Family Dollar 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

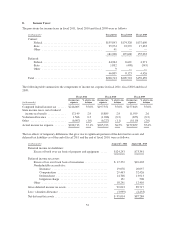

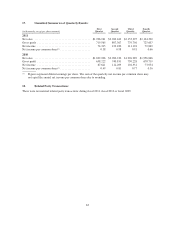

The Company had state net operating loss carryforwards of $112.4 million as of August 27, 2011, and $95.6

million as of August 28, 2010, in various states. These carryforwards expire at different intervals up to fiscal year

2031. Management considers all available evidence in determining the likelihood that a deferred tax asset will

not be realized. As a result, the Company increased the valuation allowances related to these state loss

carryforwards.

The Company classifies accrued interest expense and penalties related to uncertain tax positions as a component

of income tax expense. During fiscal 2011 interest and penalties increased income tax expense by $1.0 million

and for fiscal 2010 and fiscal 2009 interest and penalties reduced income tax expense by $1.5 million and $0.2

million, respectively. The increase is related to uncertain tax positions booked during the fiscal year as compared

to prior years that were decreased due to settlements of uncertain tax positions.

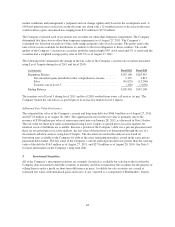

As of August 27, 2011, the Company had a liability related to uncertain tax positions of $26.3 million, including

a gross unrecognized tax benefit of $20.2 million and accrued interest and penalties of $6.1 million. The related

non-current deferred tax asset balance was $9.3 million as of August 27, 2011. If the Company were to prevail on

all unrecognized tax benefits recorded, approximately $17.0 million of the gross unrecognized tax benefits,

including penalties and tax effected interest of $6.1 million, would result in income tax benefits in the income

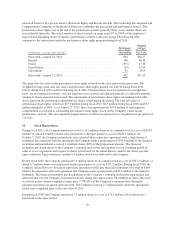

statement of a future period. A reconciliation of the beginning and ending amount of total unrecognized tax

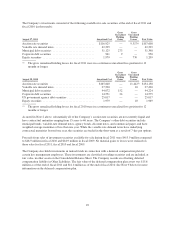

benefits is as follows:

(in thousands)

Unrecognized Tax

Benefit

Interest and

Penalties Total

Balance at August 30, 2008 ........................ $31,515 $ 7,667 $ 39,182

Increases related to prior year tax positions ....... 3,033 2,076 5,109

Decreases related to prior year tax positions ....... (4,867) (202) (5,069)

Increases related to current year tax positions ..... 12,037 285 12,322

Settlements during the period .................. (3,097) (863) (3,960)

Lapse of statute of limitations .................. (5,376) (2,841) (8,217)

Balance at August 29, 2009 ........................ $33,245 $ 6,122 $ 39,367

Increases related to prior year tax positions ....... 849 2,004 2,853

Decreases related to prior year tax positions ....... (327) (21) (348)

Increases related to current year tax positions ..... 2,260 411 2,671

Settlements during the period .................. (16,907) (3,066) (19,973)

Lapse of statute of limitations .................. (785) (354) (1,139)

Balance at August 28, 2010 ........................ $18,335 $ 5,096 $ 23,431

Increases related to prior year tax positions ....... 6,305 1,799 8,104

Decreases related to prior year tax positions ....... (4,472) — (4,472)

Increases related to current year tax positions ..... 3,190 530 3,720

Settlements during the period .................. (1,542) (553) (2,095)

Lapse of statute of limitations .................. (1,622) (795) (2,417)

Balance at August 27, 2011 ........................ $20,194 $ 6,077 $ 26,271

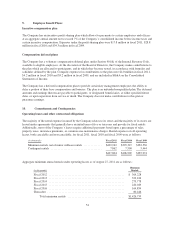

On a quarterly and annual basis, the Company accrues for the effects of open uncertain tax positions and the

related interest and penalties. The Company is subject to U.S. federal income tax as well as income tax in

multiple state and local jurisdictions. As of August 27, 2011, the Company was subject to income tax

examinations for its U.S. federal income taxes for fiscal years ending subsequent to 2007. With few exceptions,

the Company is subject to state and local income tax examinations for fiscal years ending subsequent to 2007.

The amount of future unrecognized tax positions may be reduced because the statute of limitations has expired or

the tax position is resolved with the taxing authority. It is reasonably possible that during the next 12 months the

unrecognized tax benefit may be reduced by a range of zero to $4.9 million due to settlements of audits by taxing

authorities. Such unrecognized tax benefits relate primarily to state tax issues.

53