Dell 2006 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

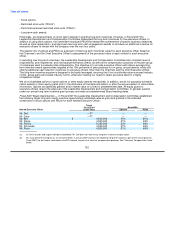

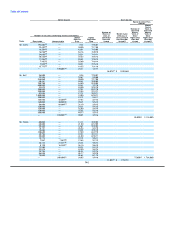

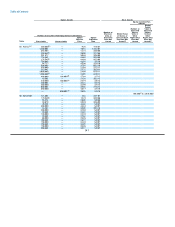

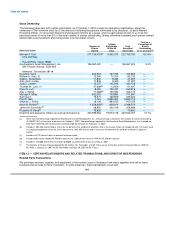

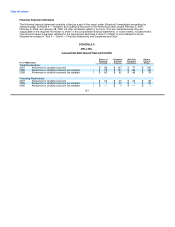

Option Awards Stock Awards

Equity Incentive Plan

Awards

Market

Payout

Number of Value of

Unearned Unearned

Number of Shares, Shares,

Shares or Market Value Units or Units or

Number of Securities Underlying Unexercised Options Units of of Shares or Other Other

Option Option Stock that Units of Stock Rights That Rights That

Exercise Expiration Have Not that Have Not Have Not Have Not

Name Exercisable Unexercisable Price Date Vested Vested(a) Vested Vested(a)

Mr. Parra(n) 17,304(l) — 28.90 7/17/08

89,510(l) — 44.69 9/23/09

350,000(l) — 43.44 3/2/10

32,679(l) — 45.90 3/24/10

200,000(l) — 37.59 8/22/10

40,000(l) — 22.94 2/12/11

200,000(l) — 24.09 6/18/11

80,000(l) — 22.10 9/6/11

80,000(l) 40,000(b) 27.64 3/7/12

120,000(l) 40,000(g) 25.45 9/5/12

30,000(l) 60,000(c) 26.19 3/6/13

150,000(l) — 34.24 9/4/13

150,000(l) — 32.99 3/4/14

150,000(l) — 35.35 9/2/14

200,000 — 40.17 3/3/15

— 280,000(h) 28.95 3/9/16

75,000(i) 1,764,000

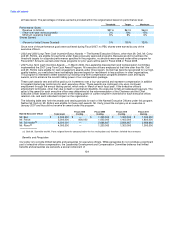

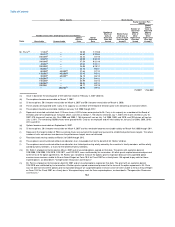

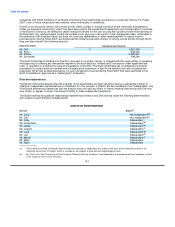

(a) Value is based on the closing price of Dell common stock on February 2, 2007 ($23.52).

(b) These options became exercisable on March 7, 2007.

(c) Of these options, 50% became exercisable on March 6, 2007 and 50% become exercisable on March 6, 2008.

(d) These awards were granted to Mr. Carty in his capacity as a member of the Board of Directors prior to his becoming an executive officer.

(e) These options become exercisable ratably on January 2 of 2008 through 2012.

(f) Represents unvested restricted stock. Of these shares, 6,576 shares were granted to Mr. Carty in his capacity as a member of the Board of

Directors prior to his becoming an executive officer, and vest as follows: 1,165 shares vested on July 1, 2007; 374 shares vested on July 16,

2007; 375 shares will vest on July 16 of 2008 and 2009; 1,166 shares will vest on July 1 of 2008, 2009, and 2010; and 789 shares will vest on

July 1, 2011. The remaining 50,000 shares were granted to Mr. Carty as an employee and will vest ratably on January 2 of 2008, 2009, 2010,

2011 and 2012.

(g) Options became exercisable on September 5, 2007.

(h) Of these options, 20% became exercisable on March 9, 2007 and the remainder become exercisable ratably on March 9 of 2008 through 2011.

(i) Represents the target number of PBUs assuming shares are earned at the target level pursuant to established performance targets. The actual

number of units earned was zero because the performance targets were not achieved.

(j) Restricted stock vesting ratably on March 3 of 2009 through 2012.

(k) These options were transferred without consideration to an irrevocable trust for the benefit of Mr. Rollins' children.

(l) These options were transferred without consideration to a limited partnership wholly owned by the executive's family members, entities wholly

owned by family members, or trusts for the benefit of family members.

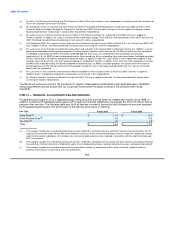

(m) Mr. Rollins' employment terminated on May 4, 2007 and all unvested options expired on that date. The grants with expiration dates of

3/20/2008, 3/26/2009, 3/24/2010, 3/23/2011, and 3/22/2012, were unaffected by his termination. All other grants expired unexercised pursuant

to the terms of the option agreements. Mr. Rollins was not able to exercise the options prior to expiration because we suspended option

exercises once we were unable to file our Annual Report on Form 10-K for Fiscal 2007 on a timely basis. We agreed to pay cash for those

expired options, as described in "Compensation Discussion and Analysis."

(n) Mr. Parra's employment terminated on April 20, 2007 and all unvested options expired on that date. The grant with an expiration date of

3/24/2010 was unaffected by his termination. All other grants expired unexercised pursuant to the terms of the option agreements. Mr. Parra

was not able to exercise the options prior to expiration because we suspended option exercises once we were unable to file our Annual Report

on Form 10-K for Fiscal 2007 on a timely basis. We agreed to pay cash for those expired options, as described in "Compensation Discussion

and Analysis." 142