Dell 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

and historical volatility of Dell's common stock over the most recent period commensurate with the estimated expected term

of Dell's stock options. Dell uses this blend of implied and historical volatility, as well as other economic data, because

management believes such volatility is more representative of prospective trends. The expected term of an award is based

on historical experience and on the terms and conditions of the stock awards granted to employees. The dividend yield of

zero is based on the fact that Dell has never paid cash dividends and has no present intention to pay cash dividends.

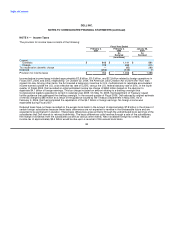

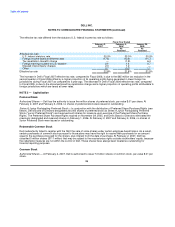

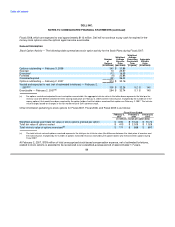

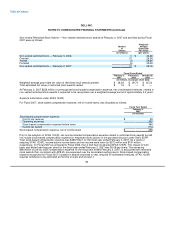

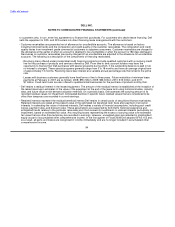

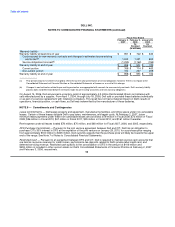

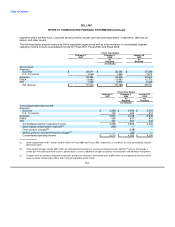

The weighted-average fair value of stock options and purchase rights under the employee stock purchase plan was

determined based on the Black-Scholes option pricing model weighted for all grants during Fiscal 2007, 2006, and 2005,

utilizing the assumptions in the following table:

Fiscal Years Ended

February 2, February 3, January 28,

2007 2006 2005

Expected term:

Stock options 3.6 years 3.8 years 3.8 years

Employee stock purchase plan 3 months 3 months 6 months

Risk-free interest rate (U.S. Government Treasury Note) 4.8% 3.9% 2.9%

Volatility 26% 25% 36%

Dividends 0% 0% 0%

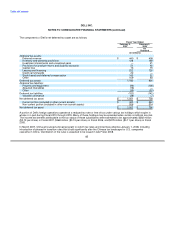

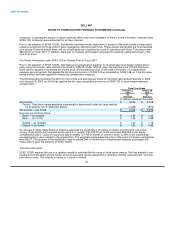

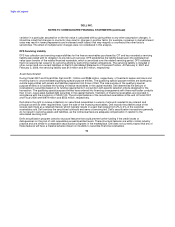

401(k) Plan — Dell has a defined contribution retirement plan (the "401(k) Plan") that complies with Section 401(k) of the

Internal Revenue Code. Substantially all employees in the U.S. are eligible to participate in the Plan. Effective January 1,

2005, Dell matches 100% of each participant's voluntary contributions, subject to a maximum contribution of 4% of the

participant's compensation, and participants vest immediately in all Dell contributions to the Plan. Prior to January 1, 2005,

Dell matched 100% of each participant's voluntary contributions, subject to a maximum contribution of 3% of the participant's

compensation. Dell's contributions during Fiscal 2007, 2006, and 2005 were $70 million, $66 million, and $48 million,

respectively. Dell's contributions are invested according to each participant's elections in the investment options provided

under the Plan. Investment options include Dell stock, but neither participant nor Dell contributions are required to be

invested in Dell stock. As a result of Dell's failure to file its Annual Report on Form 10-K for Fiscal 2007 by the original due

date, April 3, 2007, Dell suspended the right of Plan participants to invest additional contributions in Dell stock on April 4,

2007.

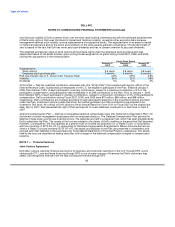

Deferred Compensation Plan — Dell has a nonqualified deferred compensation plan (the "Deferred Compensation Plan") for

the benefit of certain management employees and non-employee directors. The Deferred Compensation Plan permits the

deferral of base salary and annual incentive bonus. The deferrals are held in a separate trust, which has been established by

Dell to administer the Plan. The assets of the trust are subject to the claims of Dell's creditors in the event that Dell becomes

insolvent. Consequently, the trust qualifies as a grantor trust for income tax purposes (i.e. a "Rabbi Trust"). In accordance

with the provisions of EITF No. 97-14, Accounting for Deferred Compensation Arrangements Where Amounts Earned are

Held in a Rabbi Trust and Invested ("EITF 97-14"), the assets and liabilities of the Plan are presented in investments and

accrued and other liabilities in the accompanying Consolidated Statements of Financial Position, respectively. The assets

held by the trust are classified as trading securities, with changes in the deferred compensation charged to compensation

expense.

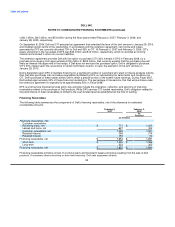

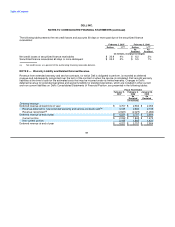

NOTE 7 — Financial Services

Joint Venture Agreement

Dell offers various customer financial services for its business and consumer customers in the U.S. through DFS, a joint

venture with CIT. Loan and lease financing through DFS is one of many sources of financing that Dell's customers may

select. Dell recognized revenue from the sale of products financed through DFS

92