Dell 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

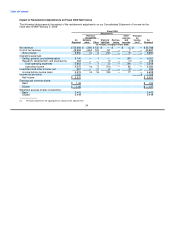

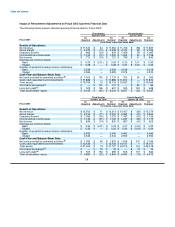

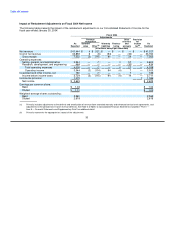

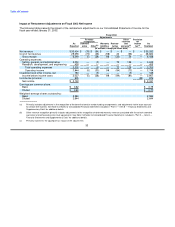

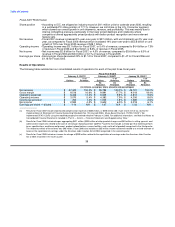

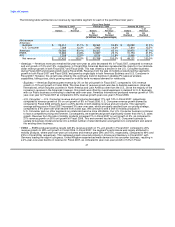

Impact of Restatement Adjustments on Fiscal 2003 Quarterly Financial Data

The following table presents selected quarterly financial data for Fiscal 2003:

First Quarter Second Quarter

May 3, 2002 August 2, 2002

As As As As

Fiscal 2003 Reported Adjustments Restated Reported Adjustments Restated

(in millions, expect per share data)

Results of Operations:

Net revenue $ 8,066 $ 17 $ 8,083 $ 8,459 $ (49) $ 8,410

Gross margin $ 1,391 $ (1) $ 1,390 $ 1,515 $ 41 $ 1,556

Operating income $ 590 $ (73) $ 517 $ 677 $ 9 $ 686

Income before income taxes $ 638 $ (77) $ 561 $ 726 $ — $ 726

Net income $ 457 $ (56) $ 401 $ 501 $ — $ 501

Earnings per common share:

Basic $ 0.18 $ (0.03) $ 0.15 $ 0.19 $ — $ 0.19

Diluted $ 0.17 $ (0.02) $ 0.15 $ 0.19 $ — $ 0.19

Number of weighted-average shares outstanding:

Basic 2,595 — 2,595 2,586 — 2,586

Diluted 2,672 — 2,672 2,649 — 2,649

Cash Flow and Balance Sheet Data:

Net cash provided by operating activities(d) $ 579 $ (1) $ 578 $ 868 $ 130 $ 998

Cash, cash equivalents and investments $ 8,194 $ 1 $ 8,195 $ 8,633 $ 1 $ 8,634

Total assets $ 13,316 $ 46 $ 13,362 $ 14,062 $ 55 $ 14,117

Short-term borrowings(a) $ — $ 162 $ 162 $ — $ 161 $ 161

Long-term debt(b) $ 520 $ 21 $ 541 $ 516 $ 48 $ 564

Total stockholders' equity(c) $ 4,521 $ 5 $ 4,526 $ 4,566 $ 10 $ 4,576

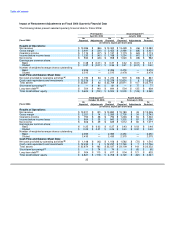

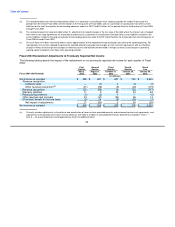

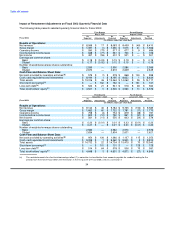

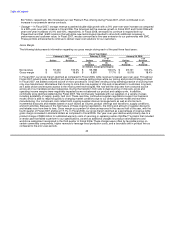

Third Quarter Fourth Quarter

November 1, 2002 January 31, 2003

As As As As

Fiscal 2003 Reported Adjustments Restated Reported Adjustments Restated

(in millions, expect per share data)

Results of Operations:

Net revenue $ 9,144 $ 40 $ 9,184 $ 9,735 $ (150) $ 9,585

Gross margin $ 1,662 $ 60 $ 1,722 $ 1,781 $ (11) $ 1,770

Operating income $ 758 $ (4) $ 754 $ 819 $ (38) $ 781

Income before income taxes $ 802 $ (12) $ 790 $ 861 $ (31) $ 830

Net income $ 561 $ (11) $ 550 $ 603 $ (24) $ 579

Earnings per common share:

Basic $ 0.22 $ (0.01) $ 0.21 $ 0.23 $ (0.01) $ 0.22

Diluted $ 0.21 $ — $ 0.21 $ 0.23 $ (0.01) $ 0.22

Number of weighted-average shares outstanding:

Basic 2,582 — 2,582 2,576 — 2,576

Diluted 2,634 — 2,634 2,621 — 2,621

Cash Flow and Balance Sheet Data:

Net cash provided by operating activities(d) $ 954 $ 126 $ 1,080 $ 1,137 $ 115 $ 1,252

Cash, cash equivalents and investments $ 9,059 $ 1 $ 9,060 $ 9,905 $ 5 $ 9,910

Total assets $ 14,712 $ 22 $ 14,734 $ 15,470 $ 70 $ 15,540

Short-term borrowings(a) $ — $ 101 $ 101 $ — $ 129 $ 129

Long-term debt(b) $ 514 $ 64 $ 578 $ 506 $ 75 $ 581

Total stockholders' equity(c) $ 4,648 $ 3 $ 4,651 $ 4,873 $ (27) $ 4,846

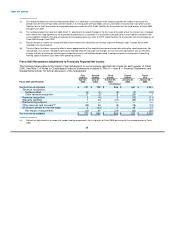

(a) The restated amounts for short-term borrowings reflect (1) a correction in classification from accounts payable for vendor financing for the

periods from the end of Fiscal 2002 until termination in the first quarter of Fiscal 2006, and (2) a correction in

34