Dell 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

owned subsidiary. Pursuant to Accounting Research Bulletin 51, Consolidated Financial Statements (as amended), these

shares are not considered to be outstanding on Dell's consolidated financial statements.

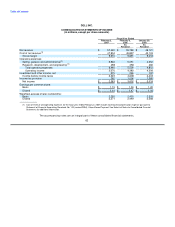

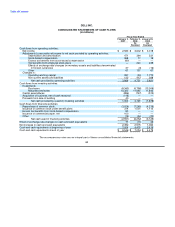

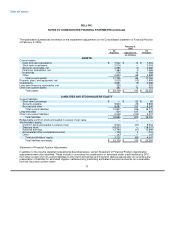

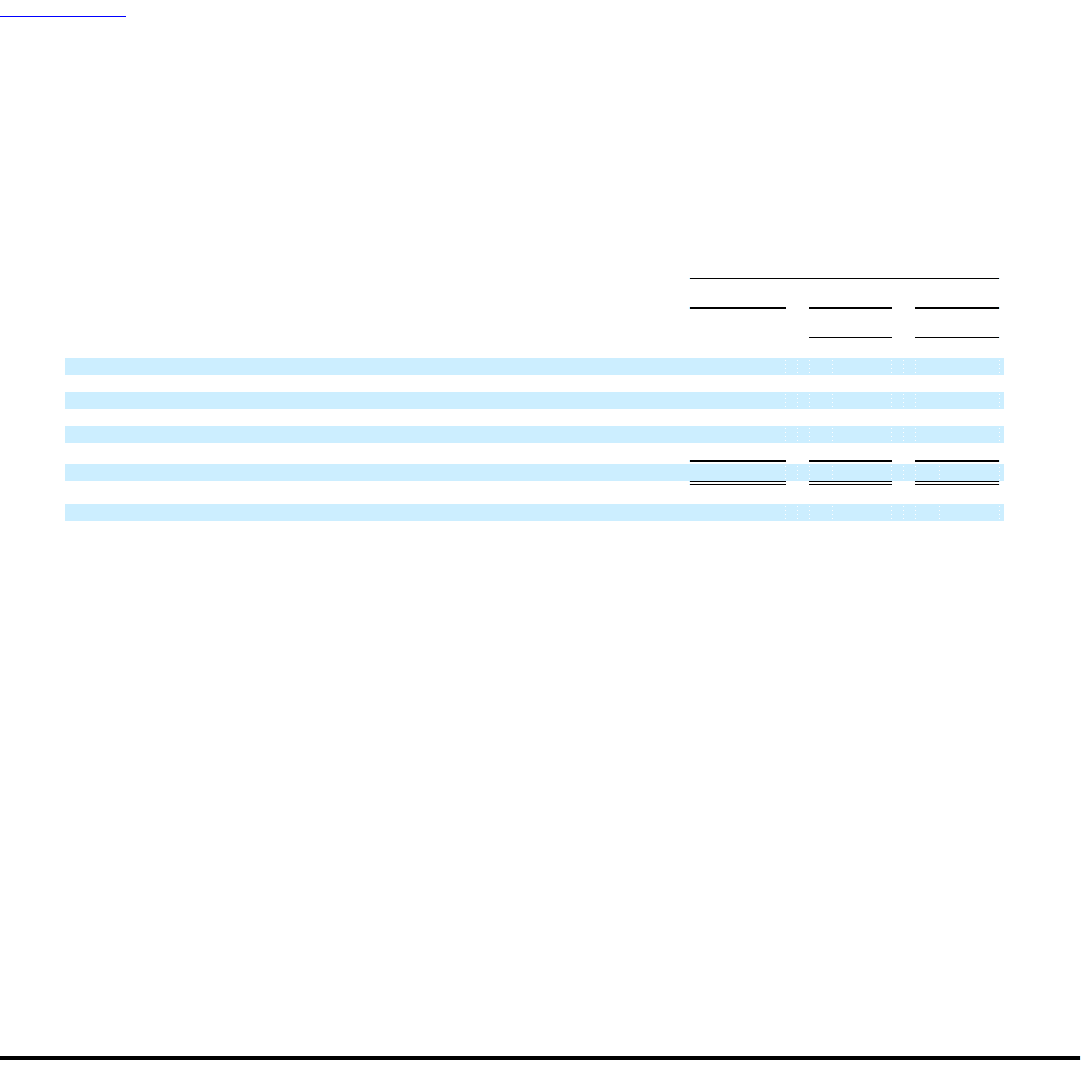

The following table sets forth the computation of basic and diluted earnings per share for each of the past three fiscal years:

Fiscal Year Ended

February 2, February 3, January 28,

2007 2006 2005

As As

Restated Restated

(in millions, except per share amounts)

Numerator:

Net income $ 2,583 $ 3,602 $ 3,018

Denominator:

Weighted-average shares outstanding:

Basic 2,255 2,403 2,509

Effect of dilutive options, restricted stock units, restricted stock, and other 16 46 59

Diluted 2,271 2,449 2,568

Earnings per common share:

Basic $ 1.15 $ 1.50 $ 1.20

Diluted $ 1.14 $ 1.47 $ 1.18

Stock-Based Compensation — At February 2, 2007, Dell had four stock-based compensation plans and an employee stock

purchase plan with outstanding stock or stock options.

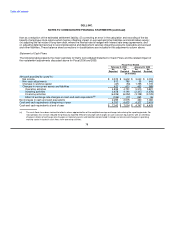

Effective February 4, 2006, Dell adopted SFAS No. 123 (revised 2004), Share-Based Payment ("SFAS 123(R)"), using the

modified prospective transition method which does not require revising the presentation in prior periods for stock-based

compensation. Under this transition method, stock-based compensation expense for Fiscal 2007 includes compensation

expense for all stock-based compensation awards granted prior to, but not yet vested at February 4, 2006, based on the

grant date fair value estimated in accordance with the original provisions of SFAS No. 123, Accounting for Stock-Based

