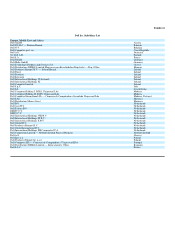

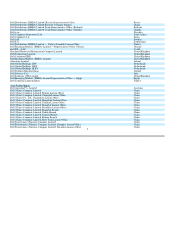

Dell 2006 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 10.8

AMENDMENT NO. 3 TO THE

DELL INC. 401(K) PLAN

This Amendment is hereby entered into by Dell Inc., a Delaware corporation, having its principal office in Round Rock, Texas (hereinafter referred to as

"Employer"):

R E C I T A L S:

WHEREAS, the Employer has previously established the Dell Inc. 401(k) Plan (the "Plan") for the benefit of those employees who qualify thereunder and

for their beneficiaries; and

WHEREAS, the Employer most recently amended and restated the Plan effective January 1, 2003; and

WHEREAS, the Employer desires to amend the Plan to comply with provisions of the final regulations under Treasury Regulation Section 1.401(k) and

Treasury Regulation Section 1.401(m) that are effective for Plan Years beginning on and after January 1, 2006; and

NOW, THEREFORE, pursuant to Section 13.1 of the Plan, the following amendment is hereby made, and shall be effective January 1, 2006:

1. Subsection 3.1(c) of the Plan is hereby amended, as underlined, to be and read as follows:

"(c) A Participant's election to defer an amount of his Considered Compensation and Bonus, if any, shall be made by authorizing his Employer, in the

manner prescribed by the Committee, to reduce his Considered Compensation (and, for the 2003 Plan Year, Bonus, if any), in the elected amount,

and the Employer, in consideration thereof, agrees to contribute an equal amount to the Plan. A Participant's election made pursuant to this

Subsection shall be implemented as soon as administratively practicable after such election is made.

A Participant's Considered Compensation deferral election shall remain in force and effect for all periods following its implementation until

modified in accordance with Subsection 3.1(c) or canceled in accordance with Subsection 3.1(d) or until such Participant ceases to be an Eligible

Employee. For the 2003 Plan Year, a Participant's Bonus deferral election shall remain in force and effect until the end of the Plan Year for which

such election was made unless earlier modified in accordance with Subsection 3.1(c) or canceled in accordance with Subsection 3.1(d) or until such

Participant ceases to be an Eligible Employee. The Company shall pay to a Participant any Considered Compensation and Bonus for a Plan Year not

deferred under this Plan. Any Contributions made pursuant to a deferral election shall not be made before the earlier of (1) the Participant's

performance of Service with respect to which the Contribution is made and (2)