Family Dollar 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

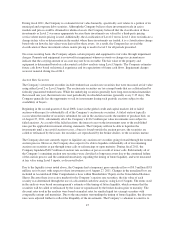

Investment securities

The Company classifies all investment securities as available-for-sale. Securities accounted for as

available-for-sale are required to be reported at fair value with unrealized gains and losses, net of taxes, excluded

from net income and shown separately as a component of accumulated other comprehensive income within

shareholders’ equity. The Company’s short-term investment securities currently consist primarily of debt

securities such as municipal bonds, and variable-rate demand notes. The Company’s long-term investment

securities currently consist of auction rate securities. See Notes 2 and 3 for more information on the Company’s

investment securities.

In addition to the cash and cash equivalents balances discussed above, the Company’s wholly-owned captive

insurance subsidiary also maintains balances in investment securities that are not designated for general corporate

purposes. These investment securities balances totaled $93.0 million as of the end of fiscal 2011 and $104.1

million as of the end of fiscal 2010.

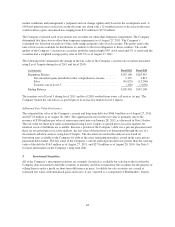

Merchandise inventories

Inventories are valued using the retail method, based on retail prices less mark-on percentages, which

approximates the lower of first-in, first-out (FIFO) cost or market. The Company records adjustments to

inventory through cost of goods sold when retail price reductions, or markdowns, are taken against on-hand

inventory. In addition, the Company makes estimates and judgments regarding, among other things, initial

markups, markdowns, future demand for specific product categories and market conditions, all of which can

significantly impact inventory valuation. These estimates and judgments are based on the application of a

consistent methodology each period. The Company estimates inventory losses for damaged, lost or stolen

inventory (inventory shrinkage) for the period from the most recent physical inventory to the financial statement

date. The accrual for estimated inventory shrinkage is based on the trailing twelve-month actual inventory

shrinkage rate and can fluctuate from period to period based on the timing of the physical inventory counts.

Stores conduct a physical inventory at least annually.

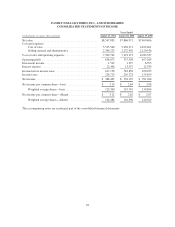

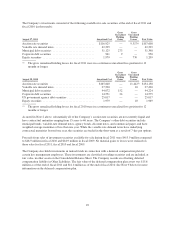

Property and equipment

Property and equipment is stated at cost. Depreciation for financial reporting purposes is calculated using the

straight-line method over the estimated useful lives of the related assets. For leasehold improvements, this

depreciation is over the shorter of the term of the related lease (generally five or ten years) or the asset’s useful

economic life.

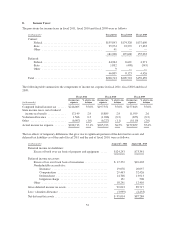

Estimated useful lives are as follows:

Buildings and building improvements ................................ 10-40 years

Furniture, fixtures and equipment ................................... 3-10 years

Transportation equipment .......................................... 3-10 years

Leasehold improvements .......................................... 5-10 years

The Company capitalizes certain costs incurred in connection with developing, obtaining and implementing

software for internal use. Capitalized costs are amortized over the expected economic life of the assets, generally

ranging from three to eight years.

Property and equipment is reviewed for impairment whenever events or changes in circumstances indicate that

the carrying amount of an asset may not be recoverable. Historically, impairment losses on fixed assets, which

typically relate to normal store closings, have not been material to the Company’s financial position or results of

operations.

43