Dell 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Cash and cash equivalents, accounts receivable, accounts payable, and accrued and other liabilities are reflected in the

accompanying Consolidated Statements of Financial Position at cost, which approximates fair value because of the short-

term maturity of these assets and liabilities.

Investments

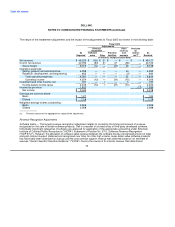

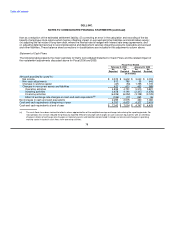

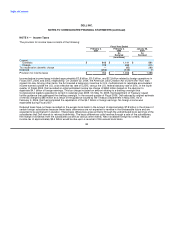

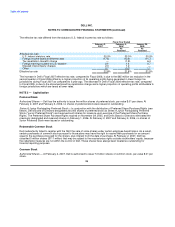

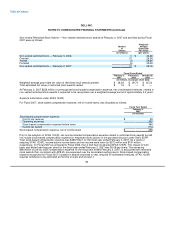

The following table summarizes by major security type the fair value and cost of Dell's investments. All investments with

remaining maturities in excess of one year are recorded as long-term investments in the accompanying Consolidated

Statements of Financial Position.

February 2, 2007 February 3, 2006

Fair Unrealized Fair Unrealized

Value Cost Gain (Loss) Value Cost Gain (Loss)

As Restated

(in millions)

Debt securities:

U.S. government and agencies $ 1,424 $ 1,449 $ (25) $ 2,501 $ 2,547 $ (46)

U.S. corporate 1,163 1,170 (7) 1,638 1,657 (19)

International corporate 156 159 (3) 352 359 (7)

State and municipal governments 41 41 — 115 115 —

Debt securities 2,784 2,819 (35) 4,606 4,678 (72)

Equity and other securities 115 109 6 96 96 —

Investments $ 2,899 $ 2,928 $ (29) $ 4,702 $ 4,774 $ (72)

Short-term $ 752 $ 756 $ (4) $ 2,016 $ 2,028 $ (12)

Long-term 2,147 2,172 (25) 2,686 2,746 (60)

Investments $ 2,899 $ 2,928 $ (29) $ 4,702 $ 4,774 $ (72)

At February 2, 2007, Dell had 762 debt investment positions that had fair values below their carrying values for a period of

less than 12 months. The fair value and unrealized losses on these debt investment positions totaled $1.5 billion and

$21 million, respectively, at February 2, 2007. At February 2, 2007, Dell had 329 investment positions that had fair values

below their carrying values for a period of more than 12 months. The fair value and unrealized losses on these investment

positions totaled $800 million and $15 million, respectively, at February 2, 2007. The unrealized losses are due to changes in

interest rates and are expected to be recovered over the contractual term of the instruments.

