Dell 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

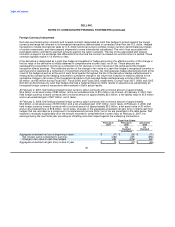

Dell also uses forward contracts to hedge monetary assets and liabilities, primarily receivables and payables, denominated in

a foreign currency. These contracts are not designated as hedging instruments under SFAS 133, and therefore, the change

in the instrument's fair value is recognized currently in earnings and is reported as a component of investment and other

income, net. The change in the fair value of these instruments represents a natural hedge as their gains and losses offset the

changes in the underlying fair value of the monetary assets and liabilities due to movements in currency exchange rates.

These contracts generally expire in three months or less.

Commercial Paper

On June 1, 2006 Dell implemented a $1.0 billion commercial paper program with a supporting $1.0 billion senior unsecured

revolving credit facility. This program allows Dell to obtain favorable short-term borrowing rates. Dell pays facility commitment

and letter of credit participation fees at rates based upon Dell's credit rating. Unless extended, this facility expires on June 1,

2011, at which time any outstanding amounts under the facility will be due and payable. The facility requires compliance with

conditions that must be satisfied prior to any borrowing, as well as ongoing compliance with specified affirmative and

negative covenants, including maintenance of a minimum interest coverage ratio. Amounts outstanding under the facility may

be accelerated for typical defaults, including failure to pay principal or interest, breaches of covenants, non-payment of

judgments or debt obligations in excess of $200 million, occurrence of a change of control, and certain bankruptcy events.

At February 2, 2007 $100 million was outstanding under the commercial paper program and was due within 90 days. The

weighted-average interest rate on these outstanding short-term borrowings was 5.3% at February 2, 2007. There were no

outstanding advances under the commercial paper program as of October 26, 2007. Dell uses the proceeds of the program

and facility for general corporate purposes, including funding DFS growth.

DFS Credit Facilities

DFS maintains credit facilities with CIT that provide a maximum capacity of $750 million to fund leased equipment. These

borrowings are secured by DFS' assets and contain certain customary restrictive covenants. Interest on the outstanding

loans is paid quarterly and calculated based on an average of the two- and three-year U.S. Treasury Notes plus 4.45%. DFS

is required to make quarterly payments if the value of the leased equipment securing the loans is less than the outstanding

principal balance. At February 2, 2007 and February 3, 2006, outstanding advances from CIT totaled $122 million and

$133 million, respectively, of which $87 million and $63 million, respectively, is included in short-term borrowings and

$35 million and $70 million, respectively, is included in long-term debt on Dell's Consolidated Statements of Financial

Position. The credit facilities expire on the earlier of (i) the dissolution of DFS; (ii) the purchase of CIT's ownership interest in

DFS; or (iii) the acceleration of the maturity of the debt by CIT arising from a default.

Vendor Financing

Dell had a vendor financing plan with a third party where participating vendors could elect to have their payables paid early

by the third party as compared to Dell's standard payment terms. Vendors who elected to participate in this plan could take a

discount on their invoices to accelerate the timing of payment. This discount, net of the third party's cost of funds, was

allocated between the third party and Dell. This plan was terminated in the first quarter of Fiscal 2006. Discounted invoices

paid by the program are estimated to be $200 million and $1.0 billion in Fiscal 2006 and 2005, respectively. Dell recognized

the amounts due to the third party as short-term borrowings in the Consolidated Statement of Financial Position and the

payments

82