Dell 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

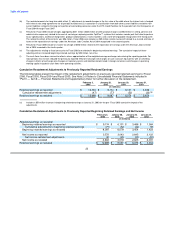

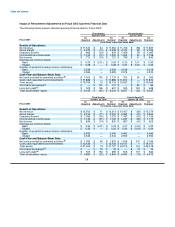

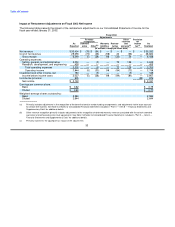

(a) The restated amounts for short-term borrowings reflect (1) a correction in classification from accounts payable for vendor financing for the

periods from the end of Fiscal 2002 until termination in the first quarter of Fiscal 2006, and (2) a correction in classification from other current

liabilities for the short-term portion for outstanding advances under the DFS Credit Facilities for the periods from the third quarter of Fiscal 2004

through Fiscal 2007.

(b) The restated amounts for long-term debt reflect (1) adjustments to record changes in the fair value of the debt where the interest rate is hedged

with interest rate swap agreements for all periods restated and (2) a correction in classification from both other current liabilities and other non-

current liabilities related to the long-term portion of outstanding advances under the DFS Credit Facilities for the periods from the third quarter of

Fiscal 2004 through Fiscal 2007.

(c) The cash flows have been revised to reflect a closer approximation of the weighted-average exchange rates during the reporting periods. For

most periods, this revision reduced the previously reported effect of exchange rate changes on cash and cash equivalents with an offsetting

change in effects of exchange rate changes on monetary assets and liabilities denominated in foreign currencies and changes in operating

working capital included in cash flows from operating activities.

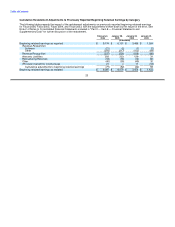

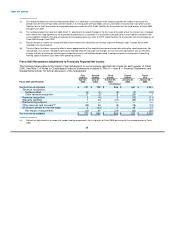

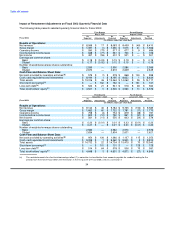

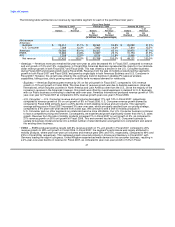

Fiscal 2004 Restatement Adjustments to Previously Reported Net Income

The following table presents the impact of the restatement on our previously reported net income for each quarter of Fiscal

2004:

First Second Third Fourth Fiscal

Quarter Quarter Quarter Quarter Year

May 2, August 1, October 31, January 30, January 30,

Fiscal 2004 (As Restated) 2003 2003 2003 2004 2004

(in millions)

Net income as reported $ 598 $ 621 $ 677 $ 749 $ 2,645

Revenue recognition:

Software sales — (1) 2 (3) (2)

Other revenue recognition(a) (31) (58) (6) (20) (115)

Revenue recognition (31) (59) (4) (23) (117)

Warranty liabilities 11 5 35 43 94

Restructuring reserves (3) (2) 1 — (4)

Other reserves and accruals 43 (31) (24) 26 14

(Provision) benefit for income taxes (9) 24 (6) (16) (7)

Net impact of adjustments 11 (63) 2 30 (20)

Net income as restated $ 609 $ 558 $ 679 $ 779 $ 2,625

(a) Primarily includes adjustments to the deferral and amortization of revenue from extended warranty and enhanced service level agreements, and

adjustments to the period end in-transit revenue deferrals. See Note 2 of Notes to Consolidated Financial Statements included in "Part II —

Item 8 — Financial Statements and Supplementary Data" for additional detail.

32