Dell 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

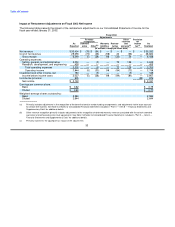

Table of Contents

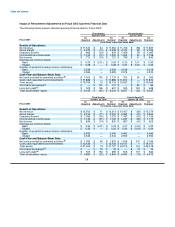

Summary of Investigation Findings

The investigation raised questions relating to numerous accounting issues, most of which involved adjustments to various

reserve and accrued liability accounts, and identified evidence that certain adjustments appear to have been motivated by

the objective of attaining financial targets. According to the investigation, these activities typically occurred in the days

immediately following the end of a quarter, when the accounting books were being closed and the results of the quarter

were being compiled. The investigation found evidence that, in that timeframe, account balances were reviewed,

sometimes at the request or with the knowledge of senior executives, with the goal of seeking adjustments so that

quarterly performance objectives could be met. The investigation concluded that a number of these adjustments were

improper, including the creation and release of accruals and reserves that appear to have been made for the purpose of

enhancing internal performance measures or reported results, as well as the transfer of excess accruals from one liability

account to another and the use of the excess balances to offset unrelated expenses in later periods. The investigation

found that sometimes business unit personnel did not provide complete information to corporate headquarters and, in a

number of instances, purposefully incorrect or incomplete information about these activities was provided to internal or

external auditors.

The investigation identified evidence that accounting adjustments were viewed at times as an acceptable device to

compensate for earnings shortfalls that could not be closed through operational means. Often, these adjustments were

several hundred thousand or several million dollars, in the context of a company with annual revenues ranging from

$35.3 billion to $55.8 billion and annual net income ranging from $2.0 billion to $3.6 billion for the periods in question. The

errors and irregularities identified in the course of the investigation revealed deficiencies in our accounting and financial

control environment, some of which were determined to be material weaknesses, that require corrective and remedial

actions. For a description of the control deficiencies identified by management as a result of the investigation and our

internal reviews described below, as well as management's plan to remediate those deficiencies, see "Part II —

Item 9A — Controls and Procedures."

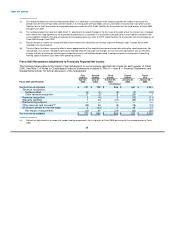

Other Company Identified Adjustments

Concurrently with the investigation, we also conducted extensive internal reviews for the purpose of the preparation and

certification of our Fiscal 2007 and prior financial statements and our assessment of internal controls over financial

reporting. Our procedures included expanded account reviews and expanded balance sheet reconciliations to ensure all

accounts were fully reconciled, supported, and appropriately documented. We also implemented improvements to our

quarterly and annual accounting close process to provide for more complete review of the various business unit financial

results. These additional reviews identified issues involving, among other things, revenue recognition in connection with

sales of third party software, amortization of revenue related to after-point-of-sale extended warranties, and accounting for

certain vendor reimbursement agreements.

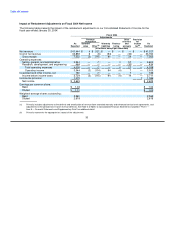

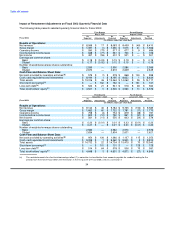

Restatement

As a result of issues identified in the Audit Committee investigation, as well as issues identified in the additional reviews

and procedures conducted by management, the Audit Committee, in consultation with management and

PricewaterhouseCoopers LLP, our independent registered public accounting firm, concluded on August 13, 2007 that our

previously issued financial statements for Fiscal 2003, 2004, 2005, and 2006 (including the interim periods within those

years), and the first quarter of Fiscal 2007, should no longer be relied upon because of certain accounting errors and

irregularities in those financial statements. Accordingly, we have restated our previously issued financial statements for

those periods. See Note 2 of Notes to Consolidated Financial Statements included in "Part II — Item 8 — Financial

Statements and Supplementary Data."

37