Compensation ("SFAS 123"). Stock-based compensation expense for all stock-based compensation awards granted after

February 3, 2006 is based on the grant-date fair value estimated in accordance with the provisions of SFAS 123(R). Dell

recognizes this compensation expense net of an estimated forfeiture rate over the requisite service period of the award,

which is generally the vesting term of five years for stock options and five-to-seven years for restricted stock awards. In

March 2005, the Securities and Exchange Commission ("SEC") issued Staff Accounting Bulletin No. 107 ("SAB 107")

regarding the SEC's interpretation of SFAS 123(R) and the valuation of share-based payments for public companies. Dell

has applied the provisions of SAB 107 in its adoption of SFAS 123(R). See Note 6 of Notes to Consolidated Financial

Statements for further discussion of stock-based compensation.

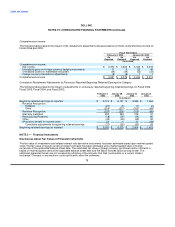

Prior to the adoption of SFAS 123(R), Dell measured compensation expense for its employee stock-based compensation

plans using the intrinsic value method prescribed by Accounting Principles Board Opinion No. 25, Accounting for Stock

Issued to Employees ("APB 25"). Dell applied the disclosure provisions of SFAS 123 such that the fair value of employee

stock-based compensation was disclosed in the notes to its financial statements. Under APB 25, when the exercise price of

Dell's employee stock options equaled the market price of the underlying stock at the date of the grant, no compensation

expense was recognized.

Recently Issued Accounting Pronouncements — In February 2006, the FASB issued SFAS No. 155, Accounting for Certain

Hybrid Instruments ("SFAS 155"), which is an amendment of SFAS 133, and SFAS No. 140, Accounting for Transfers and

Servicing of Financial Assets and Extinguishments of

69