiations to sell the Company to Trian

Group and redeem or rescind the stockholders’ rights plan. This lawsuit was voluntarily dismissed without

prejudice on July 19, 2011.

The Company is involved in numerous other legal proceedings and claims incidental to its business, including

litigation related to alleged failures to comply with various state and federal employment laws, some of which are

or may be pled as class or collective actions, and litigation related to alleged personal or property damage, as to

which the Company carries insurance coverage and/or has established accrued liabilities as set forth in the

Company’s financial statements. While the ultimate outcome cannot be determined, the Company currently

believes that these proceedings and claims, both individually and in the aggregate, should not have a material

effect on the Company’s financial position, liquidity or results of operations. However, the outcome of any

litigation is inherently uncertain and, if decided adversely to the Company, or, if the Company determines that

settlement of such actions is appropriate, the Company may be subject to liability that could have a material

effect on the Company’s financial position, liquidity or results of operations.

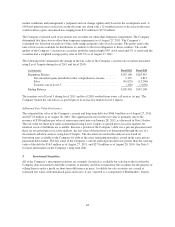

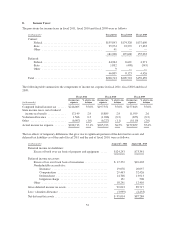

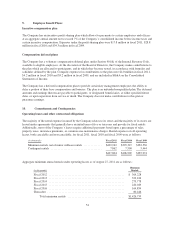

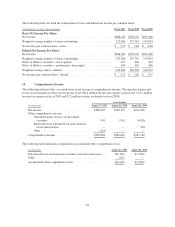

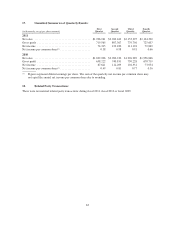

11. Stock-Based Compensation:

The Family Dollar Stores, Inc. 2006 Incentive Plan (the “2006 Plan”) permits the granting of a variety of

compensatory award types. The Company currently grants non-qualified stock options and performance share

rights under the 2006 Plan. Shares issued related to stock options and performance share rights represent new

issuances of common stock. A total of 12.0 million common shares are reserved and available for issuance under

the 2006 Plan, plus any shares awarded under the Company’s previous plan (1989 Non-Qualified Stock Option

Plan) that expired or were canceled or forfeited after the adoption of the 2006 Plan. As of August 27, 2011, there

were 10.0 million shares remaining available for grant under the 2006 Plan. The Company also issues shares

under the 2006 Plan in connection with director compensation. These shares are currently issued out of treasury

stock and are not material.

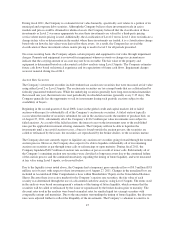

The Company’s results for fiscal 2011, fiscal 2010 and fiscal 2009 include stock-based compensation expense of

$14.7 million, $15.7 million and $13.3 million, respectively. These amounts are included within SG&A on the

Consolidated Statements of Income. Tax benefits recognized in fiscal 2011, fiscal 2010 and fiscal 2009 for stock-

based compensation totaled $5.4 million, $5.8 million and $4.9 million, respectively.

57