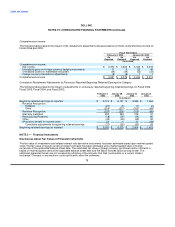

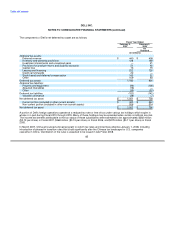

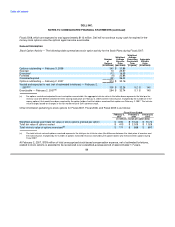

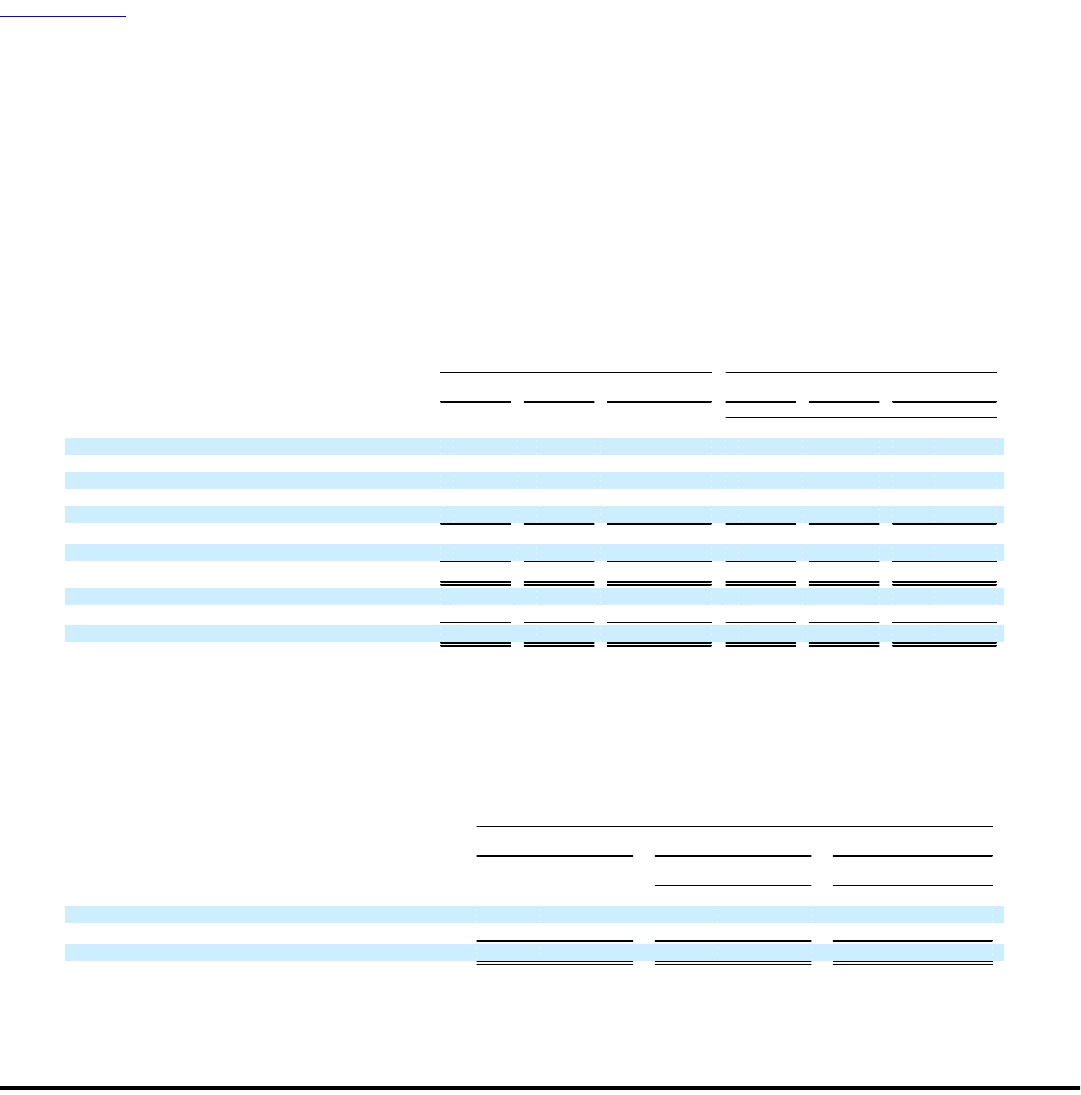

The following table summarizes Dell's realized gains and losses on investments:

Fiscal Year Ended

February 2, February 3, January 28,

2007 2006 2005

As As

Restated Restated

(in millions)

Gains $ 9 $ 13 $ 40

Losses (14) (15) (34)

Net realized (loss) gain $ (5) $ (2) $ 6

Dell routinely enters into securities lending agreements with financial institutions in order to enhance investment income. Dell

requires that the loaned securities be collateralized in the form of cash or securities for values which generally exceed the

value of the loaned security. At February 2, 2007, there were no securities on loan.

80