Dell 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

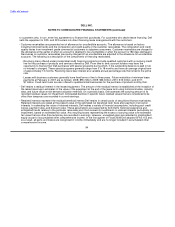

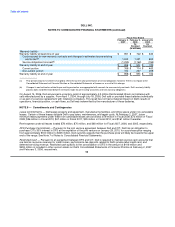

• Income Tax — Dell is currently under audit in various jurisdictions, including the United States. The tax periods open to

examination by the major taxing jurisdictions to which Dell is subject include Fiscal 1999 through Fiscal 2007. Dell does not

anticipate a significant change to the total amount of unrecognized benefits within the next 12 months.

Dell is involved in various other claims, suits, investigations, and legal proceedings that arise from time to time in the ordinary

course of its business. Although Dell does not expect that the outcome in any of these other legal proceedings, individually or

collectively, will have a material adverse effect on its financial condition or results of operations, litigation is inherently

unpredictable. Therefore, Dell could incur judgments or enter into settlements of claims that could adversely affect its

operating results or cash flows in a particular period.

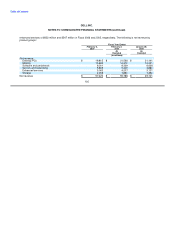

Certain Concentrations — All of Dell's foreign currency exchange and interest rate derivative instruments involve elements of

market and credit risk in excess of the amounts recognized in the consolidated financial statements. The counterparties to

the financial instruments consist of a number of major financial institutions. In addition to limiting the amount of agreements

and contracts it enters into with any one party, Dell monitors its positions with, and the credit quality of the counterparties to,

these financial instruments. Dell does not anticipate nonperformance by any of the counterparties.

Dell's investments in debt securities are placed with high quality financial institutions and companies. As part of its cash and

risk management processes, Dell performs periodic evaluations of the credit standing of the institutions in accordance with

its investment policy. Dell's investments in debt securities have effective maturities of less than five years. Management

believes that no significant concentration of credit risk for investments exists for Dell.

Dell markets and sells its products and services to large corporate clients, governments, healthcare and education accounts,

as well as small-to-medium businesses and individuals.

Dell purchases a number of components from single or limited sources. In some cases, alternative sources of supply are not

available. In other cases, Dell may establish a working relationship with a single source or a limited number of sources if Dell

believes it is advantageous due to performance, quality, support, delivery, capacity, or price considerations. If the supply of a

critical single- or limited-source material or component were delayed or curtailed, Dell's ability to ship the related product in

desired quantities and in a timely manner could be adversely affected. Even where alternative sources of supply are

available, qualification of the alternative suppliers and establishment of reliable supplies could result in delays and a possible

loss of sales, which may have an adverse effect on Dell's operating results.

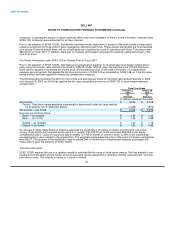

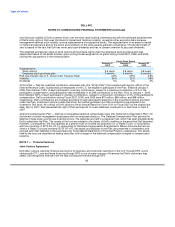

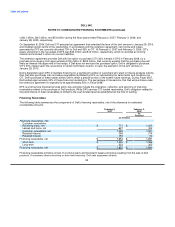

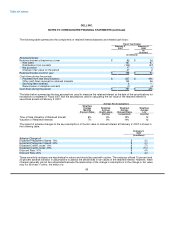

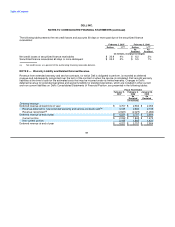

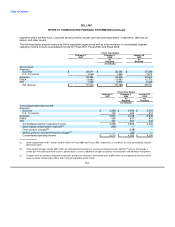

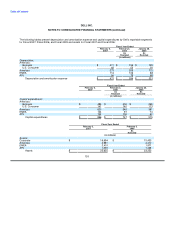

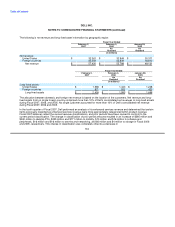

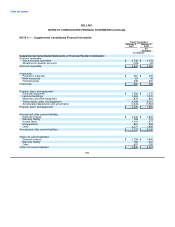

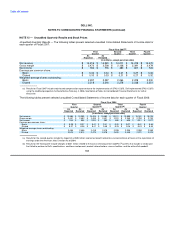

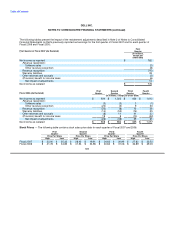

NOTE 10 — Segment Information

Dell conducts operations worldwide and is managed in three geographic regions: the Americas; Europe, Middle East and

Africa ("EMEA"); and Asia Pacific-Japan ("APJ"). The Americas region, which is based in Round Rock, Texas, covers the

U.S., Canada, and Latin America. Within the Americas, Dell is further segmented into Business and U.S. Consumer. The

Americas Business ("Business") segment includes sales to corporate, government, healthcare, education, and small and

medium business customers, while the U.S. Consumer segment includes sales primarily to individual consumers. The EMEA

segment, based in Bracknell, England, covers Europe, the Middle East, and Africa. The APJ region, based in Singapore,

covers the Asian countries of the Pacific Rim as well as Australia, New Zealand, and India.

Corporate expenses are included in Dell's measure of segment operating income for management reporting purposes;

however, with the adoption of SFAS 123(R), beginning in Fiscal 2007, stock-based compensation expense is not allocated to

Dell's reportable segments. The asset totals disclosed by geography are directly managed by those regions and include

accounts receivable, inventory, certain fixed assets, and certain other assets. Assets are not allocated specifically to the

Business and U.S. Consumer

101